Waste Connection (WCN) Gains on Acquisitions Amid Low Liquidity

Waste Connection WCN has had an impressive run over the past six months, wherein the company’s shares have gained 23.9%, outperforming the 20% rally of the industry it belongs to.

WCN reported solid first-quarter 2024 results. Adjusted earnings (excluding 15 cents from non-recurring items) of $1 per share beat the Zacks Consensus Estimate by 2% and increased 16.9% year over year. Revenues of $2.1 billion surpassed the consensus estimate by 1% and rose 9.1% from the year-ago quarter.

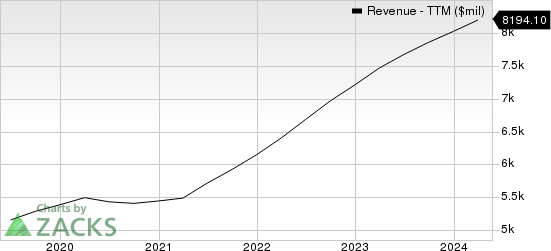

Waste Connections, Inc. Revenue (TTM)

Waste Connections, Inc. revenue-ttm | Waste Connections, Inc. Quote

How Is Waste Connection Doing?

Waste Connections typically targets secondary and rural markets to capture a higher local market share, which would be challenging to attain in the highly competitive urban markets. Customer churn decreases improve financial returns. Early mover advantage in E&P waste treatment and disposal in certain rural basins assist in improving market positioning and generating higher financial returns in those areas. The company focuses on growing its market presence and leverages its franchise-based platforms to broaden its customer base beyond the exclusive market territories.

The focus of the company is to provide vertically integrated services. The operations are managed via decentralization, which leaves the responsibility of decision-making to customers. This facilitates identifying and addressing customers’ needs on a real-time basis in a cost-effective manner. Such a low overhead and highly efficient operational structure help it expand into new territories and operate in small communities that competitors may not find enticing.

Waste Connections has been acquiring companies actively. In 2023, 2022 and 2021, the company completed 13, 24 and 30 acquisitions, respectively. These acquisitions significantly contributed to its top line, with $410.9 million in 2023, $552 million in 2022 and $215.39 million in 2021. The notable acquisitions made by Waste Connections include American Disposal Services, Groot Industries and Progressive Waste.

WCN is exposed to multiple operational risks, such as truck accidents, equipment defects, malfunctions and failures. Additional risk of explosion and fire is being posed by fuelling stations, and landfill gas collection and control systems. The company’s Canadian operations are exposed to risks involving fluctuations in the forex rate and uncertainty in monetary devaluation.

Waste Connections’ current ratio (a measure of liquidity) at the end of first-quarter 2024 was 0.75, lower than the year-ago quarter's 0.82. A current ratio of less than 1 indicates that the company may have problems paying off its short-term obligations.

Zacks Rank & Stocks to Consider

Waste Connections currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Lightspeed POS LSPD and Western Union WU.

Lightspeed carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LSPD has a long-term earnings growth expectation of 33.4%. It delivered a trailing four-quarter earnings surprise of 191.7%, on average.

Western Union currently has a Zacks Rank of 2. It has a long-term earnings growth expectation of 3.8%.

WU delivered a trailing four-quarter earnings surprise of 15.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

Lightspeed Commerce Inc. (LSPD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance