What's in the Cards for Bausch Health (BHC) Q1 Earnings?

Bausch Health Companies Inc. BHC is scheduled to report first-quarter 2019 results on May 6, before the market opens.

In the last reported quarter, the company’s earnings beat estimates by 19.3%. Bausch’s earnings track record has been pretty decent so far. The company beat earnings expectations in the last four quarters, delivering an average positive surprise of 88.3%.

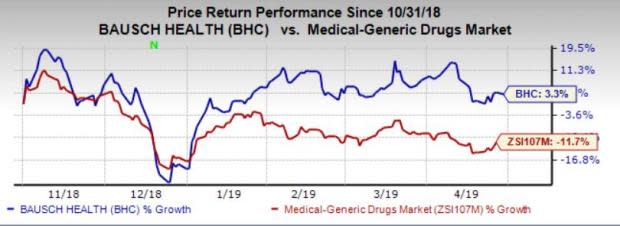

Bausch’s stock has gained 3.3% in the past six months against 11.7% decline of the industry.

Factors Likely to Impact Results

Bausch conducts business in four operating segments — the Bausch + Lomb/International segment, the Salix segment, the Ortho Dermatologics segment and the Diversified Products segment.

Approximately 75% of the company’s total 2018 revenues were generated by the Bausch + Lomb/International and the Salix segments. Hence, the focus will be on these two segments in the first quarter.

The Salix business continues to drive growth and contribute to the top line. In particular, increased sales of Xifaxan, Apriso and Relistonare should drive revenues in the first quarter.

Bausch launched 10 products in 2018, which should result in incremental revenues in the first quarter. Investors will also focus on new drug approvals in the to-be-reported quarter. In February 2019, Bausch announced that the FDA has approved Lotemax SM (loteprednol etabonate ophthalmic gel) 0.38%, a new gel formulation for the treatment of postoperative inflammation and pain following ocular surgery.

Meanwhile, investors are expected to focus on pipeline development, apart from the regular top and bottom-line numbers in the upcoming quarterly results. Bausch has narrowed focus on seven recently launched or expected to be launched products pending completion of testing and receipt of FDA approval. The products include Vyzulta, Siliq, Bryhali (psoriasis), Lumify, Duobrii, Relistor and SiHy Daily. Among these, the FDA recently approved Duobrii for the topical treatment of plaque psoriasis in adults. We expect an update on the launch of the same and a tentative increase in guidance.

The focus will also be on the company’s efforts to pay debt, as it had been under the scanner for its huge levels of debt. Bausch repaid $400 million of debt in the fourth quarter of 2018 and $1 billion in 2018.

Earnings Whispers

Our proven model does not conclusively show that Bausch will beat on earnings in the quarter to be reported. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates. Unfortunately, that is not the case here, as you will see below.

Earnings ESP: Earnings ESP for Bausch is -2.40%. This is because the Zacks Consensus Estimate stands at 89 cents and the Most Accurate Estimate at 87 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Bausch carries a Zacks Rank #2, which is favorable. However, the negative ESP makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Bausch Health Cos Inc. Price, Consensus and EPS Surprise

Bausch Health Cos Inc. Price, Consensus and EPS Surprise | Bausch Health Cos Inc. Quote

Stocks to Consider

Here are some companies you may consider, as our model shows that these have the right combination of elements to deliver a beat in the to-be-reported quarter.

Gilead Sciences, Inc. GILD has an Earnings ESP of +1.54% and a Zacks Rank #2. The company is scheduled to release financial figures on May 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Aduro Biotech, Inc. ADRO has an Earnings ESP of +82.00% and a Zacks Rank of 2.

Mallinckrodt plc MNK has an Earnings ESP of +0.25% and a Zacks Rank of 3. The company is scheduled to report first-quarter results on May 7.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO) : Free Stock Analysis Report

Mallinckrodt public limited company (MNK) : Free Stock Analysis Report

Bausch Health Cos Inc. (BHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance