What now since US classed China as a 'currency manipulator'?

The US government classed China as a “currency manipulator” after the country’s central bank, the People’s Bank of China (PBoC), allowed the yuan to breach the key seven-per-dollar level against the US dollar (CNY=X) for the first time since 2008.

The move roiled global stock markets, with the US recording its worst trading day for 2019 and Asian and European bourses trailing lower on Monday and into Tuesday.

So what’s next?

While the classification doesn’t mean much from a legal standpoint, it does indicate heightened tension between the US and China — signalling no clear end to the current trade war.

The US government said that Treasury Secretary Steven Mnuchin will now engage with the International Monetary Fund (IMF) "to eliminate the unfair competitive advantage created by China's latest actions." However it is unclear what those talks would result in.

READ MORE: Yuan still in breach mode as US labels China "currency manipulator"

The US and China that are set to continue trade negotiations in September this year but already the markets are wildly reacting to the fact that neither party is backing down in the trade war.

While the PBoC said that the devaluation “doesn’t matter” and called for calm in the storm, J. Kyle Bass, the CIO of Hayman Capital Management, told Yahoo Finance the trade war between the US and China is "bigger than economics" as another round of tariffs is set to take effect on Chinese goods in less than a month.

Strategists like John Higgins, Capital Economics’ chief markets economist warn that the S&P 500 will plunge another 15% by the end of this year while BNY Mellon chief strategist Alicia Levine on Yahoo Finance’s The First Trade, that China's yuan devaluation has investors 'puking stocks.'

Importantly, investors are now looking at whether a trade deal between the two parties is even possible, let alone this year since tensions have rapidly escalated over the last month.

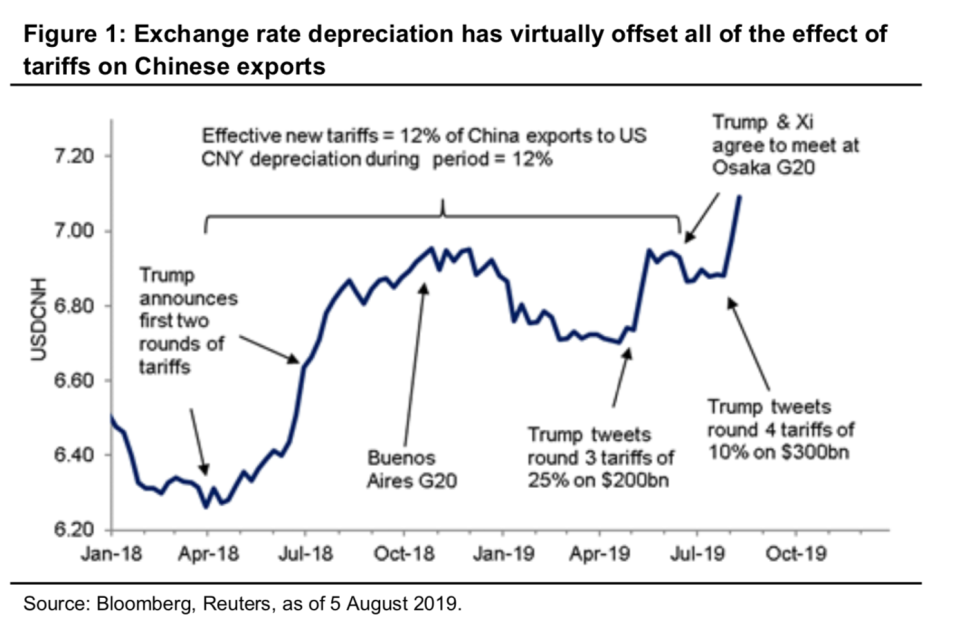

For example, Citi analysts had one key chart in a note to clients that its exchange rate can be a primary tool of retaliation — where the exchange rate depreciation has virtually offset all of the effect of tariffs on Chinese exports:

Julian Evans-Pritchard, senior China economist at Capital Economics added support to this in a note to clients too.

“The fact that [China has] now stopped defending 7.00 against the dollar suggests that they have all but abandoned hopes for a trade deal with the US,” he said.

“In a statement likely to anger Trump, the PBOC has explicitly linked today’s devaluation with the renewed tariff threat made by the US last week. In doing so, the PBOC has effectively weaponised the exchange rate, even if it is not proactively weakening the currency with direct FX intervention.

READ MORE: Kyle Bass: The US-China trade war is ‘bigger than economics’

“If anything, the PBOC will probably lean in the other direction, in order to ensure that the depreciation remains managed and gradual... We had anticipated that the PBOC would eventually devalue the currency in response to trade tensions but hadn’t expected it to come quite this soon. We now expect the renminbi to end 2019 at 7.30 per US dollar (compared with 6.90 previously). Our end-2020 forecast remains unchanged at 7.50.”

Yahoo Finance

Yahoo Finance