YUM! Brands (YUM) Q4 Earnings Surpass Estimates, Rise Y/Y

YUM! Brands, Inc. YUM reported solid fourth-quarter 2022 results, with earnings and revenues surpassing the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis.

David Gibbs, CEO of YUM! Brands, stated, “Despite a challenging environment, we achieved widespread system sales growth of 8% excluding Russia with $24 billion in digital sales, demonstrating that our iconic brands are more relevant, easy and distinctive than ever. I’m confident that our distinct competitive advantages including our world-class franchisees and the industry’s best talent will drive accelerated growth in the future.”

Earnings and Revenue Discussion

In fourth-quarter 2022, the company's adjusted earnings per share (EPS) came in at $1.31, surpassing the Zacks Consensus Estimate of $1.25. In the prior-year quarter, the company reported an adjusted EPS of $1.02.

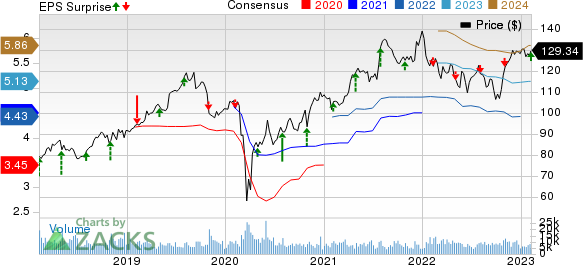

Yum! Brands, Inc. Price, Consensus and EPS Surprise

Yum! Brands, Inc. price-consensus-eps-surprise-chart | Yum! Brands, Inc. Quote

Quarterly revenues of $ 2,019 million beat the consensus mark of $1,927 million. Also, the top line increased 6.8% year over year. The upside can be attributed to an increase in franchise and property revenues.

Worldwide system sales — excluding foreign currency translation — increased 8% year over year, with Taco Bell (rising 14% year over year), KFC (6%) and Pizza Hut (4%).

Divisional Performance

YUM! Brands primarily announces results under four divisions — KFC, Pizza Hut, Taco Bell and Habit Burger Grill.

For fourth-quarter 2022, revenues from KFC totaled $793 million compared with $794 million reported in the prior-year quarter. Comps in the division increased 5% year over year compared with 7% growth reported in the previous quarter.

The segment's operating margin increased 1,500 basis points (bps) year over year to 39%. In the quarter under review, KFC Division opened 997 gross new restaurants.

At Pizza Hut, revenues amounted to $288 million, up 3% year over year. Comps in the quarter increased 1% year over year compared with 3% growth reported in the prior-year quarter.

The segment's operating margin expanded 5300 bps year over year to 34.5%. Pizza Hut Division opened 571 gross new restaurants in the fourth quarter.

Taco Bell's revenues were $766 million, up 12% from the year-ago quarter's levels. Comps in the segment increased 11% year over year compared with 8% growth reported in the year-ago quarter. Its operating margin increased 3200 bps year over year to 32.1%.

Taco Bell opened 253 gross new restaurants in the quarter under review.

In the fourth quarter, The Habit company sales amounted to $172 million compared with $131 million reported in the previous quarter. Comps in the division declined 1% year over year. In the quarter under review, the company opened nine gross new restaurants.

Other Financial Details

As of Dec 31, 2022, cash and cash equivalents totaled $367 million compared with $410 million on Sep 30, 2022. Long-term debt, as of Dec 31, 2022, stood at $11,453 million compared with $11,517 million as of Sep 30, 2022.

The company announced a hike in its quarterly dividend payout. The company raised the quarterly dividend to 60 cents per share (or $2.42 annually) from the previous payout of 57 cents (or $2.28 annually). The hiked dividend will be paid out on Mar 10, 2023, to shareholders on record as of Feb 22, 2023.

2022 Highlights

Total revenues in 2022 amounted to $6,842 million compared with $6,584 million in 2021.

Net Income in 2022 totaled $1,325 million compared with $1,575 million in 2021.

In 2022, diluted EPS came in at $4.51 compared with $4.46 reported in the previous year.

Zacks Rank & Key Picks

Yum! Brands carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the Zacks Retail-Wholesale sector are Arcos Dorados Holdings Inc. ARCO, Compass Group PLC CMPGY and Darden Restaurants, Inc. DRI.

Arcos Dorados sports a Zacks Rank #1. ARCO has a long-term earnings growth of 11.6%. Shares of the company have increased 23.9% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS suggests growth of 8.1% and 4.2%, respectively, from the year-ago period’s levels.

Compass Group carries a Zacks Rank #2 (Buy). CMPGY has a long-term earnings growth rate of 19.6%. The stock has declined 6.4% in the past year.

The Zacks Consensus Estimate for Compass Group’s 2023 sales and EPS suggests growth of 44.4% and 23.5%, respectively, from the year-ago period’s reported levels.

Darden carries a Zacks Rank #2. DRI has a long-term earnings growth rate of 9.8%. Shares of DRI have gained 6.1% in the past year.

The Zacks Consensus Estimate for Darden’s 2023 sales and EPS suggests growth of 7.9% and 5.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Compass Group PLC (CMPGY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance