Weatherford (WFT) Posts Narrower-Than-Expected Loss in Q1

Weatherford International Ltd. WFT posted first-quarter 2018 adjusted loss of 19 cents per share, narrower than the Zacks Consensus Estimate of a loss of 22 cents as well as the year-ago quarter’s adjusted loss of 32 cents. The downside was caused by adverse impact of pressure pumping operations as well as lower product sales.

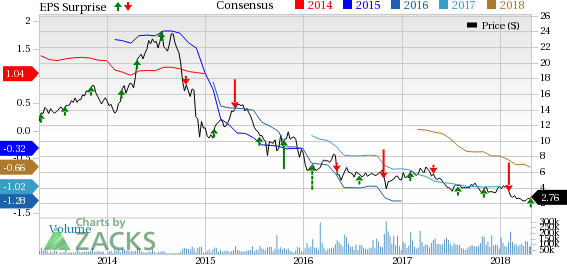

Weatherford International PLC Price, Consensus and EPS Surprise

Weatherford International PLC Price, Consensus and EPS Surprise | Weatherford International PLC Quote

Total revenues amounted to $1,423.0 million, up from $1, 386.0 million in the year-ago quarter. However, the reported figure lagged the Zacks Consensus Estimate of $1,467.0 million.

Operational Performance

The leading oilfield services company realigned its organization into two operating segments — Western Hemisphere and Eastern Hemisphere — during the fourth quarter of 2017. The Western Hemisphere segment will include the previous North America and Latin America businesses as well as land drilling rig operations in Colombia and Mexico.

The Eastern Hemisphere segment will comprise the previous Middle East/North Africa/Asia Pacific segment and Europe/SSA/Russia segment as well as land drilling rig operations in the Eastern Hemisphere. Research and development expenses will be incorporated in the Western and Eastern Hemisphere segment results.

In the first quarter, revenues from Western Hemisphere were $756 million, down 0.4% sequentially but up 3.1% year over year. Assets sale of the Pressure Pumping and Pump-Down Perforating as well as lower sale of pumping units affected quarterly results. This was partially offset by higher activity in Mexico and Argentina. The year-over-year increase can be attributed to improvement of activity in Canada, the United States and Mexico, offset by a decline in Venezuela.

Revenues in Eastern Hemisphere were $667 million, down 8.6% sequentially but up 2.1% year over year, respectively. The sequential fall was caused by lower product sales and activity in the North Sea and Russia. The year-over-year rise can be attributed to higher activity in Middle East and Russia, offset by overall decline in offshore markets of North Sea, West Africa and Asia.

Liquidity

As of Mar 31, Weatherford had $459 million in cash and cash equivalents. It had long-term debt of $7,639 million. Weatherford spent approximately $38 million in capital expenditures during the reported quarter.

Q1 Price Performance

During the January-March quarter of 2018, Weatherford’s shares lost 45.1% compared with industry’s decline of 9.7%.

Zacks Rank & Stocks to Consider

Weatherford carries a Zacks Rank #3 (Hold).

A few better-ranked players in the same sector are Nine Energy Service, Inc NINE, BaytexEnergy Corp BTE and SunCoke Energy Inc SXC. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nine Energy Service is engaged in delivering onshore completion and production services to unconventional oil and gas resource development. The company posted a positive earnings surprise of 6.25% in the preceeding quarter.

Baytex Energy is a conventional oil and gas income trust focused on maintaining its production and asset base through internal property development and delivering consistent returns to its unitholders. It pulled off an average positive earnings surprise of 77.3% over the last three quarters.

SunCoke Energy produces metallurgical coke in the United States. The company delivered an average positive earnings surprise of 130.6% in the last four quarters.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SunCoke Energy, Inc. (SXC) : Free Stock Analysis Report

Weatherford International PLC (WFT) : Free Stock Analysis Report

Baytex Energy Corp (BTE) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance