Funds like Woodford 'built on a lie' and 'fundamental questions' ignored

The UK’s top financial watchdog has been accused of “failing to address fundamental questions” raised by the suspension of the Woodford Equity Income Fund at the start of the month.

Ian Sayers, the chief executive of the Association of Investment Companies (AIC), wrote in a letter to MPs: “The suspension of Woodford Equity Income Fund has implications for the FCA, product providers, advisers, platforms and, most importantly, consumers.

“I am concerned that, despite previous problems and repeated warnings, including recent comments by Mark Carney, the FCA is still failing to address these fundamental questions.”

Sayers comments came in a letter to Treasury Select Committee chair Nicky Morgan MP. The letter was dated June 14 but published on Wednesday.

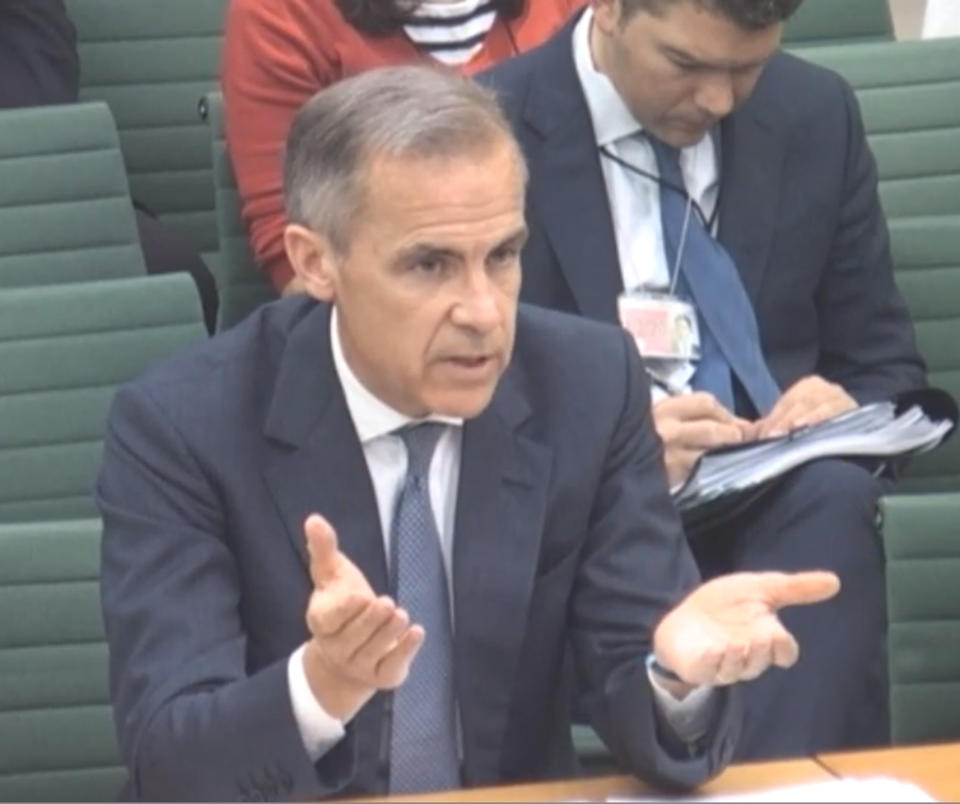

Separately on Wednesday, Bank of England governor Mark Carney told the same committee that funds like Woodford’s are “built on a lie” because of their liquidity mismatch.

READ MORE: Star fund manager Neil Woodford 'sailed close to the wind'

The Woodford Equity Income Fund, run by star stock-picker Neil Woodford, was suspended on 3 June after a liquidity crunch.

Woodford had pumped money into unlisted companies but struggled to sell these stocks as investors withdrew money from his fund. Eventually regulators decided to freeze the fund to stop investors losing money from a “fire sale” of assets to meet redemptions.

‘Lessons must be learnt’

Sayers said in his letter that the Woodford suspension was not the first liquidity problem with an investment fund and warned that a failure to address the root of the problem could risk “systematic dangers” developing.

Other high-profile examples of recent liquidity crunches include the suspension of several UK-focused property funds in the wake of the 2016 Brexit vote and the suspension of Swiss-asset manager GAM’s absolute return fund as it struggled to offload exotic private bonds.

Investors have this month also pulled over €2.5bn from French asset manager H2O over concerns it has too many illiquid bonds.

“Long-term lessons must be learnt to limit the damage when open-ended funds invest in illiquid assets,” Sayers wrote. “They should also identify how to prevent harm arising in the first place. This should include taking steps to protect the wider financial system.”

Deutsche Bank warned clients on Wednesday that the rising popularity of investment funds in the decade since the financial crisis, combined with their increasing reliance on exotic investments, could be creating “the next liquidity crisis.”

‘Built on a lie’

Prior to 2008, most pension funds and other big investors put their money into investment banks.

However, in the decade since the financial crisis momentum has shifted towards the asset management and funds industry. The assets of non-bank financial institutions have grown by over 50% since 2008, according to Deutsche Bank.

At the same time, record low interest rates and a fall in the number of companies listing on stock exchanges have led investment managers to increasingly embrace exotic investments in the hunt for returns.

Funds today invest in things like corporate bonds and shares in private companies — assets that may deliver strong paper returns but are hard to sell in a hurry. An estimated $30trn globally is invested in funds that promise daily liquidity but are underpinned by potentially illiquid assets.

READ MORE: Woodford-style investment funds ‘built on a lie’, says Bank boss

If the fund is open-ended — where the size of the fund fluctuates based on the number of investors who buy stock — a liquidity crisis can arise if too many investors try to cash out at once.

In simple terms, a liquidity crisis is when the fund can’t sell assets quick enough to pay out to investors who ask to withdraw their money from the fund. This is what happened in the case of the Woodford Equity Income Fund. Kent County Council tried to pull €250m from the fund in one day and it did not have enough cash on hand or liquid assets to meet the redemption.

Bank of England governor Mark Carney told MPs on Wednesday: “These funds are built on a lie, which is that you can have daily liquidity for assets that fundamentally aren’t liquid. And that leads to an expectation of individuals that it’s not that different to having money in a bank.”

The risks posed “could be systematic,” Carney warned. Regulators take liquidity crunches seriously as they were one of the major problems during the financial crisis, both for short-term bank financing and in the mortgage-backed securities market.

‘A square peg in a round hole’

The FCA’s chief executive and chairman were quizzed by MPs about the Woodford fund suspension earlier this week and insisted the incident was a failure of the rules rather than the regulator.

The FCA has launched a formal investigation into the Woodford case and has also been looking at the issue of fund liquidity since 2016. But Sayers warned the FCA’s guidance so far means the “expected impact will be more frequent suspensions,” which would harm both the industry and consumers.

Sayers said the FCA appears to be focused on “changing requirements for open-ended funds’ liquidity and redemption arrangements,” which is “forc[ing] a square peg into a round hole, rather than questioning if the overall approach is correct.”

He argued the FCA should make new rules requiring investment funds that deal in illiquid assets to be closed ended. Closed ended funds separate share price from underlying investment pools, meaning “trading has no impact on the composition of the underlying portfolio.”

“As long as the regulatory debate fails to address the fundamental question of the illiquidity mismatch, problems will inevitably continue, with more frequent suspensions and/or lower returns for investors,” Sayers wrote in his letter.

READ MORE: 'Perfect storm' blamed for scandals like London Capital Finance

The Investment Association, which is the industry group for asset managers, on Wednesday published proposals to create new “long-term assets funds” that would not offer daily liquidity.

Investment Association CEO Chris Cummings said the new structure was “designed to offer a new way to gain sustainable returns from investments in areas such as private companies and infrastructure.”

“Recent events have highlighted the importance of getting this right,” he wrote in the association’s ‘2025 Vision’ report.

In a separate statement on Wednesday, Sayers said it was “a pity that these threats to consumers and financial stability were not explored at yesterday’s select committee hearing with Andrew Bailey.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Yahoo Finance

Yahoo Finance