Welltower (WELL) Q1 FFO Tops, SHO Occupancy Up, '23 View Raised

Welltower Inc.’s WELL first-quarter 2023 normalized funds from operations (FFO) per share of 85 cents surpassed the Zacks Consensus Estimate of 82 cents. It also beat our estimate of 81 cents for the quarter. The reported figure improved 3.7% from the prior-year quarter’s actual.

Results reflect better-than-anticipated revenues. The total same-store net operating income (SSNOI) increased year over year, driven by SSNOI growth in the seniors housing operating (SHO) portfolio. The company also raised its guidance for 2023 FFO per share.

WELL clocked in revenues of $1.56 billion in the quarter, outpacing the Zacks Consensus Estimate of $1.54 billion and our estimate of $1.53 billion. The top line increased 11.8% year over year.

Quarter in Detail

The SHO portfolio’s same-store revenues increased almost 10% year over year to $965.2 million, backed by a 240-basis point uptick in average occupancy from the year-ago quarter. A 6.8% year-over-year rise in same-store revenue per occupied room (REVPOR) was another contributing factor.

In the first quarter, property operating expenses flared up 12.2% to $957.8 million year over year.

The company’s total portfolio SSNOI grew 11% year over year, supported by SSNOI growth in its SHO portfolio of 23.4%.

WELL’s pro-rata gross investments in the first quarter totaled $785 million. This included $529 million in acquisitions and loan funding, and $257 million in development funding. It opened four development projects for a pro-rata investment amount of $57 million. Welltower also completed pro-rata property dispositions and loan payoffs of $92 million in the quarter.

Portfolio Activity

In the quarter, WELL sold a 15% interest in 31 skilled nursing assets to Integra Healthcare Properties for $74 million as part of the earlier announced transition and sale of 147 skilled nursing facilities, originally operated by ProMedica, to Integra. This represented the second tranche of the 85/15 joint venture between Welltower and Integra. The remaining tranches are expected to close later this year.

The company acquired care homes in Northern Ireland, to be operated by Healthcare Ireland under a new triple-net master lease, for $75 million.

WELL also purchased 29 medical office buildings (MOBs) across multiple transactions for $348 million. The buyout of the MOBs, encompassing 1.3 million rentable square feet, represented an initial yield of 6.9%. This was inclusive of the acquisition of a 174,000 square feet MOB strategically located in Washington, DC, which has 82% occupancy currently and an initial yield of 6.6%.

Balance Sheet Position

As of Mar 31, 2023, WELL had $4.6 billion of near-term available liquidity comprising $0.6 billion of available cash and restricted cash and full capacity under its $4.0 billion line of credit.

Dividend Update

On May 2, concurrent with its first-quarter 2022 earnings release, Welltower announced a cash dividend of 61 cents per share for the first quarter. The dividend will be paid out on May 23 to stockholders of record as of May 16, 2023. This will mark the company’s 208th consecutive quarterly cash dividend payout.

2023 Guidance Raised

Welltower now projects 2023 normalized FFO per share of $3.39-$3.54, up from the prior-guided range of $3.35-$3.53. The Zacks Consensus Estimate for the same is pegged at $3.45, which lies within the guided range.

The company’s full-year guidance now assumes the average blended SSNOI growth of 9-13%, comprising 17-24% growth in Seniors Housing Operating, 1-3% in Seniors Housing Triple-net, 2-3% in Outpatient Medical and 3-4% in Long-Term/Post-Acute Care.

Welltower expects to fund an additional $649 million of development in 2023 relating to projects underway as of Mar 31, 2023.

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

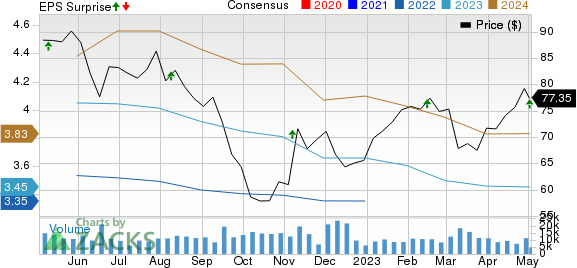

Welltower Inc. Price, Consensus and EPS Surprise

Welltower Inc. price-consensus-eps-surprise-chart | Welltower Inc. Quote

Performance of Other REITs

Healthpeak Properties, Inc. PEAK reported first-quarter 2023 FFO as adjusted per share of 42 cents, in line with the Zacks Consensus Estimate. The reported figure, however, fell short of the year-ago quarter’s 43 cents.

PEAK’s results reflected better-than-anticipated revenues. Moreover, improvement in same-store portfolio cash (adjusted) NOI was witnessed across the portfolio. The company reaffirmed its 2023 outlook for FFO as adjusted per share.

Mid-America Apartment Communities, Inc. MAA, commonly referred to as MAA, reported first-quarter 2023 core FFO per share of $2.28, surpassing the Zacks Consensus Estimate of $2.25. Moreover, the reported figure climbed 15.7% year over year.

This residential REIT’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. MAA also raised its outlook for 2023 core FFO per share.

Alexandria Real Estate Equities, Inc. ARE reported first-quarter 2023 adjusted FFO (AFFO) per share of $2.19, surpassing the Zacks Consensus Estimate of $2.15. The reported figure climbed 6.8% from the year-ago quarter’s tally. We estimated AFFO per share for the quarter to be $2.14.

ARE’s results reflected better-than-anticipated revenues on healthy leasing activity and solid rental rate growth.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance