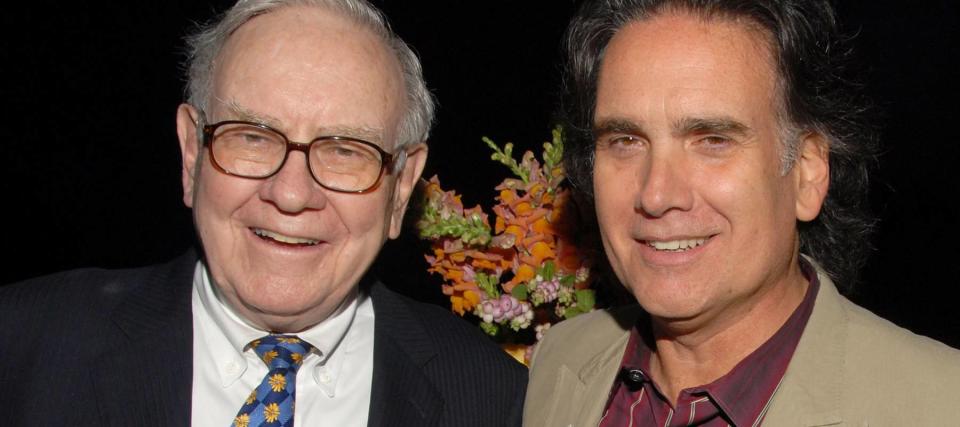

Warren Buffett's son says his dad made him 'figure out' life for himself — here are 3 things he learned

Billionaire investor Warren Buffett is one of the world’s wealthiest individuals, but surprisingly, he doesn’t plan for his vast fortune to stay within the family.

While some ultra-wealthy families get sucked into succession drama, Buffett seems to have avoided it all by setting clear expectations. His children and grandchildren won’t inherit much of his fortune, leaving them to “figure it out” themselves.

Don't miss

Beating the market is no myth: These expert stock-pickers' recent success could help you build generational wealth

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“There was no blank check anywhere, ever,” Peter Buffett, Warren’s youngest son, told KETV Newswatch 7 in April. Like much of the Buffett family, Peter had to find his own career path and became a musician and composer.

In 2010, he released a book, “Life Is What You Make It,” chronicling his father’s work ethic and family values. Here are the top three lessons Peter learned from his iconic father.

The challenge of self-discovery

The key to Buffett’s success, Peter explains, is a career built on his core passion.

“For my father, and now me, the essence of a good work ethic starts with meeting a challenge of self-discovery, of finding something you love to do, so that work — even, or especially, when it’s very difficult and arduous — becomes joyful. Maybe even sacred,” he wrote in his book.

Buffett has previously mentioned how he was fascinated with investing in stocks at a relatively young age, picking up his first investment at just 11 years old. The legendary investor has also advised young people in the past to seek out work that they would do even if they were independently wealthy.

In other words, it’s easier to dedicate many hours every day for several decades to a project when you actually enjoy it.

Read more: ‘You didn’t want to risk it’: 80-year-old woman from South Carolina is looking for the safest place for her family’s $250,000 savings. Dave Ramsey responds

Focus, focus, focus

Buffett, along with other iconic business leaders like Bill Gates, has spoken about the value of focus. Buffett, for instance, dedicated all his attention to studying and buying companies, while Gates focused his attention on tech innovation.

“The concentration he brought to the process bordered on the mystical,” Peter wrote about his father.

Buffett’s work ethic is a testament to the idea that great success requires undivided attention.

The work matters more than the rewards

It’s perhaps easy to assume that the world’s richest people launched their career with the intention of accumulating as much capital as possible. But Peter believes his father’s immense wealth — now estimated at $134 billion by Forbes — is a byproduct of his work, not the primary target.

“If my father had been working mainly for the money, his efforts would have quickly dulled into a routine — a job,” he wrote.

Peter suggests that his father’s ability to detach his work from the potential rewards is key to his success.

Rewards — such as capital appreciation and income — are fickle and beyond your control. A bad economy could wipe away several years of hard work. That doesn’t make a passionate entrepreneur feel like a failure or compel them to give up.

“Why would you wager your self-respect on factors so far out of their control?” Peter asked in his book.

Instead, a passionate individual working on something they love may keep working regardless of the rewards. They might find fulfillment in completing their work, not in the potential for compensation.

What to read next

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance