Is Yelp Poised to Surpass Estimates This Earnings Season?

Yelp Inc. YELP is set to report third-quarter 2017 results on Nov 1. The company has beaten the Zack Consensus Estimate in each of the trailing four quarters, delivering an average positive surprise of 512.5%.

Last quarter, the company came up with a positive surprise of 1000%. Revenues increased 20.8% year over year to $209 million and beat the Zacks Consensus Estimate of $205 million.

For third-quarter 2017, total revenue is expected to be in the range of $217–$222 million.

Shares of Yelp have gained 19.1% year to date, significantly underperforming 50.7% growth of its industry.

Let's see how things are shaping up for this announcement.

Factors at Play

Advertising is the primary contributor to Yelp’s revenues. In the second quarter, advertising revenues grew 19% year over year to $186.6 million. Paying advertising accounts of nearly 148k registered 18% year-over-year growth.

Apart from advertising, the company also benefited from a 19% year-over-year improvement in transaction revenues last quarter.

Yelp’s partnership with GrubHub Inc. GRUB is a key growth driver in our view. The collaboration will increase the number of restaurants available for food ordering on the platform, which will help the company gain more users. This will fuel both advertising and transaction revenues for the platform.

Accelerating consumer traffic across app and mobile is a positive for the company. In the June quarter, app unique devices rose 22% year over year to almost 28 million. Significant improvement in cumulative reviews is also noticeable.

Further, the acquisition of Eat24 business by GrubHub provides the company with a better return on investment, as noted by management in its last conference call.

Strong activity from Request-A-Quote is also expected to drive the company’s results in the soon-to-be reported quarter. Moreover, Nowait and Turnstyle acquisition will contribute meaningfully to its top line in our view.

However, the company faces stiff competition from major players like Amazon AMZN, Facebook FB and Alphabet among others. All these companies are increasing their efforts to get a bigger share of advertising dollars.

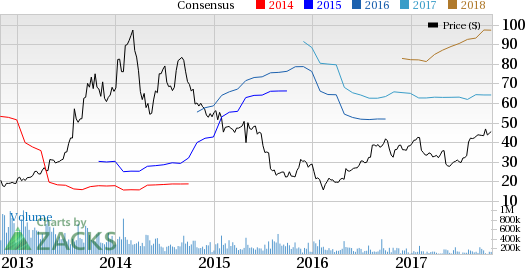

Yelp Inc. Price and EPS Surprise

Yelp Inc. Price and EPS Surprise | Yelp Inc. Quote

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or #3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Yelp has a Zacks Rank #3 and an Earnings ESP of +314.29% and that indicates a likely positive surprise. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Yelp Inc. (YELP) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

GrubHub Inc. (GRUB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance