Why is Molson Coors (TAP) an Attractive Option for the Long Run?

Molson Coors Beverage Company TAP is an attractive bet for the long term, owing to its strong fundamentals, pricing initiatives, gains from its revitalization plan and the premiumization of its global portfolio. The company is on track with increased investments toward core brands and innovations. Strength across its Coors Light and Miller Lite brands, as well as its beyond-beer approach, bodes well.

Molson Coors reported a top-line beat in the third quarter of 2022, driven by the continued benefit from a favorable sales mix and improved pricing trends across regions. Sales also improved year over year. On a constant-currency basis, net sales rose 7.9%. Net sales per hectoliter increased 9.2% on a brand-volume basis.

However, consumer inflationary pressures, a strike at its Quebec brewery and the cycling of a solid shipment in the prior-year quarter hurt the company’s results. Consequently, its adjusted earnings per share declined 24.6% year over year and missed the Zacks Consensus Estimate.

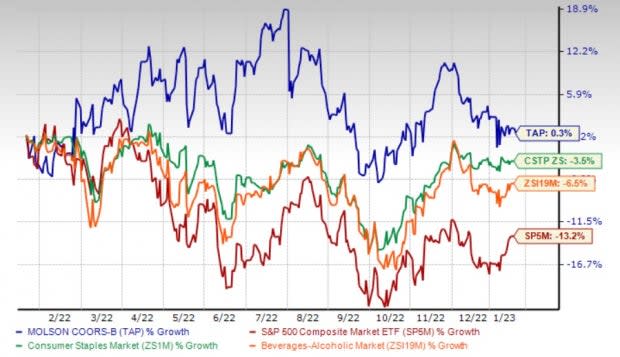

Despite the odds, shares of Molson Coors have gained 0.3% in the past year against the industry’s decline of 6.5%. The stock’s performance also compared favorably against the Consumer Staples sector’s fall of 3.5% and the S&P 500’s decline of 13.2% in the same period.

The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s sales suggests growth of 4.3% from the year-ago period’s reported number, while earnings estimates indicate a decline of 7%.

Image Source: Zacks Investment Research

Molson Coors’ Strategies on Track

Molson Coors is witnessing significant benefits from its revitalization plan focused on achieving sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. It intends to invest in iconic brands and growth opportunities in the above-premium beer space; expand in adjacencies and beyond beer, without hampering the support for its existing large brands; and create digital competencies for commercial functions, supply-chain-related system capabilities and employees.

To facilitate these investments, TAP plans to generate savings of $150 million by simplifying its structure. It is also building on the strength of its iconic core brands. Additionally, the company’s cost-savings program, announced in 2020, targets delivering cost savings of $600 million over three years.

Molson Coors is also committed to growing its market share through innovation and premiumization. With a view to accelerating portfolio premiumization, the company has been aggressively growing its above-premium portfolio in the past few years.

The company highlighted that it is making efforts to change the shape of its product portfolio and expand in growth areas. Its U.S. above-premium portfolio witnessed sales that outpaced its U.S. economy portfolio, driven by rapid growth of its hard seltzers, the successful launch of Simply Spiked Lemonade, and the continued strength in Blue Moon and Peroni’s.

Despite the continued uncertainties related to the pandemic, as well as rising cost inflation, management retained the 2022 view. Net sales are projected to grow in the mid-single digits in constant currency. Underlying EBIT is likely to grow year over year in the high-single digits in constant currency. Underlying depreciation and amortization are projected to be $700 million, plus or minus 5%, compared with the $750 million mentioned earlier.

Headwinds to Address

Molson Coors has been witnessing lower brand and financial volume. Sluggishness in the America segment, owing to lower Canada shipments and continued impacts of the Québec labor strike, hurt brand volumes in the third quarter. Financial volume was hurt by a soft industry performance in the Americas and the Québec labor strike, as well as the impacts of the Russia-Ukraine conflict and consumer inflationary pressures across Central and Eastern European countries.

Inflationary pressures are likely to be other headwinds. COGS per hectoliter continues to be affected by cost inflation on materials, transportation and energy costs, and mix impacts from both portfolio premiumization. Molson Coors has been witnessing weakened consumer demand across the beer industry in its Central and Eastern European regions. This is mainly due to muted disposable income stemming from inflationary pressure.

Stocks to Bet On

We highlighted three better-ranked stocks in the Consumer Staples sector, namely Anheuser-Busch InBev BUD, The Coca-Cola Company KO and PepsiCo Inc. PEP.

Anheuser-Busch InBev, alias AB InBev, currently flaunts a Zacks Rank #1 (Strong Buy). BUD has a trailing four-quarter earnings surprise of 8.8%, on average. It has a long-term earnings growth rate of 9.7%. The company has declined 7.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AB InBev’s current financial-year sales and earnings per share suggests growth of 7.3% and 1.8%, respectively, from the year-ago reported numbers. The consensus mark for BUD’s earnings per share has moved down 4.9% in the past seven days.

Coca-Cola currently has a Zacks Rank #2 (Buy) and an expected long-term earnings growth rate of 6.2%. KO has a trailing four-quarter earnings surprise of 8.8%, on average. The company has gained 1.1% in the past year.

The Zacks Consensus Estimate for Coca-Cola’s current financial-year sales and earnings suggests growth of 10.8% and 6.9%, respectively, from the year-ago reported numbers. The consensus mark for KO’s earnings per share has been unchanged in the past 30 days.

PepsiCo currently has a Zacks Rank of 2. PEP has a trailing four-quarter earnings surprise of 1.1%, on average. It has a long-term earnings growth rate of 7.7%. Shares of PEP have gained 0.5% in a year.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 7.2% and 8%, respectively, from the prior-year reported numbers. The consensus mark for PEP’s earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company The (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

AnheuserBusch InBev SANV (BUD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance