Wolverine Hits a New 52-Week High: What's Next for Investors?

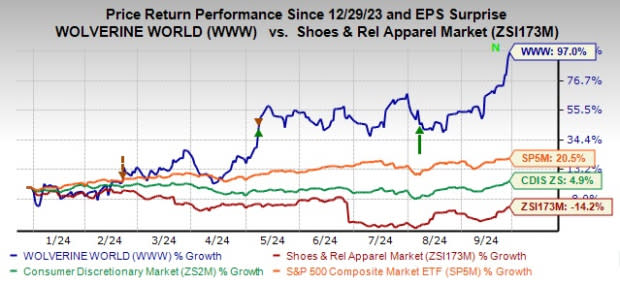

Wolverine World Wide, Inc.’s WWW shares reached a 52-week high of $17.57 on Friday before closing at $17.51. So far, WWW stock has rallied 97% against the Zacks Shoes and Retail Apparel industry’s sharp 14.2% decline.

The company’s ongoing strategic approach and product diversification have enabled it to outperform the broader Zacks Consumer Discretionary sector and the S&P 500 index’s growth of 4.9% and 20.5%, respectively, during the same period.

Image Source: Zacks Investment Research

Moreover, technical indicators are supportive of Wolverine’s strong performance. The stock is trading above both its 50-day and 200-day moving averages, indicating robust upward momentum and price stability. This technical strength reflects positive market perception and confidence in its financial health and prospects.

From a valuation perspective, Wolverine’s shares present an attractive opportunity, trading at a discount relative to industry benchmarks. With a forward 12-month price-to-sales ratio of 0.85, which is below the industry’s average of 2.33, the stock offers compelling value for investors seeking exposure to the sector. Additionally, a Value Score of B validates its appeal.

Image Source: Zacks Investment Research

WWW’s Significant Debt Reduction and Margin Improvement

Wolverine has made notable strides in reducing its debt, thereby significantly improving its balance sheet. By the end of the second quarter, its net debt was $666 million, implying a $270 million decrease from the prior-year level.

This proactive debt reduction strategy boosts the company's financial flexibility, enabling strategic investments in growth initiatives. Wolverine aims to further reduce its net debt by an additional $175 million by the end of 2024, reinforcing its long-term financial stability.

In the second quarter, Wolverine also recorded a 400-basis point increase in the adjusted gross margin, which reached 43.1%. This improvement highlights its strong profitability, driven by strategic cost management, efficient inventory control and targeted pricing strategies.

Wolverine Boosts Growth Through Product Innovation

Wolverine’s substantial investments in demand generation, including marketing and advertising, have significantly increased brand visibility, strengthened customer loyalty and driven sales growth. Its commitment to delivering innovative, trend-forward products has strongly resonated with consumers.

Saucony, one of Wolverine’s flagship brands, exemplifies this strategy’s success with popular product launches like the Triumph 22 and Hurricane 24, both of which enjoys strong consumer demand. In the second quarter of 2024, Saucony's revenue contribution surged 900 basis points year over year, with e-commerce growth surpassing 20%. Additionally, brands like Merrell and Sweaty Betty have fortified their market positions through product enhancements and targeted consumer engagement.

Wolverine Poised for Strong Growth in 2024

With a solid market presence, Wolverine is well-positioned to capitalize on its leadership to drive growth. For 2024, the company anticipates a significant improvement in the gross margin, projecting an adjusted figure of 44.5% at the midpoint, up approximately 460 basis points from the previous year. Adjusted selling and general administrative expenses are expected to be $640 million or 37.5% of sales, a reduction from $716 million in 2023. The adjusted operating margin is forecasted to be 7.4%, marking a 350-basis-point increase from 2023.

Adjusted earnings per share are projected to be between 75 and 85 cents , up from the previous guided range of 65-85 cents, despite a projected 10-cent negative impact from foreign exchange fluctuations. Notably, Wolverine delivered adjusted earnings of 5 cents per share in 2023.

For the third quarter, the gross margin is expected to reach 45%, a 300-basis-point improvement from the prior year. The company also expects further gains in operating margin and earnings, projecting a third-quarter adjusted operating margin of 7% and adjusted earnings per share of 20 cents.

Conclusion

Investors may consider Wolverine stock due to its strong market momentum and impressive financial performance. The stock has significantly outperformed its industry, indicating robust growth potential. Wolverine's effective debt reduction strategy and improved margins enhance its financial stability while ongoing investments in product innovation and marketing have strengthened brand visibility and customer loyalty.

With shares trading at an attractive valuation relative to industry peers and a positive outlook for future growth, the company presents a compelling opportunity for investors seeking exposure in the sector. It currently sports a Zacks Rank #1 (Strong Buy).

Other Stocks to Consider

Other top-ranked stocks are Nordstrom Inc. JWN, Abercrombie & Fitch Co. ANF and Crocs, Inc. CROX.

Nordstrom is a leading fashion specialty retailer in the United States. The company offers an extensive selection of both branded and private-label merchandise. It currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2024 sales indicates growth of 0.6% from the fiscal 2023 figure. JWN has a trailing four-quarter average negative earnings surprise of 17.8%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It sports a Zacks Rank of 1 at present. ANF delivered a 16.8% earnings surprise in the last reported quarter.

The consensus estimate for Abercrombie’s fiscal 2025 earnings and sales indicates growth of 63.4% and 13.1%, respectively, from the fiscal 2024 levels. ANF has a trailing four-quarter average earnings surprise of 28%.

Crocs offers a wide variety of footwear products, including sandals, wedges, flips and slides that cater to people of all ages. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Crocs’ 2024 earnings and sales indicates growth of 6.8% and 4%, respectively, from the year-ago figures. CROX has a trailing four-quarter average earnings surprise of 14.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report