Wind farms push down energy prices says SSE boss after ‘misconstrued’ debate

The boss of energy giant SSE has hit out at a “misconstrued” notion of what is causing the current energy crisis, saying his latest wind farm could have knocked nearly £70 off bills if it had opened in time for this winter.

Alistair Phillips-Davies said that some were not understanding the cause of the hike in energy bills – something that is down to spikes in global gas prices, not the expansion of renewable energy.

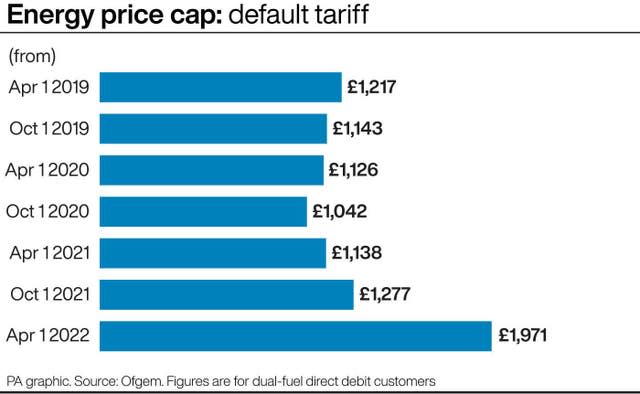

What he says is supported by energy regulator Ofgem, which was on Thursday forced to announce a 54% hike in energy bills for millions of households.

“The increase is driven by a record rise in global gas prices over the last six months, with wholesale prices quadrupling in the last year,” the regulator said.

But on Friday, reports emerged that cabinet ministers are pushing to weaken the UK’s net zero ambitions in the belief it could drive down energy bills.

In response, Mr Phillips-Davies said: “In some quarters, the root cause of the current energy crisis is becoming misconstrued. Let’s be clear, the volatile global gas market is behind the huge price increases that are now facing millions.”

Some have also said that, if the UK had developed gas fracking sites, it might have kept gas prices down.

However, the chief executive of Shell on Thursday said that even the global giant, which produces more than 1% of the world’s natural gas, could only do “so much” to influence energy prices.

Mr Phillips-Davies said that far from being a burden, renewable energy will be the answer to bringing down bills.

Money paid back to customers by wind turbine operators has slashed bills by £20 over the next price cap period, Ofgem figures showed.

SSE is currently building the world’s largest offshore wind farm in UK waters. When finished, it will sell electricity that is a quarter the price of recent record highs.

Had it been operational this winter, it could have saved each household £67, according to calculations done by the company.

Mr Phillips-Davies said: “Net zero, and the investment required to get there, is part of the solution, not the problem.

“Gas has an important role to play in the transition, but this is not a binary choice. We need both gas and new low-carbon technologies in order to have cleaner, cheaper and more secure energy supplies.

“Investments in indigenous, low-carbon power sources and greater flexibility will help reduce the amount of gas we need, allowing us to meet more of our own demand and rely less on imports.

“What’s more, renewables pay money back to consumers when wholesale prices are high – this has saved hundreds of millions this winter and potentially even more in the future.

“Net zero is not only an environmental decision, it’s a rational economic one. Investing now will not only reduce our future exposure to gas markets but it will also support jobs and growth.

“Short term action is clearly needed to help consumers through this very challenging period but we mustn’t blink now on net zero or we risk locking in the next energy crisis.”

Earlier in the day, E.ON’s UK boss Michael Lewis said the Government must focus on reducing gas consumption if it is to get energy bills down.

He told BBC Breakfast: “If we’re really going to tackle long-term energy prices, what we really need to do is drive hard on zero carbon, get ourselves off the global gas market and invest massively in energy efficiency.”

Yahoo Finance

Yahoo Finance