Why the weight-loss drug boom is just the beginning

How breakthrough obesity medications are revolutionising healthcare

Gorodenkoff/Shutterstock

The era of weight-loss drugs is officially here. Fuelled by blockbuster marvels like Ozempic and Mounjaro, which were developed to treat type 2 diabetes, pharmaceutical companies have been making billions thanks to a number of targeted obesity medications, including Wegovy and Zepound.

Pharma giants Novo Nordisk and Eli Lilly are leading the charge with these game-changing medications, known as GLP-1 agonists, which have taken the world by storm and sent their stock soaring to stratospheric levels. But the current boom is just the beginning.

Scores of other weight management drugs are in development, with their potential extending far beyond shrinking waistlines. Rather, these wonder medications are showing remarkable promise in treating everything from heart failure and liver disease to Alzheimer's, depression, and even addiction. Read on for the inside story on the weight-loss drug boom and the possibilities that lie ahead.

All dollar amounts in US dollars

The origins of the new game-changing weight-loss drugs

Science Photo Library/Alamy

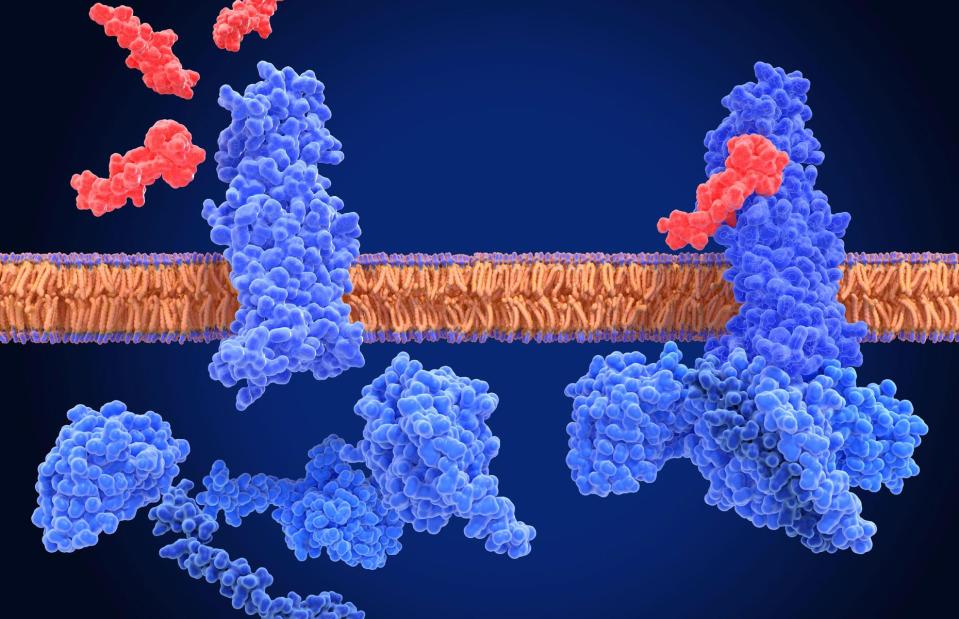

The weight-loss drug gold rush stems from the discovery of glucagon-like peptide-1 (GLP-1) back in the 1980s.

This crucial gut hormone stimulates insulin production, decreases blood sugar, and suppresses appetite by slowing the progression of food through the digestive system.

Scientists realised the hormone had serious potential as a diabetes treatment. But there was a major catch: when injected into the body, GLP-1 was rapidly broken down by enzymes and had zero effect. The hunt was on for a drug that could mimic the hormone but linger for longer – and success eventually came thanks to a venomous lizard...

The venomous lizard behind the boom

Danita Delimont/Shutterstock

In 1990, Dr John Eng of the Veterans Affairs Medical Center in New York was searching for hormones in the natural world with potentially therapeutic qualities. He honed in on the Gila monster, the only venomous lizard native to America, after he discovered the reptile could keep its blood sugar levels stable even when hungry.

Intrigued, Dr. Eng studied the reptile's toxic saliva and isolated a peptide called exendin that works in much the same way as GLP-1 but lasts longer. Working with other experts, Dr. Eng showed that the peptide could successfully treat diabetes, and went on to develop a synthetic version called exenatide. This became Byetta, the first GLP-1 agonist drug on the market.

Released by Amylin Pharmaceuticals in the US in 2005, the diabetes drug had one key drawback: it had to be injected twice a day. Enter Novo Nordisk...

Longer-lasting GLP-1 agonists

Mohammed_Al_Ali/Shutterstock

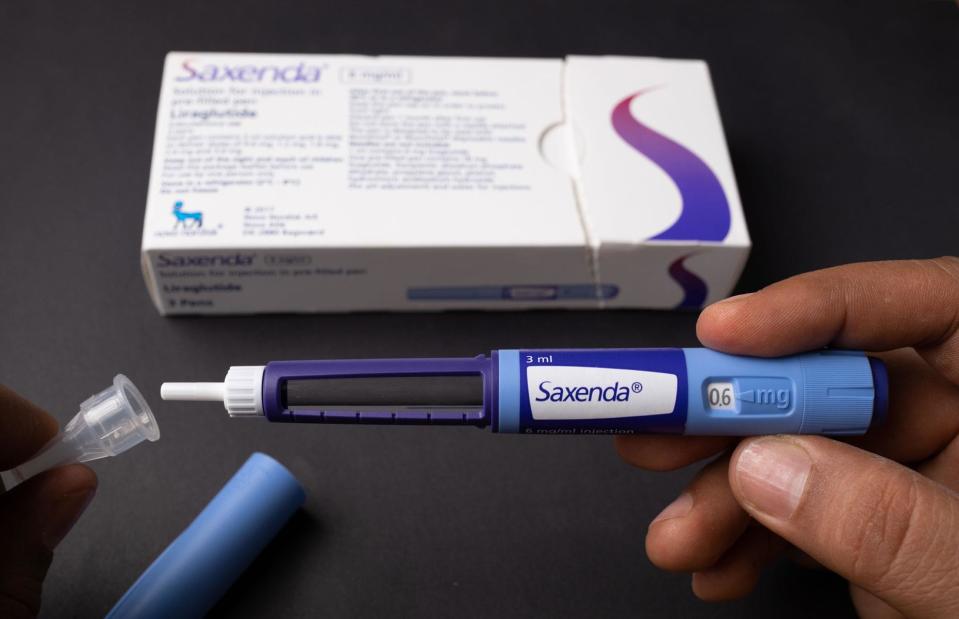

The Danish drugmaker came up with a longer-lasting GLP-1 agonist called liraglutide by attaching a fatty molecule to the hormone, cutting the dosage down to one injection a day. Marketed as Victoza, the diabetes medication was cleared for use in the EU in 2009 and secured US FDA approval the following year.

Soon after, those on the drug began reporting modest weight loss. Novo Nordisk launched clinical trials of the medication as an obesity treatment, and, following positive results, a double-strength version just for weight management was released in the US in 2014 under the brand name Saxenda.

Novo Nordisk's semaglutide innovation

Kittyfly/Shutterstock

Novo Nordisk remained laser-focused on improving its diabetes drug. As The New York Times has noted, weight loss was lower on its list of priorities and there was even some resistance within the company against taking that route.

The company's scientists played around with the chemical structure of GLP-1 and found an even better way of preventing the hormone from being broken down with the invention of semaglutide. This meant just one injection a week was required rather than a daily shot.

Ozempic and Rybelsus launch around the world

KK Stock/Shutterstock

The diabetes medication was approved in the US in 2017 under the brand name Ozempic. The EU, Japan, Canada, and Brazil followed suit in 2018, while the UK and Australia gave the drug the regulatory all-clear in 2019, followed by China in 2021. New Zealand followed suit last year and Ozempic is now available in several other countries.

In the meantime, Novo Nordisk has also rolled out Rybelsus, a version of the medication in pill form for the needle-phobic.

Wegovy is released in the US

Tobias Arhelger/Shutterstock

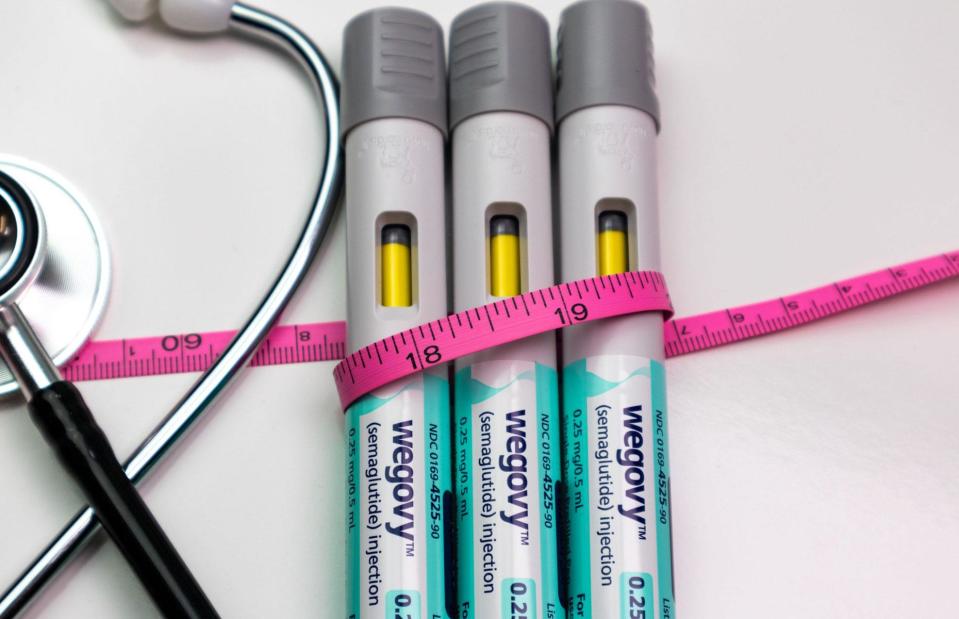

Incredibly, diabetics taking Ozempic found they were getting significantly slimmer. For reasons mostly unknown, it turned out people taking the drug were losing around 15% of their body weight on average, three times what Saxenda was achieving. Needless to say, a huge buzz began to build, especially on social media platforms like TikTok.

In 2021, the drug was featured on US daytime TV staple The Dr Oz Show as a potential cure for obesity. News stories started cropping up everywhere, and the off-label use of Ozempic as a weight-loss drug surged. That same year, Novo Nordisk released a souped-up version of the drug in the US called Wegovy, specifically approved for weight loss.

Celebrity fans and the debut of Eli Lilly's Mounjaro and Zepbound

Axelle/Bauer-Griffin/FilmMagic/Getty Images

Celebrities began to admit use of the drug, with a slew of top names revealing they'd dropped pounds by using Ozempic, Wegovy, or other GLP-1 agonists. Among them were Elon Musk, Oprah Winfrey, Kelly Clarkson, and Sharon Osbourne.

In 2022, US pharma titan Eli Lilly joined the fray after developing tirzepatide, which combines GLP-1 with another gut hormone. It was released in the US, EU, UK, Canada, and elsewhere as the diabetes drug Mounjaro and followed the next year by a weight-loss version called Zepbound.

This drug is even more effective than Wegovy for weight management – people taking the highest dose of Zepbound shed an average of 21% of their body weight, compared to 15% on Wegovy.

Skyrocketing sales

oleschwander/Shutterstock

Unsurprisingly, these blockbuster weight-loss drugs have been flying off the shelves. Last year, sales of obesity management medications hit $6 billion (£4.7bn), up 154% from 2022, while diabetes-targeted GLP-1 agonists pulled in billions more.

Sales of Novo Nordisk's Ozempic generated $13.9 billion (£11bn) in 2023. Rybelsus made the firm $2.7 billion (£2.1bn) and Wegovy turned over $4.5 billion (£3.6bn). The company's sales were so impressive they bumped up Denmark's GDP and saved the country from zero growth.

Rival Eli Lilly's diabetes drug Mounjaro generated $5.2 billion (£4.1bn), while its weight-loss medication Zepbound, which only came out in the last quarter of the year, brought in more than $175 million (£138m).

Colossal growth forecast for the weight-loss drug market

Seemanta Dutta/Alamy

The market for these revolutionary weight-loss drugs is mushrooming, which makes sense when you consider around three billion people around the world are overweight or obese. According to Morgan Stanley, the market could increase more than 15-fold by 2030 as sales reach a staggering $144 billion (£114bn).

With sales set to balloon over the coming years, Novo Nordisk and Eli Lilly have seen their respective share prices and market values shoot up. At the time of writing, Novo Nordisk is worth $655 billion (£517bn). That figure eclipses Denmark's GDP and makes it Europe's most valuable company.

Eli Lilly is worth even more. With a market cap of $860 billion (£678bn), it's now the world's most valuable pharma company and 10th most valuable firm overall.

The biggest markets worldwide for weight-loss drugs

Richard Levin/Alamy

North America has emerged as the biggest market for obesity drugs. According to Fortune Market Insights, it accounted for $3 billion (£2.4bn) in sales last year, which is half the global market.

Europe is next in terms of market size, followed by the Asia-Pacific region, which is expected to see sales increase at a faster rate due to the higher prevalence of obesity in parts of the region.

As we've mentioned, phenomenal growth is expected for the sector in the coming years and Morgan Stanley predicts as much as 9% of the US population will be taking these weight-blasting medications by 2035.

Wildly varying prices for weight-loss drugs around the world

Natalia Varlei/Alamy

Prices for these groundbreaking drugs vary wildly across the world, with Americans typically paying more. Ozempic and Wegovy are up to 15 times more expensive in the US compared to other countries.

Last year, an analysis found Americans paid a whopping $936 (£738) on average for an Ozempic injection. The French spent just $83 (£65), and Aussies paid only $87 (£69), while Brits and Swedes parted with $93 (£73) and $96 (£76) respectively. The cost stood at a relatively reasonable $147 (£116) in Canada and $169 (£133) in Japan, which is the second most expensive country for Ozempic after the US.

Americans were also paying considerably more for Eli Lilly's Mounjaro and Zepbound, despite the fact they're made by a US company.

US lawmakers criticise high prices

MADS CLAUS RASMUSSEN/Ritzau Scanpix/AFP via Getty Images

US lawmakers are up in arms, accusing the drugmakers of ripping off Americans.

Following the threat of a subpoena, Novo Nordisk's CEO Lars Fruergaard Jørgensen has agreed to testify before a Senate hearing in September over his company's "outrageously high" US prices. However, the American authorities may need to focus on properly regulating drug prices instead.

Weight-loss drugs are cheaper in other countries because they set strict limits on how much pharma companies can charge, whereas these firms are mostly given free rein in the US.

Severe global shortage of weight-loss drugs

Uwe Aranas/Shuttertock

As millions of people clamour for these breakthrough drugs – despite the punishing costs in some cases – the companies that make them are struggling to keep up with the fierce demand.

Novo Nordisk is operating its manufacturing lines 24/7 and spending billions on upgrading supply chains, yet demand continues to massively exceed supply. And no wonder: 25,000 Americans start on Wegovy every week in 2024, marking a five-fold increase from December.

Eli Lilly is also investing billions into production, though its coveted diabetes and weight-loss drugs are also in drastically short supply.

The black market for weight-loss drugs booms

Pete Hansen/Shutterstock

With shortages rife and prices sky-high, an increasing number of people are resorting to obtaining their weight-loss drug of choice via the mostly online black market.

Unscrupulous sellers are hawking counterfeit versions of the medications, with the knock-off meds not only ineffective but also downright dangerous.

The issue has become so prevalent that it's prompted an alert from the World Health Organization (WHO), while Eli Lilly recently released an open letter warning about fake versions of its blockbuster drugs Mounjaro and Zepbound. The pharma companies and authorities are working to shut down the counterfeiters, but the problem is likely to persist until the shortages end and prices fall.

Side effects of the new weight-loss drugs

voronaman/Shutterstock

While the new weight-loss medications have been hailed as wonder drugs by some, they can cause a number of unpleasant side effects, and even more serious complications in rarer cases. These medications don't work for everyone and rates of weight loss can vary, with some users plateauing after several months.

Almost half of the people taking a GLP-1 agonist report one or more gastrointestinal issues when taking their drug of choice. Symptoms can include nausea, vomiting, acid reflux, bloating, stomach cramps, diarrhoea, and constipation.

These side effects tend to ease, though some people find them unbearable to deal with and have stopped taking the medication. Other minor side effects include fatigue and injection site irritation.

Weight-loss drugs can spoil your enjoyment of food

Estrada Anton/Shutterstock

On another note, some have complained that the drugs ruin their enjoyment of food.

In an interview with Wired, Professor Jens Juul Holst, a pioneer in the field, said that long-term use of the medications can take the pleasure out of eating and make life "miserably boring".

Professor Holst has suggested this is a key reason why many struggle to take the drugs for more than two years. He's stressed the importance of providing people with dietary and lifestyle advice to help them manage their weight once they've come off the medications, as the pounds can easily pile back on, undoing any benefits of taking the drugs.

Lack of long-term data

Zoran Zeremski/Shutterstock

Perhaps the biggest cause for concern is the lack of long-term data on these weight-loss drugs. As obesity expert Dr Rekha Kumar explained to America's CBS News earlier this year, these medications have arrived on the scene relatively recently.

Another possible downside of the weight-loss drug craze is an increase in fatphobia, as it reinforces the belief that weight is something that can be easily controlled.

Rachel Pick, contributor to British newspaper The Guardian, has even suggested Ozempic and similar medications are killing off the body positivity movement, turning back the clock on years of progress towards more accepting attitudes.

A global insulin shortage

Spencer Platt/Getty Images

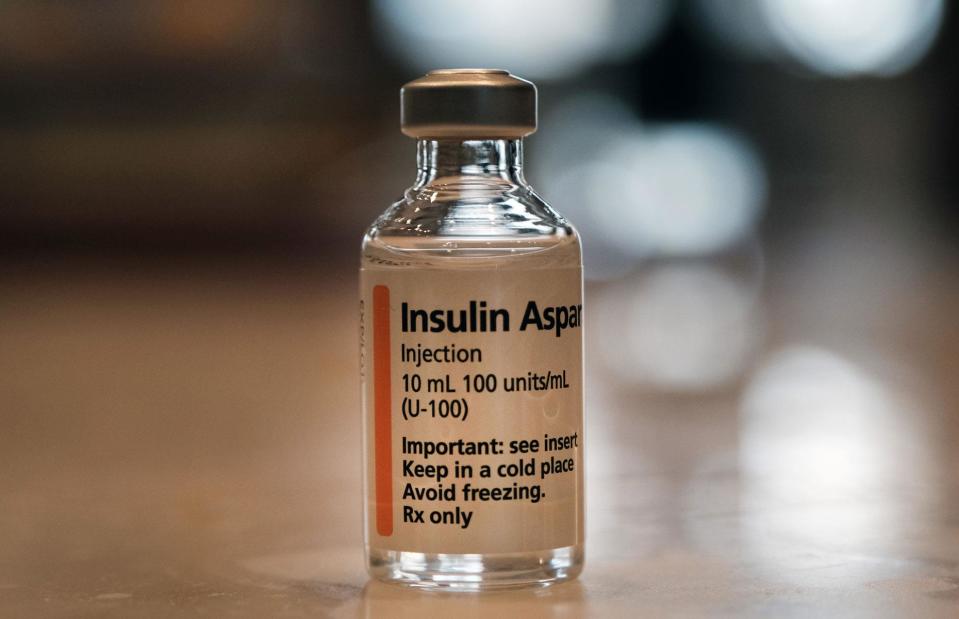

What's more, the weight-loss drug gold rush has led to a shortage of insulin, with drugmakers cutting production of the essential diabetes medication in favour of the more lucrative weight-loss marvels.

Supply issues have plagued numerous countries, including the US, Canada, and the UK, but it's the world's less affluent nations that have been hit the hardest.

In late June, South Africa's public health system completely ran out of insulin pens, mainly because of Novo Nordisk's decision not to renew its contract in the country and concentrate instead on its blockbuster obesity drugs.

Additional potential health benefits

KKStock/Alamy

On the positive side, scientists are finding ever more tantalising benefits of these remarkable medications.

Wegovy has been shown to significantly reduce the risk of major cardiovascular events, including heart attacks and strokes.

And though kidney problems have been listed as a side effect of semaglutide, the active ingredient of Wegovy and Ozempic, it paradoxically appears to slow the progression of kidney disease, according to research from Novo Nordisk.

Possible treatments for liver disease, cancer and more

oleschwander/Shutterstock

Eli Lilly's tirzepatide and a new GLP-1 agonist called survodutide from Zealand Pharma/Boehringer are showing promising signs as potent treatments for fatty liver disease and more serious renal conditions.

GLP-1 agonists may also reduce the risk of colon cancer, as well as helping to prevent other cancers. Meanwhile, tirzepatide is being evaluated as a treatment for sleep apnoea.

The drugs are also being explored as addiction treatments. Intriguingly, there are reports of people stopping smoking, ceasing alcohol use, refraining from nail-biting, and ditching other compulsive behaviours. Research is now underway that could lead to a new class of anti-addiction drugs.

Potential treatments for mental health conditions and neurological disorders

Robert Kneschke/Shutterstock

In terms of mental health, GLP-1 agonists may exacerbate depression in some people, though they appear to ease the condition in others, opening up the possibility of these drugs being repurposed as antidepressants. Studies have also shown that GLP-1 agonists are linked with lower rates of anxiety.

These wonder medications could mitigate the risk of Alzheimer's disease and other forms of dementia, as well as neurological disorders such as Parkinson's, by preventing the build-up of amyloid, a protein that forms plaques that impair brain function.

Given the amazing potential of GLP-1 agonists, it makes sense there are so many in the pipeline...

The barrage of obesity drugs coming our way

Ropisme/Shutterstock

A total of 124 obesity drugs are in development, of which 40% are GLP-1 or GIP agonists. Much of the focus is on creating more affordable weight-loss medications that come with fewer side effects.

Cheaper mimics are emerging in China, India, and elsewhere as pharma companies take advantage of expiring patents to create their own low-cost generic versions. The liraglutide patent has already expired and semaglutide's will expire in 2026, so accessing these drugs is likely to become considerably more affordable as the decade progresses.

Weight-loss drugs with fewer side effects on the horizon

Mojahid Mottakin/Shutterstock

Meanwhile, Western pharma companies are concentrating on minimising side effects.

US biotech firm Altimmune has combined GLP-1 with glucagon, another peptide hormone that regulates blood sugar. The resulting drug, pemvidutide, offers similar weight loss and other beneficial effects as semaglutide but unlike the latter, it preserves lean muscle tissue.

Denmark's Zealand Pharma has, in addition to survodutide, developed a drug called petrelintide, which is based on yet another blood sugar-regulating peptide hormone. It promises fewer GI-related side effects and is also billed as preserving lean muscle mass. Other major Western drugmakers and biotech firms developing obesity drugs include Roche, AstraZeneca, Amgen, and Viking Therapeutics.

Weight-loss drugs could transform the global economy

Stokkete/Shutterstock

Obesity drugs are proving to be an industry disruptor matched by few other pharma innovations. They even have the potential to transform the economy.

For instance, according to Goldman Sachs, the drugs could boost US GDP by 1%, simply by reducing obesity-related illness and improving workplace productivity. As a result, public healthcare spending is likely to be significantly reduced, freeing up money for other areas.

Some of the predictions are, at best, random – for example, with fewer heavier passengers, airlines could save tens of millions of dollars a year. That's according to analysts at global research firm Jeffries, who suggest this could result in cheaper airfares.

Potential economic winners and losers

MBI/Shutterstock

Gyms are also likely to see an uptick in membership levels, while sales of sportswear are set to boom. The fashion industry is likely to reap the benefits as newly slender customers update their wardrobes, although plus-size retailers will probably see a downturn – as could the food and drink industry.

Stocks in major companies in the sector, such as Hershey, Kraft Heinz, and Coca-Cola, have faltered recently as analysts weigh their reduced prospects for growth.

That said, these firms are starting to rise to the challenge. Nestlé has just announced a new meal line called Vital Pursuit, aimed specifically at people taking weight-loss drugs. Its competitors will almost certainly follow suit with their own Wegovy and Zepbound-friendly products.

The future of medicine

Gorodenkoff/Shutterstock

While the new weight-loss medications are the latest wonder drugs, a bewildering array of novel treatments and technologies are already available or in development that could be just as impactful.

Interestingly, the global pharma industry is facing an enormous patent cliff this decade as hundreds of medicines are losing patent protection.

This is putting a lot of pressure on these firms to innovate and create the next blockbuster drug or technology. The most exciting areas include CRISPR-based gene therapy, immunology, mRNA vaccines, AI-powered healthcare, personalised medicine, and digital twins.

Gene therapy and immunology

MedSci/Alamy

CRISPR-based gene therapy has the potential to transform the treatment of multiple diseases, particularly those with a genetic cause.

Last year saw the launch of the world's first CRISPR-based gene therapy, a treatment for sickle cell disease and beta-thalassemia. And the therapy may result in cures for lifelong conditions such as herpes.

Immunology, which is effectively the study of what stimulates the body to fight disease, is another potentially game-changing area.

This approach powers Merck & Co's blockbuster Keytruda cancer drug, which is forecast to be the world's best-selling medication in 2028, with a turnover of almost $31 billion (£24bn). And the most promising treatments for Alzheimer's disease are all immunotherapy-based.

Vaccines for cancer and AI-powered personalised medicine

MangKangMangMee/Shutterstock

mRNA vaccines saved countless lives during the COVID-19 pandemic and bagged a Nobel prize. Now the technology is being used to develop vaccines against cancer and other life-threatening conditions.

Meanwhile, AI is becoming increasingly integrated into healthcare, while personalised medicine tailored to the precise needs of the individual is poised to transform medicine. Johnson & Johnson is leading the way, and underpinning the approach is the use of digital twins. These are effectively virtual clones that enable medical professionals to diagnose illnesses, practice surgeries, and test the outcome of drug treatments.

One thing's for certain: with a host of new medications and treatments in the pipeline, the future of pharma is looking very exciting.

Now discover how much countries around the world really spend on healthcare

Yahoo Finance

Yahoo Finance