Why Investors Should Retain Waste Connections (WCN) Stock Now

Waste Connections, Inc. WCN has an impressive Growth Score of B. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

The company has an expected long-term earnings per share (three to five years) growth rate of 11.2%. Earnings are expected to register year-over-year growth of 10% in 2023 and 13.3% in 2024.

Factors That Augur Well

Being a leading player in the waste management industry, Waste Connections is likely to benefit from ongoing trends such as increasing environmental concerns, rapid industrialization, increase in population and active government measures to reduce illegal dumping.

With the prime location of disposal sites being within competitive markets, Waste Connections has optimal asset positioning to generate higher profitability. Given the importance of and costs associated with the transportation of waste to treatment and disposal sites, having disposal capacity proximate to the waste stream offers a competitive advantage and serves as a barrier to entry.

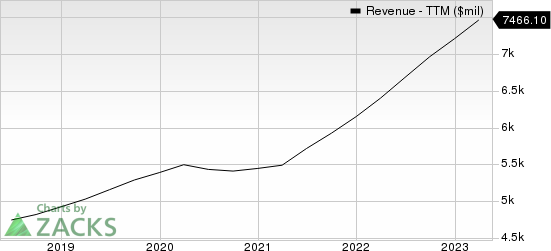

Waste Connections, Inc. Revenue (TTM)

Waste Connections, Inc. revenue-ttm | Waste Connections, Inc. Quote

Waste Connections has a steady dividend as well as a share repurchase policy. In 2022 and 2021, It paid $243 million and $220.2 million in dividends and repurchased shares worth $425 million and $339 million, respectively. In 2020, it paid $199.9 million in dividends and repurchased shares worth $105.7 million. Such moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

Some Risks

Waste Connections' current ratio (a measure of liquidity) at the end of first-quarter 2023 was pegged at 0.82, lower than the current ratio of 1.12 at the end of the prior-year quarter. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank & Stocks to Consider

Waste Connections currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are DocuSign DOCU, Green Dot GDOT, and Maximus MMS.

For the first quarter of fiscal 2023, the Zacks Consensus Estimate of DocuSign’s revenues is expected to grow 8.9% year over year to $641.2 million and the same for earnings suggests an increase of 39.5% to 53 cents per share. The company has an impressive earning surprise history, beating the Zacks Consensus mark in three instances and missing on one instance. It has an average surprise of 12.3%.

DOCU has a growth score of A and a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues is expected to decline 4.2% year over year to $340.1 million and the same for earnings indicates a 52.7% dip to 35 cents. The company has an impressive earning surprise history, beating the Zacks Consensus mark in all four trailing quarters. It has an average surprise of 37.3%.

GDOT has a Value score of A and currently sports a Zacks Rank of 1.

For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues is expected to grow 6.1% year over year to $1.2 billion and the same for earnings indicates a 33.3% rise to $1.04. The company has an impressive earning surprise history, beating the Zacks Consensus mark in three instances and missing on one instance. It has an average surprise of 9.6%.

MMS has a VGM score of A and a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance