Zimmer Biomet (ZBH) Hits 52-Week High: What's Driving It?

Shares of Zimmer Biomet Holdings, Inc. ZBH scaled a new 52-week high of $138.74 on Apr 19, before closing the session marginally lower at $138.12.

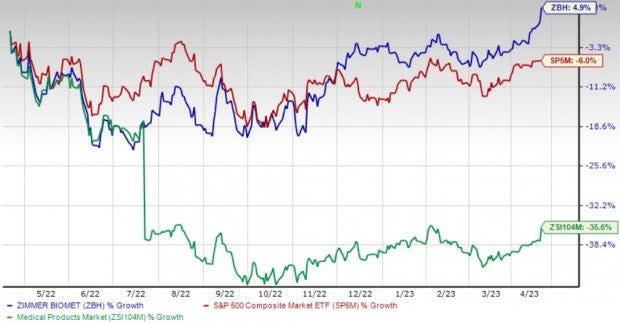

In the past year, this Zacks Rank #2 (Buy) stock has gained 4.9% against the 35.7% decline of the industry and the S&P 500 composite’s fall of 6%.

Zimmer Biomet’s long-term expected growth rate of 6.2% compares with the industry’s growth projection of 14.1%. The company’s earnings yield of 5.1% compares favorably with the industry’s negative yield. Zimmer Biomet’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 7.7%.

Image Source: Zacks Investment Research

Zimmer Biomet is witnessing an upward trend in its stock price, prompted by its continued business recovery. The optimism led by solid fourth-quarter 2022 performance and focus on emerging markets to drive growth are expected to contribute further. However, stiff competition and pricing pressure persist.

Let’s delve deeper.

Key Growth Drivers

Continued Business Recovery: Investors are upbeat about Zimmer Biomet’s rebound in its business in the past few quarters despite macroeconomic challenges. In the fourth quarter of 2022, strong U.S. sales were driven by strong elective procedure recovery and commercial execution, especially in Zimmer Biomet’s Knee and Hip businesses. The global Knees business was also solid, with strong performance driven by knee procedure recovery across most regions and an easier comp outside the United States. The company witnessed continued traction across hip products, including the G7 revision system and Avenir Complete primary hip, which is focused on the direct anterior surgical approach.

Focus on Emerging Markets: Investors are optimistic about Zimmer Biomet working to strengthen its foothold in emerging markets that have provided long-term opportunities for growth over the recent past. The company's strategic investments in these regions over the past several quarters to improve operational and sales performance are yielding results. While the integration of Biomet is over, the combined company has started to get benefited from a strong presence in emerging markets with an extended portfolio that includes upper and lower joints.

Strong Q4 Results: Zimmer Biomet’s robust fourth-quarter 2022 results buoy optimism. Each of the company’s geographic segments and product divisions recorded year-over-year sales growth at constant exchange rate. Despite challenging macroeconomic conditions, expansion in its adjusted gross and operating margins was encouraging. The company registered strong elective procedure recovery and commercial execution, especially in the Knee and Hip businesses.

Downsides

Pricing Pressure: Pricing continues to remain a major headwind for Zimmer Biomet. The company's top-line growth in fourth-quarter 2022 was partially offset by continued pricing pressure, mostly in the Americas and Europe operating segments. Zimmer Biomet witnessed significant headwinds from inflationary pressure in the quarter, which increased the adjusted operating expenses to $791 million, an increase from the prior year.

Competitive Landscape: The presence of a large number of players has made the medical devices market intensely competitive. The orthopedic industry, in particular, is highly competitive. Zimmer Biomet needs to constantly introduce or acquire new products to withstand competitive pressure and maintain its market share.

Other Key Picks

A few other top-ranked stocks in the broader medical space are IDEXX Laboratories, Inc. IDXX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

IDEXX Laboratories, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 18%. IDXX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 3.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

IDEXX Laboratories has lost 0.9% compared with the industry’s 11.3% decline in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 8.6% compared with the industry’s 2% decline over the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 6% compared with the industry’s 11.3% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance