Williams-Sonoma (NYSE:WSM) Posts Q1 Sales In Line With Estimates, Stock Soars

Kitchenware and home goods retailer Williams-Sonoma (NYSE:WSM) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 5.4% year on year to $1.66 billion. It made a non-GAAP profit of $4.07 per share, improving from its profit of $2.64 per share in the same quarter last year.

Is now the time to buy Williams-Sonoma? Find out in our full research report.

Williams-Sonoma (WSM) Q1 CY2024 Highlights:

Revenue: $1.66 billion vs analyst estimates of $1.65 billion (small beat)

EPS (non-GAAP): $4.07 vs analyst estimates of $2.73 (49.3% beat)

Gross Margin (GAAP): 48.3%, up from 38.5% in the same quarter last year

Free Cash Flow of $187.3 million, down 36% from the same quarter last year

Same-Store Sales were down 4.9% year on year

Store Locations: 517 at quarter end, decreasing by 14 over the last 12 months

Market Capitalization: $20.2 billion

“We are pleased to deliver strong results in the first quarter of 2024, driven by an improving top-line trend and continued strength in our profitability. We remain committed to executing on our three key priorities in 2024 – returning to growth, elevating our world-class customer service, and driving margin,” said Laura Alber, President and Chief Executive Officer.

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Williams-Sonoma is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

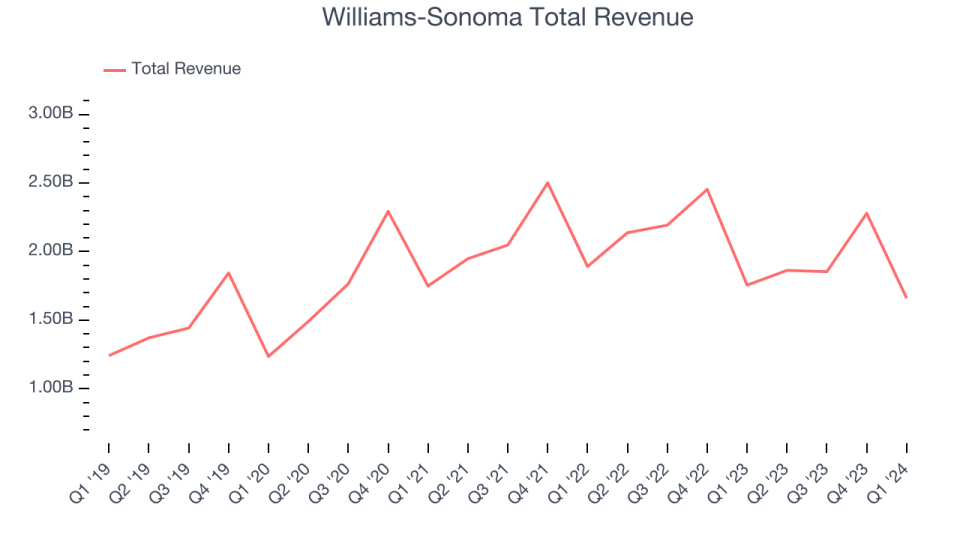

As you can see below, the company's annualized revenue growth rate of 6.1% over the last five years was weak as its store count dropped.

This quarter, Williams-Sonoma reported a rather uninspiring 5.4% year-on-year revenue decline to $1.66 billion in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 2.3% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Williams-Sonoma's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 3.2% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Williams-Sonoma's same-store sales fell 4.9% year on year. This decrease was a further deceleration from the 6% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Williams-Sonoma's Q1 Results

We were impressed by how significantly Williams-Sonoma blew past analysts' EPS and gross margin expectations this quarter. We were also excited it raised its full-year operating margin guidance to 17.8% at the midpoint. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 5% after reporting and currently trades at $330.15 per share.

Williams-Sonoma may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance