Yuan Pressure Mounts as Trading Disruptions Appear Once More

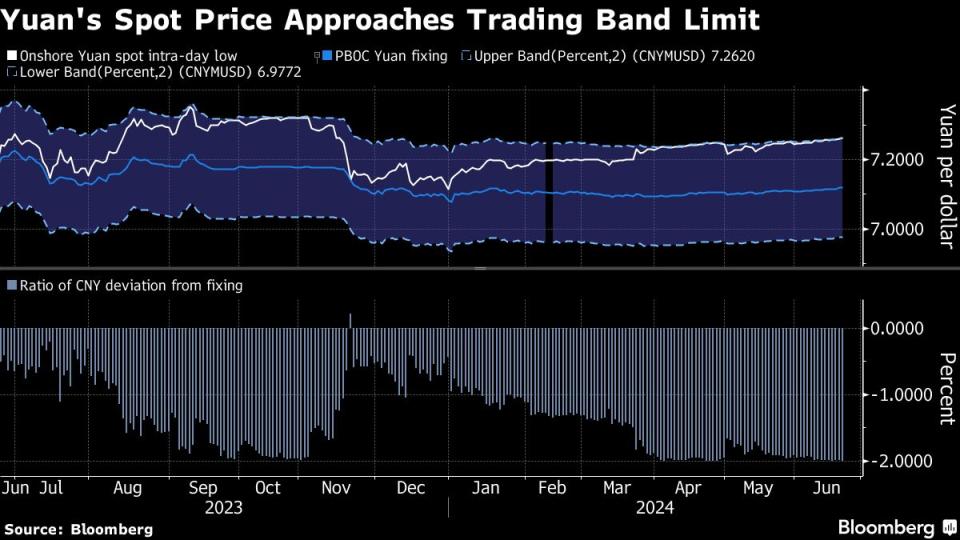

(Bloomberg) -- The yuan is bumping up against the weak edge of its allowed trading range against the dollar, and once again, certain currency transactions with shorter settlement dates are being affected.

Most Read from Bloomberg

Nvidia’s 13% Stock Rout Has Traders Scouring Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Wikileaks’ Julian Assange to Plead Guilty, Ending Yearslong US Battle

Overnight swaps haven’t traded since Tuesday, as the implied yuan price they would settle at would fall outside the managed currency’s permitted 2% daily band, according to traders who asked not to be identified discussing private matters. The swaps are typically used by banks and corporates looking to settle currency transactions earlier than the industry standard of two days.

In April, investors were briefly blocked from similar swap trades, when the yuan fell to the closest its been to the edge of the band since 2015. China’s currency is trading at a seven-month low amid broad strength in the dollar, and was about 1.999% weaker than its fixed daily reference rate on Monday, according to calculations by Bloomberg.

The People’s Bank of China is faced with managing a gradual decline in the yuan as a resurgent dollar weighs on currencies across the region from Japan to Indonesia. The PBOC is wary of triggering a vicious cycle of capital outflows and further losses in the currency, and favors stability over rapid declines.

But yuan weakness highlights the deteriorating sentiment toward the world’s second-largest economy, which is also experiencing a bond market rally as investors seek out havens. Yields are at or close to record lows amid mixed economic data and expectations of further monetary stimulus.

The PBOC weakened the so-called daily fixing slightly for the fourth straight session Monday. State-owned banks have also been active supporting the currency, according to traders.

“Touching the trading band may further intensify yuan depreciation pressure, leading to an excessively fast depreciation pace,” said Ken Cheung, chief Asian FX Strategist at Mizuho Securities Asia. “We may see some actions to take place to limit the volatility, aiming to moderate yuan depreciation pressure and provide enough liquidity for FX trading.”

The yuan edged higher on Monday in both onshore and offshore markets, lifted by a weaker US dollar that fell the most in more than a month.

To Credit Agricole, the central bank’s action on the yuan will depend on the move in the greenback and “they will be opportunistic”, strategist Eddie Cheung said.

“Tthe PBOC will be more open to weakness in the yuan fixing when the dollar is weak or steady, but will probably hold the fixing a bit more steady under dollar strength to prevent excessive yuan depreciation expectations,” he said.

--With assistance from Karl Lester M. Yap.

(Updates levels. A previous version corrected the day in the deckhead.)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance