Winners And Losers Of Q1: IPG Photonics (NASDAQ:IPGP) Vs The Rest Of The Semiconductor Manufacturing Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the semiconductor manufacturing stocks, including IPG Photonics (NASDAQ:IPGP) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.3%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but semiconductor manufacturing stocks have performed well, with the share prices up 16.3% on average since the previous earnings results.

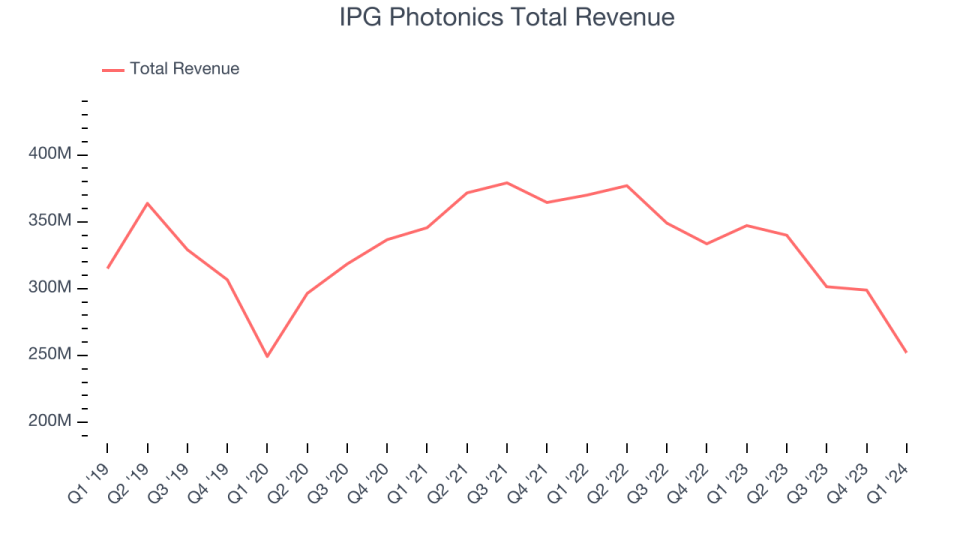

IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

IPG Photonics reported revenues of $252 million, down 27.4% year on year, falling short of analysts' expectations by 0.7%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

"In the first quarter, we continued to generate strong cash flow from operations, reduce inventory and control manufacturing expenses, in spite of the challenging conditions. We also remained focused on our strategy to unlock additional growth opportunities for fiber lasers such as welding, cleaning, heating and medical, which would allow us to diversify our revenue away from highly competitive markets," said Dr. Eugene Scherbakov, IPG Photonics' Chief Executive Officer.

IPG Photonics delivered the slowest revenue growth of the whole group. The stock is down 4.5% since the results and currently trades at $84.58.

Read our full report on IPG Photonics here, it's free.

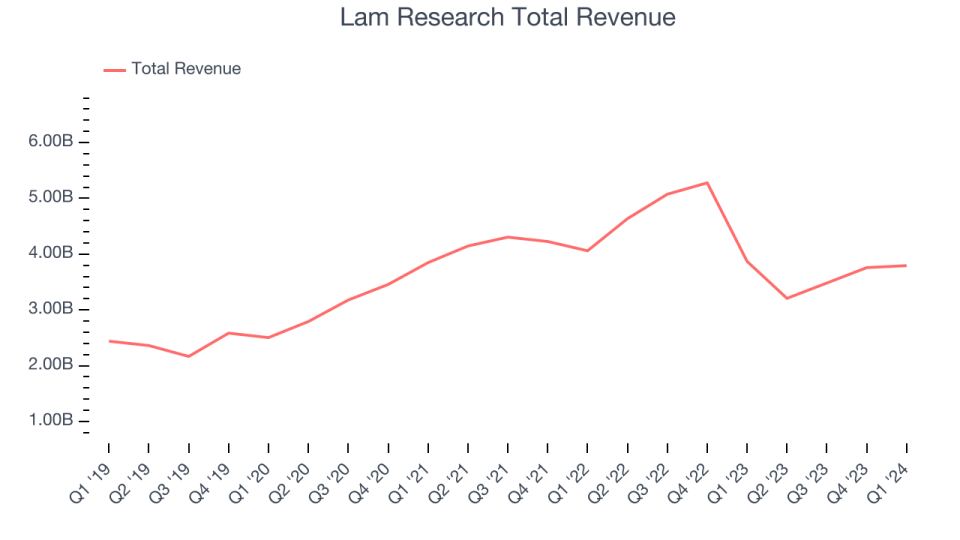

Best Q1: Lam Research (NASDAQ:LRCX)

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $3.79 billion, down 2% year on year, outperforming analysts' expectations by 1.7%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 22.3% since the results and currently trades at $1,081.5.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $172.1 million, down 0.5% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 11.2% since the results and currently trades at $49.24.

Read our full analysis of Kulicke and Soffa's results here.

Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $25.43 million, down 23.6% year on year, surpassing analysts' expectations by 8.2%. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Amtech pulled off the biggest analyst estimates beat among its peers. The stock is up 30.5% since the results and currently trades at $6.48.

Read our full, actionable report on Amtech here, it's free.

Amkor (NASDAQ:AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.37 billion, down 7.2% year on year, falling short of analysts' expectations by 0.9%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 29.5% since the results and currently trades at $40.81.

Read our full, actionable report on Amkor here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance