Why a summer rate cut is still in play despite inflation ‘shocker’

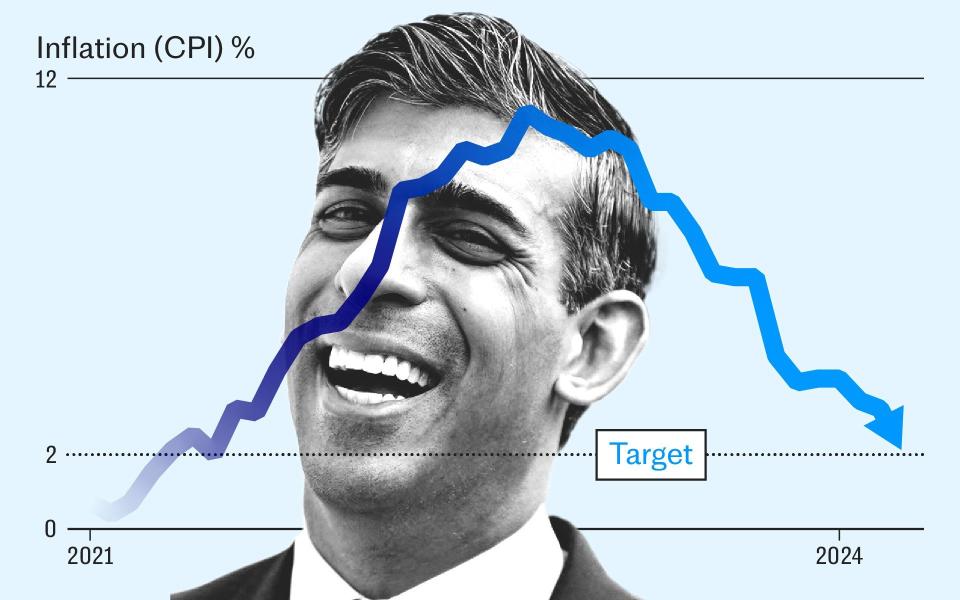

This is what Rishi Sunak has been waiting for. Not since July 2021 has Britain’s inflation rate started with the number “2”.

The Prime Minister hailed the fall in the consumer prices index, to 2.3pc, as a “major moment for the economy, with inflation back to normal”. Surely, Downing Street must have been hoping, the narrative would now shift to economic stability – and imminent interest rate cuts by the Bank of England ahead of a looming general election.

Unfortunately, the markets were less impressed.

Wednesday’s inflation data sparked a frenzy among traders who pushed back their prediction for the first reduction in interest rates from 5.25pc from June to November, in large part because of stubborn prices in the crucial services sector. Previously, they had been predicting a cut as soon as June.

The reaction is a blow for Sunak – but, given Bank of England officials have repeatedly hinted at summer cuts, traders also risk being too pessimistic.

Yael Selfin, chief UK economist at KPMG, said the numbers mean the Bank’s Monetary Policy Committee (MPC) is unlikely to cut rates next month, even though inflation is now in “striking distance of the Bank of England 2pc target”.

“This may still not be enough to convince more cautious MPC members to commit to a rate cut in June,” she said, “especially while wage growth remains elevated and economic growth momentum is strong.”

The election also introduces a very political element.

Since becoming independent in May 1997, the Bank of England has never cut rates immediately before a general election. There have been six over that time.

When Tony Blair was re-elected for his second term as Labour prime minister in June 2001, the Bank’s rate-setting panel met the day before the election. Policymakers voted to hold rates steady after having delivered three cuts already that year and then resumed cutting in August.

This year inflation is expected to pick up again in the second half of the year to around 2.6pc, while pay growth is expected to cool. July may be as good as it gets for the economy.

Markets have been particularly spooked by inflation in the dominant services sector, which only dropped from 6pc to 5.9pc compared to the Bank’s own prediction of 5.5pc.

However, Selfin believes traders may be too pessimistic in their predictions.

There is another month of inflation data before the Bank’s next rate decision on June 20, which keeps the door open for a summer cut – albeit in August. By then, Downing Street may have a new occupant.

Governor Andrew Bailey has said he is “optimistic” the inflation crisis is at an end. Ben Broadbent, the deputy governor, said this week that “if things continue to evolve with MPC forecasts... then it’s possible Bank Rate could be cut some time over the summer.”

Selfin believes an August rate cut is therefore still very much in play – months sooner than the market bets suggest.

“Our forecast sees further declines in headline inflation, which could for a time bring the annual rate below 2pc, potentially picking up slightly early in 2025,” she said.

“That could leave enough margin for the [Bank] to start easing rates in August while keeping the overall monetary policy stance tight for at least another year.”

Today’s drop in inflation was not as big as forecast by economists, who had been expecting a fall to 2.1pc.

However, analysts were more concerned by the fine print than the headline figure.

Rob Wood, chief UK economist at Pantheon Macroeconomics, described the rise in services prices – which the Bank is watching closely – as a “shocker”.

“Upside surprises were widespread, not focused on a few erratic components,” he said.

Inflation in restaurants and hotels rose to 6pc in April from 5.8pc in March, while the price of cinema and concert tickets rose by 8.3pc from 5.4pc.

Paul Dales, chief UK economist at Capital Economics, said this “suggests the persistence in domestic inflation is fading even slower than the Bank of England had assumed”.

He said that – along with smaller-than-expected easing in so-called core inflation, which strips out volatile movements in food and energy prices, from 4.2pc to 3.9pc instead of the 3.6pc rate expected by the market – this “may mean that businesses are passing on some of the rise in the minimum wage in their selling prices”.

George Moran, an economist at Nomura, agreed that the current rate of services price growth was “too high for comfort”.

He said: “We think the data will make it hard for the Bank to consider a cut in June”.

However, he described the shift in market bets on interest rates as an “overreaction”, partly because of “one-off” factors driving the rise in services inflation, including increases in council property rents that are based on historical price rises and other bill rises that are always uprated above inflation, such as annual increases in mobile phone and broadband bills.

A 6.7pc increase in the TV licence – the first since 2021 – also put upward pressure on inflation last month.

“If these factors are excluded, it takes some heat off the services CPI number and perhaps suggests the Bank may not read this as hawkishly as the headline services number would suggest,” said Moran, who still expects the Bank to start cutting in November.

Halving inflation from its double-digit highs remains the sole pledge that Sunak has delivered on after outlining his five priorities at the start of 2023 .

It’s true that green shoots are emerging, with the economy expanding at its fastest rate since 2021 in the first three months of the year.

The International Monetary Fund warned the Bank on Tuesday that keeping rates too high for too long could end up inflicting more harm than good on the economy. It is calling for up to three rate cuts this year.

The next move in rates is clearly down. But it looks like homeowners and other borrowers will have to wait a little longer for relief.

Yahoo Finance

Yahoo Finance