Is Yum China (YUMC) Doomed to Have a Terrible 2022 Too?

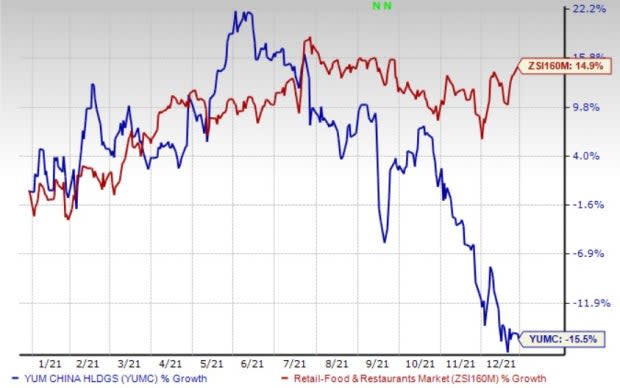

2021 has been tough for Yum China Holdings, Inc. YUMC. The company’s shares have declined 15.5% year to date, against the industry’s growth of 14.9%. The dismal performance was primarily due to the coronavirus pandemic. In the third quarter, its operations were negatively impacted by the Delta variant. However, YUMC is gradually coming out of the woods. Expansion efforts, menu innovation and robust loyalty program bode well.

Factors Likely to Drive Growth

Yum China is focused on continuous unit growth of restaurants in order to drive incremental sales. In 2018, the company opened 819 restaurants and re-modeled 931 stores. This exceeds the company’s prior target of opening 600-650 stores in 2018. In 2019, the company opened 1,006 stores, bringing the total store count to 9,200 in more than 1,300 cities. The company remodeled 972 stores in 2019. In 2020, the company inaugurated 1,165 new stores, bringing the total store count to 10,506. Meanwhile, remodeled store count stood at 939. From the start of the year to Sep 30, 2021, the company opened 1,243 gross new stores. It is worth mentioning that more than 80% of the company's current portfolio has been remodeled or built over the past five years.

Another riveting growth potential of Yum China resides in its continual menu innovation to drive top-line growth. KFC’s extraordinary performance can be attributed to greater sales of menu offerings like crayfish burger, stuffed chicken wing and spicy chicken burger. Apart from such consumer-preferred food items, the company offers signature menus for the Chinese New Year. Yum China is also serving coffee across its restaurants and expanding the dessert category. The company will increase investment to expand its presence in the Coffee segment as it believes that the beverage has a strong demand in China. In March 2021, Pizza Hut refreshed its menu, replacing 40% of the menu with new or upgraded offerings such as Beef Wellington and Roast beef tapas.

In the third quarter of 2021, KFC reported solid sales concerning menu offerings such as Juicy Whole Chicken and Angus Beef Burger. Backed with solid customer acceptance, it initiated the roll-out of steamed dumplings (xiaolongbao), Hot Pepper Soup (Hulatang) and Hot Dry Noodles. The company stated that it is currently working on the beef burger platform, thereby covering different price points. Meanwhile, Pizza Hut initiated the roll out of limited-time offerings such as Seabass Pizza with pickled vegetables and spicy stir-fried pot pizza.

The Zacks Rank #3 (Hold) company created a robust loyalty program that has more than 350 million loyalty members, cumulatively. Pizza Hut membership increased 100 million members. In the third quarter, member sales accounted for nearly 60% system sales. In the third quarter of 2021, the company sold 19 million privilege memberships at KFC and Pizza Hut.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the same space include Papa John's International, Inc. PZZA, Arcos Dorados Holdings Inc. ARCO and McDonald's Corporation MCD.

Papa John's currently carries a Zacks Rank #2 (Buy). The company benefits from its off-premise business model. Sales at off-premise business model have exceeded pre-pandemic levels. We believe that a boost in customer count coupled with targeted off-premise marketing is likely to drive the channel’s performance in the upcoming periods. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Papa John's reported better-than-expected earnings in three of the trailing four quarters, the average surprise being 27.2%. The company’s fiscal 2021 earnings is likely to witness growth of 142.1%. PZZA stock has gained 57.4% in the past year.

Arcos Dorados carries a Zacks Rank #2. ARCO has a long-term earnings growth of 42.9%. Shares of the company have increased 11.5% so far this year.

The Zacks Consensus Estimate for Arcos Dorados current financial-year sales and EPS suggests growth of 31% and 112.5%, respectively, from the year-ago period’s levels.

McDonald’s carries a Zacks Rank #2. A robust drive-thru presence and investments in delivery and digitization in the past few years have helped the company to tide over the pandemic. The company has a trailing four-quarter earnings surprise of 6.8%, on average.

The Zacks Consensus Estimate for McDonald's current financial year sales and EPS suggests growth of 20.9% and 55.7%, respectively, from the year-ago period’s levels. MCD has rallied 26.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance