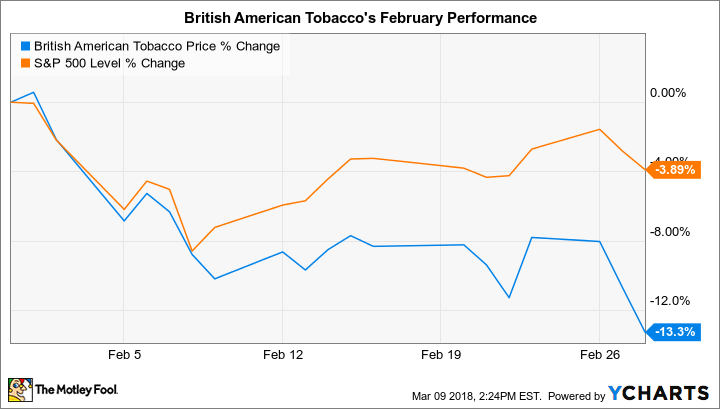

Why British American Tobacco Stock Fell 13% in February

What happened

British American Tobacco (NYSE: BTI) trailed the market last month by shedding 13% compared to a 4% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

That drop knocked shares into negative territory over the past 12 months, compared to a 17% gain for the broader market.

So what

Investors had a lukewarm response to the tobacco giant's fiscal 2017 earnings report last month. That announcement showed that organic cigarette volume fell by 2.6%, which modestly outperformed the broader industry's 3.5% decline.

Image source: Getty Images.

British American Tobacco managed solid adjusted growth, though, thanks to its recent acquisition of Reynolds American that made it the world's biggest global tobacco company. Profitability inched higher, and cash flow was up a healthy 16%.

Now what

Management is hoping to extract value from its bigger nicotine portfolio in 2018 even as profits are pressured by the extra debt it had to take on to complete the massive Reynolds merger. Staple cigarette products, along with growth brands like Vype and Glo, should allow the company to deliver on its commitment of annual adjusted earnings growth in the high single digits even as tobacco consumption declines on a global basis.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance