West Pharmaceutical's (WST) Latest Investment to Boost Business

West Pharmaceutical Services, Inc. WST recently announced that it had made a strategic investment in Latch Medical. Following this, the company will take a minority ownership stake in Latch Medical.

It is worth mentioning that Latch Medical is a Dublin-based renowned name in next-generation vaccine and biologics delivery technology and is pioneering a new approach to intradermal delivery.

The latest minority investment is expected to significantly boost West Pharmaceutical’s global business.

Rationale Behind the Investment

Per West Pharmaceutical’s management, the continuously evolving methods of delivering medicines to patients reflect their desire for ease of use and effectiveness. Management believes the latest investment will likely boost its business by including Latch Medical's innovative intradermal-delivery technology. This, in turn, will likely provide total care via better outcomes and support innovative technologies that serve patients.

Latch Medical's management feels that West Pharmaceutical’s investment in it can accelerate the impact of its technology.

Industry Prospects

Per a report by bcc research, the global market for vaccine delivery devices should grow from $3.7 billion in 2021 to $4.4 billion by 2026 at a CAGR of 3.8%. Factors like demand for advanced vaccine delivery devices, and urgency for developed and efficient vaccination devices during the COVID-19 pandemic are expected to drive the market.

Given the market potential, West Pharmaceutical’s recent investment is likely to provide a significant boost to its business globally.

Notable Developments

Last month, West Pharmaceutical reported second-quarter 2022 results, wherein it recorded a robust year-over-year uptick in the overall top line and the bottom line. It also saw strong performance by the Proprietary Products segment and continued strong demand for the company’s NovaPure, Envision and Daikyo Crystal Zenith products. Solid double-digit organic sales growth in the Biologics and Generics market units and mid-single digit organic sales growth in the Pharma market unit were other quarterly highlights.

In June, West Pharmaceutical announced its plans to introduce its new Daikyo Crystal Zenith (CZ) 2.25mL Insert Needle Syringe System at the BIO International Convention. The 2.25mL CZ Insert Needle Syringe System is an expansion upon the 1mL Insert Needle Syringe System being offered currently.

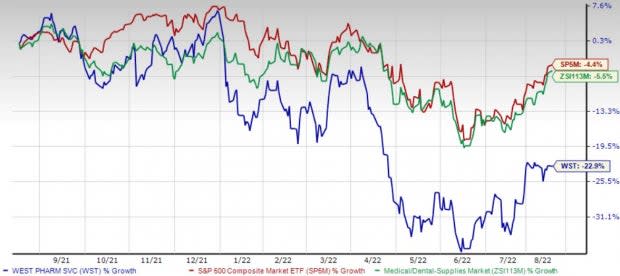

Price Performance

The stock has lost 22.9% over the past year compared with the industry’s 5.5% fall and the S&P 500's 4.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, West Pharmaceutical carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Patterson Companies, Inc. PDCO and McKesson Corporation MCK.

AMN Healthcare, flaunting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.7%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 4.6% against the industry’s 27.5% fall in the past year.

Patterson Companies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.6%. PDCO’s earnings surpassed estimates in all the trailing four quarters, the average beat being 16.5%.

Patterson Companies has gained 2.5% against the industry’s 5.5% fall over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 9.9%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average beat being 13%.

McKesson has gained 82.9% against the industry’s 5.5% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance