Why Campbell Soup Stock Gained 21% in June

What happened

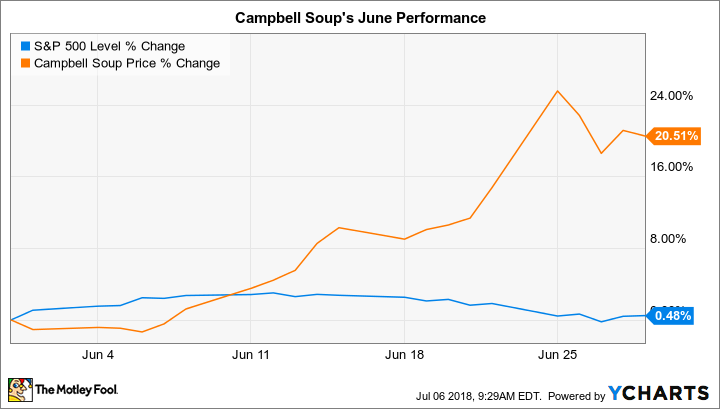

Consumer packaged foods specialist Campbell Soup (NYSE: CPB) outpaced the market last month by gaining 21% compared to a less-than-1% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

^SPX Price change. Data source: YCharts.

The rally wasn't enough to make shareholders whole, though, as the stock has trailed the market over the past one-year, three-year, and five-year periods.

So what

Investors pushed shares higher in June following reports suggesting the company might be close to a deal where it would be acquired. One such rumor, late in the month, caused an 11% spike in the stock price after Kraft Heinz was identified as a potential buyer.

Image source: Getty Images.

Now what

It's impossible to predict whether Kraft or any other consumer foods company will reach a deal to buy Campbell Soup at a premium to the current share price. Thus, investors looking at the stock today should focus on its operating results, which are trending lower right now. In fact, the company's latest profit downgrade implies it will suffer its fourth consecutive year of declining earnings as it struggles with weak sales and pricing pressures.

Until Campbell Soup can find a way to improve its portfolio to the point that it can pass along any cost increases to consumers, its stock isn't likely to break out of its multi-year downward trend.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance