Winners And Losers Of Q1: Universal Technical Institute (NYSE:UTI) Vs The Rest Of The Education Services Stocks

Looking back on education services stocks' Q1 earnings, we examine this quarter's best and worst performers, including Universal Technical Institute (NYSE:UTI) and its peers.

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

The 8 education services stocks we track reported a strong Q1; on average, revenues beat analyst consensus estimates by 3.6%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but education services stocks have shown resilience, with share prices up 7.1% on average since the previous earnings results.

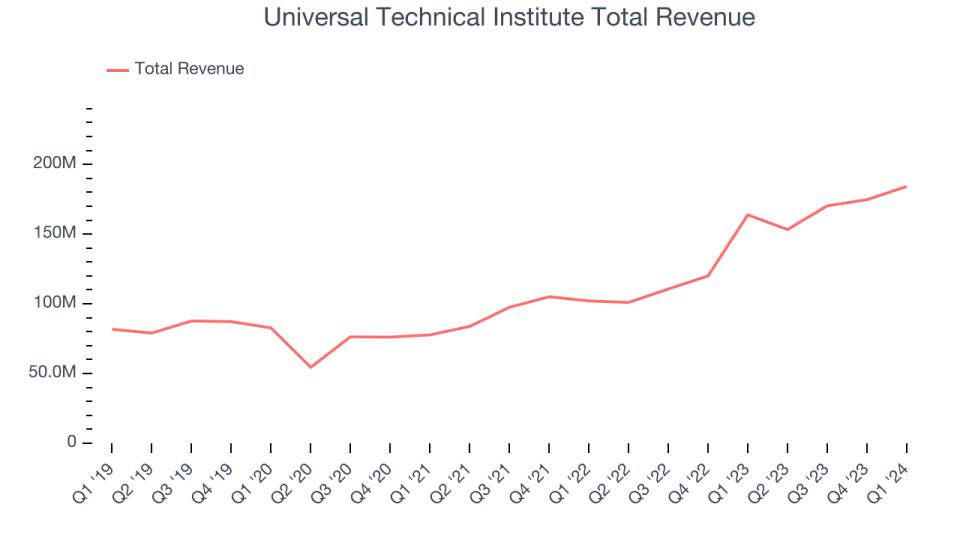

Universal Technical Institute (NYSE:UTI)

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Universal Technical Institute reported revenues of $184.2 million, up 12.4% year on year, topping analysts' expectations by 4%. It was a decent quarter for the company, with full-year revenue guidance beating analysts' expectations but a miss of analysts' earnings estimates.

"We maintained our momentum in the second quarter, demonstrating strong market demand across our growing program footprint," said Jerome Grant, CEO of Universal Technical Institute.

The stock is down 3.2% since the results and currently trades at $16.15.

Is now the time to buy Universal Technical Institute? Access our full analysis of the earnings results here, it's free.

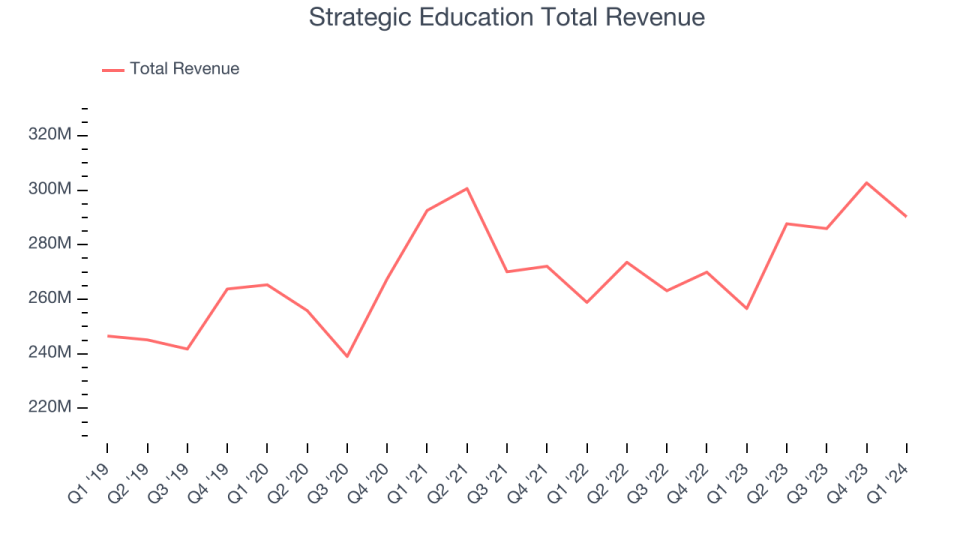

Best Q1: Strategic Education (NASDAQ:STRA)

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ:STRA) is a career-focused higher education provider.

Strategic Education reported revenues of $290.3 million, up 13.1% year on year, outperforming analysts' expectations by 5.8%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 8.1% since the results and currently trades at $108.8.

Is now the time to buy Strategic Education? Access our full analysis of the earnings results here, it's free.

Bright Horizons (NYSE:BFAM)

Founded in 1986, Bright Horizons (NYSE:BFAM) is a global provider of child care, early education, and workforce support solutions.

Bright Horizons reported revenues of $622.7 million, up 12.5% year on year, exceeding analysts' expectations by 1.2%. It was an ok quarter for the company, with a decent beat of analysts' organic revenue estimates but full-year revenue guidance missing analysts' expectations.

Bright Horizons had the weakest full-year guidance update in the group. The stock is up 4.2% since the results and currently trades at $108.64.

Read our full analysis of Bright Horizons's results here.

Adtalem (NYSE:ATGE)

Formerly known as DeVry Education Group, Adtalem Global Education (NYSE:ATGE) is a global provider of workforce solutions and educational services.

Adtalem reported revenues of $412.7 million, up 11.8% year on year, surpassing analysts' expectations by 5.4%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and full-year revenue guidance exceeding analysts' expectations.

Adtalem delivered the highest full-year guidance raise among its peers. The stock is up 28.4% since the results and currently trades at $67.27.

Read our full, actionable report on Adtalem here, it's free.

Perdoceo Education (NASDAQ:PRDO)

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ:PRDO) is an educational services company that specializes in postsecondary education.

Perdoceo Education reported revenues of $168.3 million, down 14% year on year, surpassing analysts' expectations by 3%. It was a very strong quarter for the company, with a decent beat of analysts' earnings estimates.

Perdoceo Education had the slowest revenue growth among its peers. The stock is up 11.1% since the results and currently trades at $20.38.

Read our full, actionable report on Perdoceo Education here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance