Should Zulu Principle investors consider Smurfit Kappa?

Jim Slater, author of the acclaimed investment bookThe Zulu Principle argued that ‘elephants don't gallop’, and targeted his investment strategy at smaller companies which have greater scope for growth. So does this mean that Zulu Principle investors should completely shun large cap growth stocks? Given that Slater’s son Mark has been investing his fund in such large housebuilders as Bellway, there may be some room to bend his rules. Smurfit Kappa popped onto our radar this week as the StockRank jumped from 77 to 90. It would qualify for Stockopedia’s Zulu Principle Screen if it was a smaller cap company that had a higher return on capital (see below). So should Zulu investors consider it...?

What is Smurfit Kappa?

Smurfit Kappa is one of the world’s leading providers of paper-based solutions. It manufactures recycled paper as well as corrugated boards and other packaging. The firm is headquartered in Dublin and employs 43,000 people across 350 production sites. It is a dual-listed stock which trades on the London and Ireland Stock Exchanges.

All about the criteria

Let’s take a closer look at how well Smurfit Kappa fulfills Jim Slater’s criteria.

Positive Growth Record

Slater likes companies that have grown earnings in at least four of the past five years. Smurfit Kappa meets this criteria, having grow earnings from -€0.18 per share (2009) to €1.43 (2014) - thanks in part to a cost saving strategy that was implemented during the recession. In 2009 the Group responded to reduced demand and overcapacity by halting production at its Sturovo mill, before cutting jobs as part a rationalization operation at Togher, County Cork. These actions were part of a wider cost reduction programme which the group drove forward to make over €125 million in saving benefits.

The company has also grown through a series of strategic acquisitions. As early as 2007, the company’s IPO prospectus listed ‘its active management of its asset base through acquisitions and disposals’ as a key competitive strength. True to its word, the company proceeded to acquire a corrugated box plant in Romania to gain entry to Eastern Europe. Fast forward a few years: in 2012 the firm completed the acquisition of the Orange County Container Group (OCCG) to take advantage of strong and improving trading conditions in Mexico and North America.

Low PE Ratio in relation to Growth Rate

Brokers expect Smurfit Kappa to grow earnings by 35% in 2015 and 17% in 2016. Slater warns investors not to pay an excessive price for future earnings. He describes the PEG ratio - which divides the PE ratio by the earnings growth rate - as a useful metric for ‘measuring the value you get for your money’. Slater likes companies with a PEG ratio below 1. Again, Smurfit Kappa meets this criteria - with a PEG ratio of 0.7.

Optimistic Chairman’s Statement

He also warns that ‘if the chairman is pessimistic, earnings growth could be at an end.’ Smurfit produced an optimistic annual report on 29 July. It announced that the group ‘is a significantly stronger business today than at any other time in its recent history’. The management team added that ‘we continue to expect to deliver earnings growth year-on-year and remain focused on accelerating returns to shareholders’. That’s another criteria met...

Something New

Slater targets companies that have ‘something new’, like new products or an acquisition, that could lead to a substantial increase in future earnings. We have mentioned that Smurfit has grown its earnings thanks in part to an acquisitive growth strategy. Two additional acquisitions were announced in 2015. In March, the company acquired Grupo CYBSA, which should provide access to the higher growth markets of El Salvador and Costa Rica. Shortly after, in April, Smurfit agreed to acquire Inspirepac, a print and display business based in the UK.

Dividend Yield

Slater likes companies with a strong dividend, not only because these stocks provide investors with income, but also because ‘some institutions will not invest in companies which do not pay dividends... we are anxious not to preclude any of them from participating in our selections.’ Smurfit cancelled dividends during the recession but they have risen from €0.15 (2011) to €0.56 (2014) in line with earnings. The company is expected to pay a 2.1% dividend in 2015.

High Relative Strength

Over the last year, Smurfit Kappa has returned 67% while the FTSE 100 has only appreciated by 3%. The share price has risen as brokers have become increasingly optimistic about the company. In July the EPS forecast consensus was for €1.87 per share. Brokers now expect the company to generate €1.93.

At this point, investors may think that the company ticks most of the boxes for Slater’s strategy. However, there are some important criteria that Smurfit does not meet...

Market Capitalisation

In the Zulu Principle (1992), Slater insisted that investors should target companies that are smaller than £100 million. This limit was raised to £250 million when he wrote Beyond the Zulu Principle in 1996. If we inflation adjust this target to today’s prices by the CPI his cutoff would have risen to about £430m. Smurfit Kappa has a market cap of £4.5 billion, making it arguably too big for Slater’s strategy.

High Cash Flow, Low Borrowings

Slater advises investors to ‘look for self-financing companies that generate cash’. Smurfit Kappa is currently highly cash generative, with operating cash flow per share (€2.94) in excess of earnings per share (€1.40). However, the company is highly geared. Gross Gearing stands at 158.8% while Net Gearing is 151.1%. Slater dedicates an entire chapter to cyclical stocks in the Zulu Principle, where he explains that ‘gearing should not be more than 100%’ in cyclicals stocks so this is a clear red flag. Companies with weak balance sheets are more likely to run into trouble if the going gets tough and the market his bearish territory.

Competitive Advantage

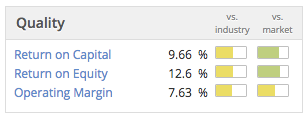

For Slater, it is important that a company has a good competitive advantage, which will be usually evidenced by a high return on capital employed (over 12% and ideally in the region of 20%) in addition to good operating margins relative to the industry. Smurfit fails to meet these criteria. It has a ROCE of 9.7% which is good versus the market but no outstanding relative to peers, while the company’s operating margins are only slightly higher than the industry median.Would Slater hold back?

Smurfit Kappa satisfies many of the other key outlined in the Zulu Principle though misses the grade in others. Slater lists his criteria in order of importance (see below). Smurfit Kappa meets three of the five ‘mandatory’ criteria, two of the ‘important’ criteria and also pays a solid dividend. So what would Slater do? He insists that ‘there can be little compromise on the first five criteria’ and ‘with the second three, you might put up with one of them being weak, provided all the other criteria were in place’.

Mandatory Criteria:

(1) Strong earnings growth record

(2) Low PEG Factor

(3) Optimistic Chairman’s Statement

(4) Strong Financial Position

(5) Competitive Advantage

Important:

(6) Something New

(7) Small Market Capitalisation

(8) Relative Strength

Desirable:

(9) Dividend Yield

(10) Reasonable Asset Position

(11) Management Shareholding

Smurfit Kappa fails to make the grade in a number of key areas. It is highly geared, does not show the signs of financial signs of a strong competitive advantage and is a large cap company. Our analysis suggests that Zulu Principle investors would likely hold back from purchasing Smurfit.

In this case would Slater be right to stick firmly to his rules, or would he be missing an investment opportunity? Feel free to leave your opinions below...

Read More about Smurfit Kappa on Stockopedia

Discuss Smurfit Kappa on Stockopedia

Yahoo Finance

Yahoo Finance