Webinar: Aussie Crosses at Key Inflection Points Ahead of RBA

DailyFX.com -

Talking Points

Weekly webinar covering featured scalp setups

Updated targets & invalidation levels

EURAUD 30min

Chart Created Using FXCM Marketscope 2.0

Notes: EURAUD has continued to hold above the 1.5298-1.5325 barrier discussed last week. The pair broke above the upper median-line parallel last night & our near-term focus remains weighted to the topside while above this threshold with a breach higher targeting 1.5565 & 1.5662. A break below keeps the short-bias in play targeting the median-line / 200-day moving average at 1.5030/40.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders” series.

AUDUSD 30min

Notes:The AUDUSD weekly opening range is taking shape just above key near-term support & bullish invalidation at 7029/37. Resistance objectives remain unchanged from last week at 7105, 7136 and the key 61.8% retracement at 7171. A break below this key support targets subsequent support objectives at 6983-7000 & 6947.

For updates on these setups and more trades throughout the week, subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

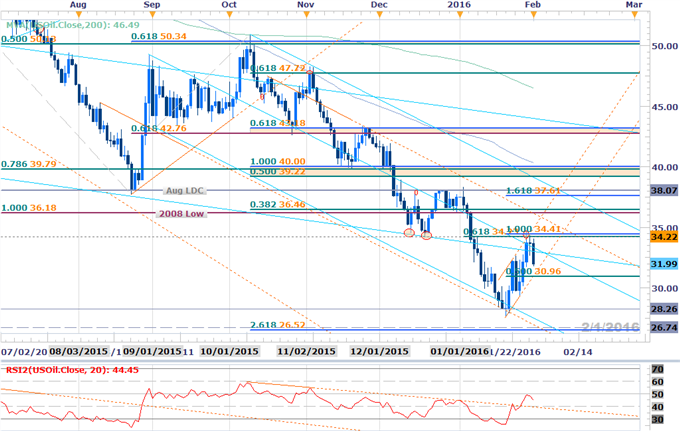

Crude Oil Daily

Notes: Crude revesed course at a key resistance confluence at 34.23/41 where the 100% extension & the key 61.8% retracement convege on the December lows. Near-term support & bullish invalidation rests at the confluence of the 50% retracement of the recent advance & basic trendline support extending off the lows at 30.96.

Gold Daily

Notes: The rally in gold is vulnerable near-term as the precious metal attempts to break above the upper median line parallel extrending off the October high. Topside breach targets the 200-day moving average at 1131 & the 61.8% retracement of the October decline at 1136. Interim support rests at 1108 backed by our bullish invalidation level at 1096. Highlighted these levels in the weekly Gold Forecast.

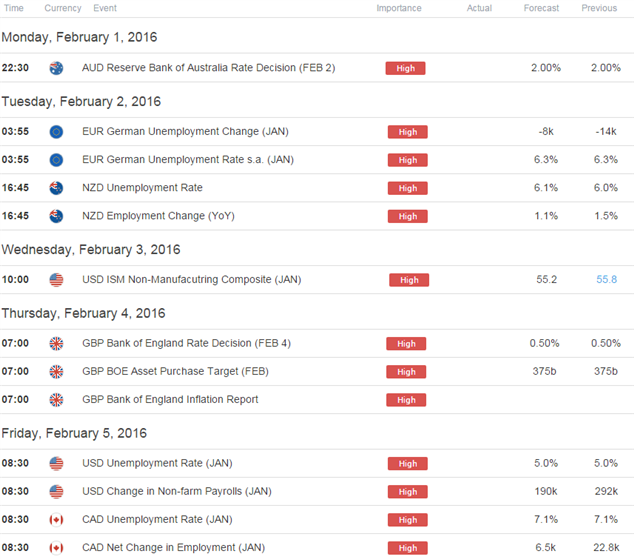

Relevant Data Releases

Other Setups in Play:

EURAUD Approaches Critical Support- Longs Favored Above 1.5300

GBPJPY Coiling For Next Big Move- Breach of 170.50 to Fuel Recovery

EURGBP at Key Inflection Point Ahead of BoE- Something's Gotta Give

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Deskat 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance