Why Legacy Reserves (LGCY) Could Shock the Market Soon

It can be very difficult to find companies that are both flying under the radar, and still might have potential for gains. Many times, stocks are off investors’ radar screens for a reason, though there are some hidden gems that could be worth uncovering by those with a high risk tolerance.

One way to find these underappreciated stocks is by looking at companies that haven’t seen their share prices move higher lately, but have observed analysts raising earnings estimates for their stock. This trend could signal that investors haven’t quite embraced the rising estimate story yet, but that the potential for a big move higher is definitely there.

One such company that looks well positioned for a solid gain, but has been overlooked by investors lately, is Legacy Reserves LP LGCY. This Oil and Gas - Exploration and Production – U.S. stock has actually seen estimates rise over the past month for the current fiscal year by about 51.9%. But that is not yet reflected in its price, as the stock lost 28.6% over the same time frame.

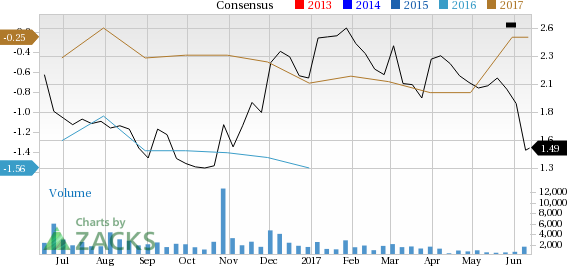

Legacy Reserves LP Price and Consensus

Legacy Reserves LP Price and Consensus | Legacy Reserves LP Quote

You should not be concerned about the price remaining muted going forward. This year’s expected earnings growth over the prior year is 85.6%, which should ultimately translate into price appreciation.

And if this isn’t enough, LGCY currently carries a Zacks Rank #2 (Buy) which further underscores the potential for its outperformance (See the performance of Zacks' portfolios and strategies here: About Zacks Performance). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

So if you are looking for a stock flying under-the-radar that is well-equipped to bounce down the road, make sure to consider Legacy Reserves. Solid estimate revisions and an impressive Zacks Rank suggest that better days may be ahead for LGCY and that now might be an interesting buying opportunity.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Click for Free Legacy Reserves LP (LGCY) Stock Analysis Report >>

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance