Wyndham (WH) Expands Footprint With Decameron Collaboration

Wyndham Hotels & Resorts, Inc. WH has entered into a partnership with Decameron All Inclusive Hotels & Resorts, thus expanding its all-inclusive offerings to more than 50 resorts globally.

This collaboration includes nine new all-inclusive resorts of Decameron across Mexico, Panama and Jamaica into Wyndham’s portfolio, thereby diversifying the latter’s product portfolio and expanding its global market reach. The new resorts also joined Wyndham's rewards program, Wyndham Rewards, enabling the members to earn points on their stays.

The nine all-inclusive resorts are segregated under the two renowned brands of Wyndham, which are Trademark Collection and Ramada. Five of the nine resorts comprising Grand Decameron Complex Bucerías, Grand Decameron Panama, Grand Decameron Los Cabos, Grand Decameron Montego Beach and Grand Decameron Cornwall Beach are considered under the Trademark Collection brand. The last four resorts, which include Decameron Los Cocos Guayabitos, Decameron La Marina Guayabitos, Decameron Isla Coral Guayabitos and Decameron Club Caribbean Runaway Bay, are considered under the Ramada brand.

Wyndham on an Expansion Spree

Wyndham has been keenly focused on expanding its geographic footprint and product offerings across all segments by leveraging its diversified brand portfolio. This accretive aim of the company is backed by its disciplined capital allocation strategy, which encompasses investments in high-return businesses, accompanied by strategic collaborations and buyouts.

During the first quarter of 2024, the company opened more than 13,000 rooms globally, showcasing 27% year-over-year growth. As of Mar 31, 2024, WY had 876,300 rooms globally, up 4% from 844,800 rooms at the prior-year quarter end. During the quarter, the company opened 50 new hotels across the United States, including key destinations Charlotte, Raleigh, Tucson and Jacksonville. The newly opened hotels include 11 hotel conversions under the newly created WaterWalk Extended Stay by Wyndham brand. Furthermore, Wyndham is optimistic about its new ECHO Suites brand, which will offer new extended-stay products. The brand’s opening dates are expected in 2024.

As of the first quarter, WH’s global development pipeline consisted of nearly 2,000 hotels and approximately 243,000 rooms, showcasing an 8% year-over-year increase. Among the total pipeline, about 58% of it is international.

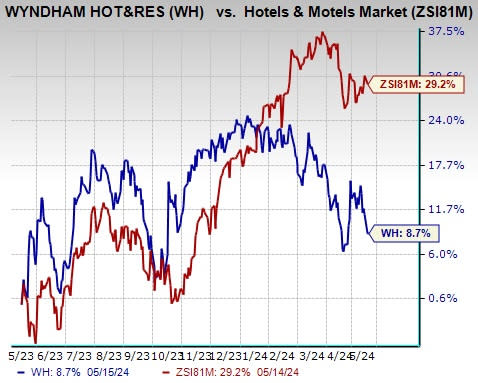

Image Source: Zacks Investment Research

Shares of this American hotel franchisor gained 8.7% in the past year compared with the Hotels and Motels industry’s 29.2% growth. Although shares of the company have underperformed its industry, the ongoing expansion initiatives are likely to foster growth in the upcoming period.

Zacks Rank & Key Picks

Wyndham currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has increased 51.4% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has surged 83.8% in the past year.

The Zacks Consensus Estimate for NFLX’s 2024 sales and EPS implies a rise of 14.7% and 52.1%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 84.1% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.6% and 61.9%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance