Yonyou Network TechnologyLtd And Two Other Stocks That Might Be Valued Below Market Estimates On Chinese Exchange

Amid a week of modest declines in China's major stock indices, concerns about the country's economic slowdown have cast a shadow over market sentiment. As investors navigate these challenging conditions, identifying stocks that may be undervalued becomes crucial, offering potential opportunities in a market poised for careful scrutiny.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥170.55 | CN¥328.62 | 48.1% |

Uni-Trend Technology (China) (SHSE:688628) | CN¥32.59 | CN¥64.28 | 49.3% |

Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.11 | CN¥34.09 | 46.9% |

Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥24.65 | CN¥46.96 | 47.5% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥14.67 | CN¥29.31 | 50% |

DongHua Testing Technology (SZSE:300354) | CN¥31.28 | CN¥58.02 | 46.1% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥33.62 | CN¥66.56 | 49.5% |

China Film (SHSE:600977) | CN¥10.88 | CN¥20.19 | 46.1% |

Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.77 | CN¥18.84 | 48.1% |

Levima Advanced Materials (SZSE:003022) | CN¥13.80 | CN¥27.49 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener

Yonyou Network TechnologyLtd

Overview: Yonyou Network Technology Co., Ltd. operates as a provider of digital intelligence platforms and services for enterprises and public organizations, both domestically in China and internationally, with a market capitalization of approximately CN¥35.07 billion.

Operations: The company generates approximately CN¥10.07 billion from its cloud service and software business segment.

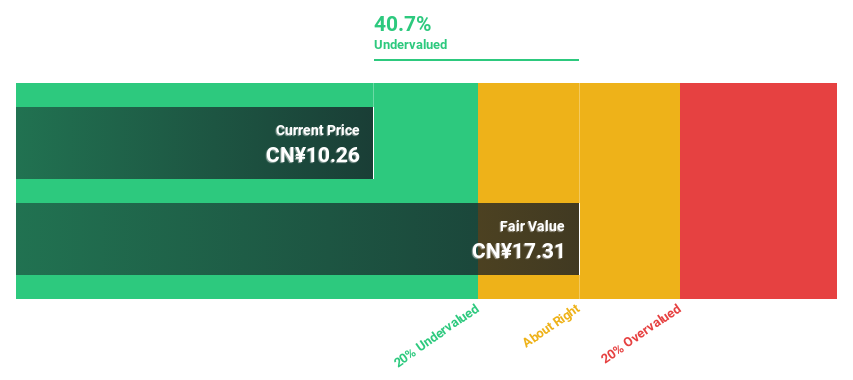

Estimated Discount To Fair Value: 40.7%

Yonyou Network Technology Ltd., currently trading at CN¥10.26, significantly below the estimated fair value of CN¥17.31, appears undervalued based on cash flow analyses. Despite a recent net loss reported in Q1 2024 (CN¥453.03 million), the company is expected to become profitable within three years, with earnings forecasted to grow 51.53% annually. However, its Return on Equity is anticipated to remain low at 5.4%. Additionally, Yonyou has actively repurchased shares, spending CN¥716.4 million to buy back 1.14% of its stock as part of a recently completed plan.

Seres GroupLtd

Overview: Seres Group Ltd., operating under ticker SHSE:601127, is a company based in China that focuses on researching, developing, manufacturing, selling, and supplying automobiles and auto parts, with a market capitalization of approximately CN¥135.50 billion.

Operations: The primary revenue for the company comes from the automobile industry, generating CN¥57.31 billion.

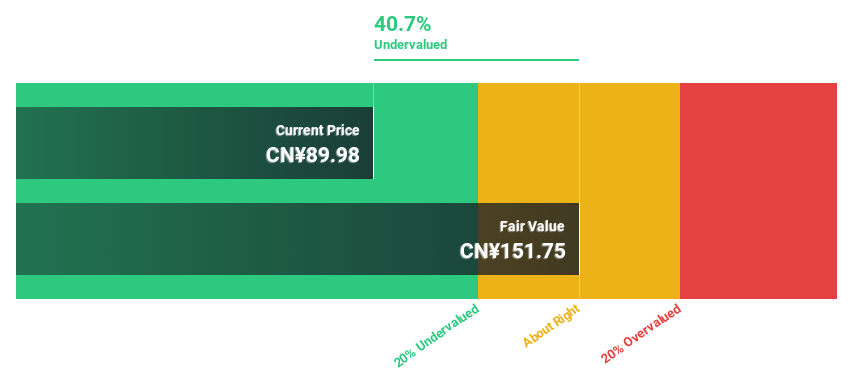

Estimated Discount To Fair Value: 40.7%

Seres Group Ltd., priced at CN¥89.98, is significantly undervalued with a fair value of CN¥151.75, indicating a potential 40.7% undervaluation based on cash flow analyses. The company's revenue is expected to grow by 27.3% annually, outpacing the market's 13.7%, and it recently turned profitable with a net income of CN¥219.55 million in Q1 2024 after a previous loss, reflecting strong operational improvements and growth prospects.

Suzhou TFC Optical Communication

Overview: Suzhou TFC Optical Communication Co., Ltd. is a company engaged in the research, development, and manufacturing of optical communication components, with a market capitalization of approximately CN¥52.27 billion.

Operations: The company generates revenue primarily from its optical communication device segment, which reported earnings of CN¥2.37 billion.

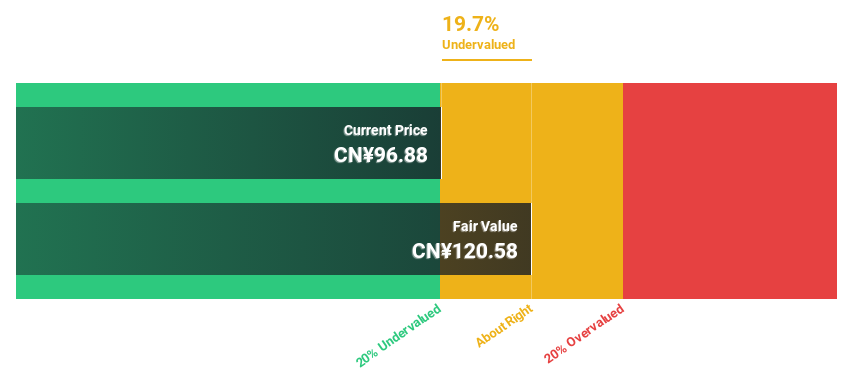

Estimated Discount To Fair Value: 27.7%

Suzhou TFC Optical Communication, with a current market price of CN¥94.36, appears undervalued compared to its estimated fair value of CN¥130.48. The company's financial performance shows robust growth, with earnings and revenue increasing by 202% and 155% respectively in the first quarter of 2024 alone. This growth trajectory is supported by a forecasted annual earnings increase of 36% and revenue growth at 37.1%, both well above market averages. However, the stock's volatility and inconsistent dividend payouts suggest potential risks for investors seeking stable returns.

Turning Ideas Into Actions

Dive into all 103 of the Undervalued Chinese Stocks Based On Cash Flows we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600588 SHSE:601127 and SZSE:300394.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance