Weekly Fundamental Forecast: FOMC; BoJ; US, EZ and UK GDP Top Busy Docket

DailyFX.com -

The economic calendar is overloaded with event risk that is both known for heavy market impact and for its growing systemic importance. What should you keep track of for trading the Dollar, Euro, Yen and Pound?

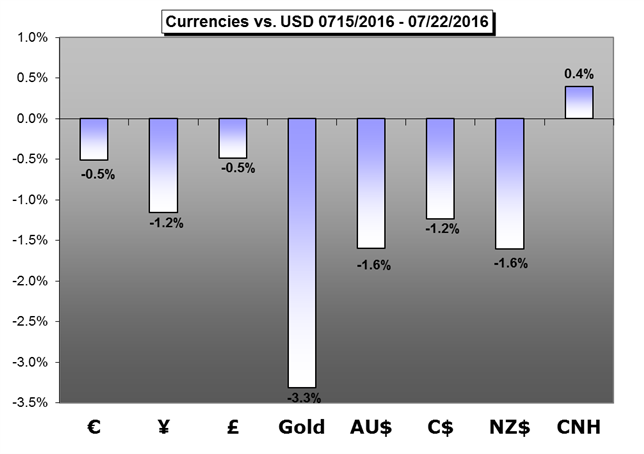

US Dollar Forecast – USDollar Looks to Fed, US GDP, Struggling Euro and Yen to Guide It

The USDollar has advanced for five consecutive weeks – although the pace hardly resembles the unconstrained bull trend through the first quarter of 2015.

Euro Forecast - Pressure Back on EUR/USD as Market Sees Looser ECB, Tighter Fed

Rates markets are starting to shift in favor of another ECB rate cut by the end of the year, while pricing for a Fed rate hike has jumped forward more than six months over the past two weeks. This all adds up to an environment tilting more bearish for EUR/USD in the short-term.

British Pound Forecast - GBP/USD Trade Seems Too Good to be True - Watch Key Risk

The British Pound finished the week almost exactly unchanged against the Dollar despite clear disappointments in UK economic data. A busy economic calendar in the days ahead could nonetheless have a lasting impact on trader sentiment, and the stakes are high heading into a critical Bank of England interest rate decision in two weeks’ time.

Japanese Yen Forecast – USD/JPY July Recovery at Risk on Wait-and-See FOMC/BOJ Policy

The diverging paths between the Federal Open Market Committee (FOMC) and the Bank of Japan (BoJ) may encourage market participants to adopt a long-term bullish bias forUSD/JPY, but the fresh batch of central bank rhetoric may heavily impact the near-term outlook should the policy statements show a greater willingness to retain the status quo.

Chinese Yuan Forecast – Yuan Stays in Range on PBOC Guidance

Both the onshore and offshore Yuan rates failed to hold above the key resistance level 6.70, falling below the 6.6800-handle this week.

Australian Dollar Forecast – Aussie Drops on RBA Minutes, Inflation to Provide Directional Cues

The Australian Dollar has put in sizeable reversal of the prior bullish trend this week, falling by as much as 234 pips or 3% against the US Dollar from last Friday’s high.

Gold Forecast – Gold Prices Vulnerable Ahead of FOMC/ July Close

Gold prices are weaker for a second consecutive week with the precious metal off by more than 1% ahead of the New York close on Friday.

What are the Traits of Successful Traders? See what our studies have found to be the most common pitfalls of retail FXtraders.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, educational webinars, updated speculative positioning measures, trading signals and much more!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance