WiSA's (WISA) E Software Solution Continues to Gain Traction

WiSA Technologies WISA announced the incorporation of WiSA E software onto the Amlogic S905X4 application processor. This integration is specifically tailored for Android hybrid OTT/IP set-top box and high-end media box applications.

The integration is aimed to expand accessibility for wireless audio connectivity to a broader market. The Amlogic S905X4 allows simultaneous video and audio decoding as well as supporting background external applications. The combination of Amlogic and operating systems like Android will offer customers a highly integrated and flexible audio experience.

WiSA Connect can be utilized by devices that incorporate WiSA E software. WiSA Connect provides a common API interface with minimal overhead to any SoC. This helps to form an interoperable ecosystem for TVs, mobile devices, and WiSA E-enabled speakers. WiSA E offers a multichannel solution that enhances the audio experience.

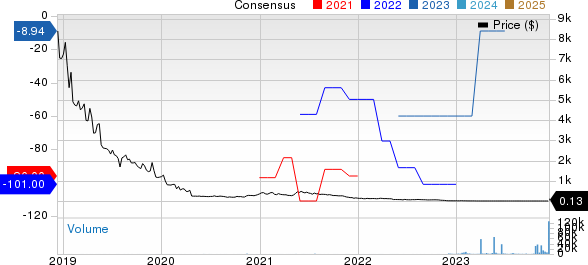

WiSA Technologies Inc. Price and Consensus

WiSA Technologies Inc. price-consensus-chart | WiSA Technologies Inc. Quote

Furthermore, WiSA E includes "WiSA Connect," which is a server managing the network on the local SoC/OS over standard Wi-Fi that significantly reduces integration costs compared to Bluetooth. WiSA E operates in the 2.4GHz or 5GHz spectrum, which can be further increased to the latest Wi-Fi standards/SoCs to 6GHz.

Per a report from Business Research Insights, the global Android TV box market is projected to grow to $44.7 billion by 2031, representing a CAGR of 23.7% from 2021 to 2031. The industry is likely to benefit from rising disposable income and growing integration of artificial intelligence, added the report.

WISA is a leading developer of spatial, wireless sound technology for smart devices and next-generation home entertainment systems. The company expects to gain momentum from the growing adoption of its sound bar and software solutions.

In December, the company announced that it has licensed WiSA E technology to a leading HDTV brand. The five-year license agreement will allow the HDTV company to incorporate WiSA E wireless immersive audio transmitter technology.

Prior to that, the company announced that Platin Audio had leveraged WiSA E wireless software to launch the Milan 5.1.4 Dolby Atmos soundbar system. WiSA E technology will improve customer experience by improving sound synchronization and clarity.

Stocks to Consider

Some stocks worth considering in the broader technology space are Pegasystems PEGA, Flex FLEX and Watts Water Technologies WTS. Pegasystems and Flex presently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pegasystems’ 2023 EPS has improved 21.2% in the past 60 days to $1.77. PEGA delivered an average earnings surprise of 1,250.2% in the trailing four quarters. Shares of PEGA have soared 49% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has increased 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%.

Flex’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11%. Shares of the company have risen 20.1% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 2.8% in the past 60 days to $8.00. Watts Water’s long-term earnings growth rate is 7.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

WiSA Technologies Inc. (WISA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance