Weekly Forex Technical Analysis, Oct 23 – Oct 27, 2017

The US Dollar closed the previous week slightly higher on Fed members’ comments and hawkish sentiment.

Currently, investors had priced in a roughly 91.7 percent probability of a rate increase in December.

In the week ahead, investors will closely watch:

UK Q3 Growth Domestic Product on Wednesday at 9:30 GMT

Bank of Canada Rate Decision on Wednesday at 15:00 GMT

ECB Interest Rate Decision on Thursday at 12:45 GMT

Japan CPI on Friday at 00:30 GMT

US Q3 Growth Domestic Product on Friday at 13:30 GMT

EUR/USD

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

1.1594 | 1.1662 | 1.1721 | 1.1790 | 1.1849 | 1.1918 | 1.1977 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

1.1730 | 1.1760 | 1.1779 | 1.1794 | 1.1809 | 1.1858 |

GBP/USD

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

1.2854 | 1.2971 | 1.3078 | 1.3195 | 1.3302 | 1.3419 | 1.3526 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

1.3088 | 1.3140 | 1.3173 | 1.3200 | 1.3226 | 1.3312 |

USD/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

110.33 | 110.99 | 112.24 | 112.91 | 114.16 | 114.82 | 116.07 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

111.65 | 112.10 | 112.38 | 112.61 | 112.84 | 113.57 |

EUR/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

129.95 | 130.80 | 132.25 | 133.11 | 134.55 | 135.41 | 136.85 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

131.66 | 132.20 | 132.54 | 132.81 | 133.08 | 133.96 |

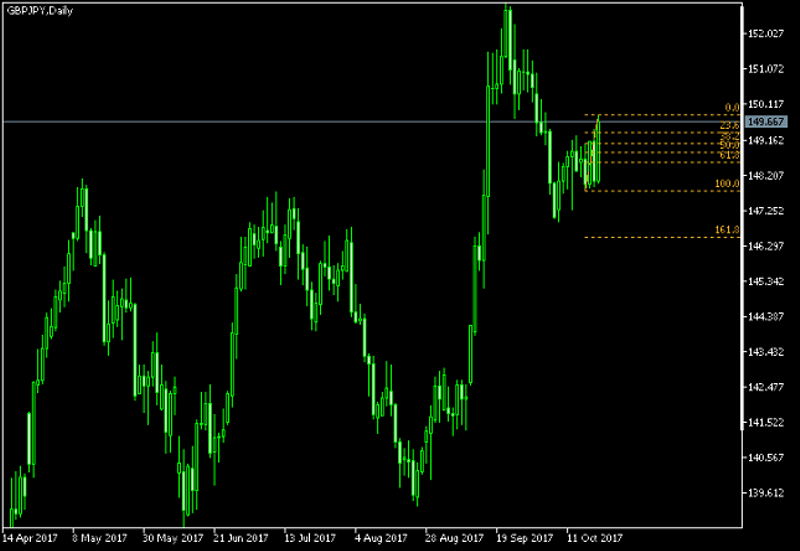

GBP/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

146.30 | 147.04 | 148.35 | 149.09 | 150.40 | 151.14 | 152.45 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

147.77 | 148.26 | 148.56 | 148.80 | 149.04 | 149.82 |

This post was originally published by EarnForex

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance