Why foreign billionaires are circling British telecoms

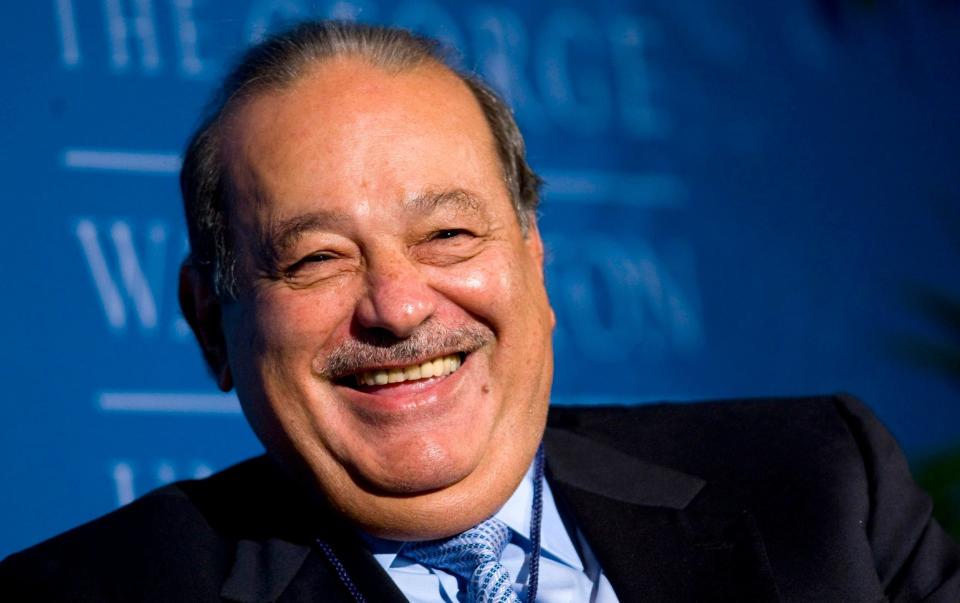

When news of Carlos Slim’s £400m investment in BT reached bosses at the telecoms company, it was welcomed with cautious optimism. “I think it’s probably a net positive,” says one insider.

The reaction outside BT has been somewhat more effusive. Analysts viewed the decision by the Mexican telecoms billionaire to take a 3.2pc stake as a vote of confidence in new chief executive Allison Kirkby, coming as it did just weeks after she unveiled her plans for the company.

In a brief statement, Slim himself suggested the investment was “financial”. However, the tycoon’s swoop is not an isolated incident. Instead, it is the latest example of a foreign billionaire snapping up shares in British telecoms giants such as BT and Vodafone.

The flurry of interest has sparked speculation that Britain’s crucial infrastructure providers could become takeover targets. The interest will also no doubt provoke questions about what it means for the millions of people who use these telecoms companies’ phone and internet services on a daily basis.

Bargain hunting lies at the heart of the trend. With share prices in the doldrums, opportunistic investors are buying up stakes on the cheap in the hope of capitalising on turnaround plans.

Slim, an 84-year-old billionaire who made his fortune in Latin American telecoms, has timed his approach prudently.

Kirkby last month outlined plans to double BT’s cash flow, cut £3bn in costs and return more money to shareholders in dividends. The investor-friendly strategy was rewarded with BT’s best day on the market in more than two decades.

“It feels like an endorsement of Allison’s strategy update, which was extremely well received by the investor community,” says Kester Mann at CCS Insight of Slim’s investment. “It’s a real shot in the arm for her.”

But the tycoon’s sudden presence has also raised eyebrows, especially given his track record in the sector. He previously bought a stake in Dutch telecoms firm KPN before mounting a failed takeover bid. He was also behind failed takeover swoops for both Telecom Italia and Portugal Telecom.

“Most likely it’s an opportunistic strategic investment aiming to capitalise on BT’s still fairly depressed share price,” says Mann. “But it could also be a bit of a beachhead to taking a stronger position in the company.”

Slim is not the only foreign billionaire on BT’s share register. French tycoon Patrick Drahi, who also made his money in telecoms, has built a stake of almost 25pc in the company.

These manoeuvres have fuelled speculation of a takeover bid – and BT has enlisted advisers at Robey Warshaw and Goldman Sachs to mount a possible defence.

The threat of a Drahi has receded as his Altice empire has been confronted with the mounting cost of its $60bn debt pile and corruption investigations in both France and Portugal.

Slim’s Grupo Carso has insisted its BT stake is a purely financial investment, while BT said it “welcomes any investor who recognises the long-term value of our business”.

Karen Egan at Enders Analysis adds that “pretty much everyone” has given up on the prospect of taking over BT because of strict national security laws.

But it is not only BT in billionaires’ crosshairs. FTSE 100 rival Vodafone is fending off pressure from French tycoon Xavier Niel, who has acquired a 2.5pc stake in the company and is agitating for change.

Liberty Global, the US giant owned by so-called “cable cowboy” John Malone, also holds a stake of almost 5pc.

Elsewhere, smaller rival Three is owned by Hong Kong billionaire Li Ka-shing’s CK Hutchison, though his holding will be diluted should a planned £15bn merger with Vodafone go ahead.

Driving this trend is a realisation that British telecoms stocks are undervalued. Even with their recent boost, BT’s shares are down by more than a third over the last five years. Vodafone’s shares have dropped by almost half over the same period.

Heavy investment in infrastructure such as 5G and full-fibre broadband has weighed on the company’s finances, while tough retail competition has put pressure on consumer prices and squeezed margins.

But now, with the bulk of this investment in the rear-view mirror, investors are seeing an opportunity.

“They are just undervalued and some of these investors are looking to seize opportunities, potentially short term, potentially longer term,” says Mann.

Egan adds that the telecoms industry can be “a bit impenetrable” to general investors given the complex technology and regulatory issues involved.

“It’s perhaps not surprising that we’re seeing experienced telecoms specialists buying into value stories that others struggle to get comfortable with,” she says.

At Vodafone, Niel also has other interests – namely the carving up of the company’s European operations.

Earlier this year, the French billionaire, also involved in telecoms, mounted a €10.5bn (£8.9bn) bid to merge Vodafone’s Italian business with his own company Iliad. However, this was rebuffed, with the British company ultimately choosing Swisscom instead.

The jilting has not gone down well with Niel. In an interview last weekend he said: “We’ve lost a lot of money since we bought our shares in Vodafone. And I’m not sure of the management of this company.”

It is not just billionaires who are interested in Britain’s phone-and-broadband providers: UAE-owned Etisalat has built a 15pc stake in Vodafone, becoming its biggest shareholder. The investment sparked an intervention from ministers, who warned there was a risk of “material influence” by the Gulf state.

The growing presence of foreign investors in a critical sector may also raise concerns for consumers who have been forced to swallow inflation-busting price rises in recent years.

Could these new shareholders drive BT and Vodafone to boost returns at the expense of investment in networks or push up prices for customers? Analysts say it is unlikely.

“If anything, people having confidence in [Kirkby’s] plan gives her additional confidence to pursue the strategy that she’s pursuing,” says Egan. “So I think it’s positive for her investment plans and investment in the UK.”

Still, the presence of a string of foreign billionaires on share registers means change could always be on the horizon – and bosses will have to be on their guard.

“I don’t see the strategy necessarily changing, but of course if these guys do take greater shares and become more influential there is always the potential that could change,” says Mann.

Yahoo Finance

Yahoo Finance