Adaptimmune Therapeutics plc (ADAP)

NasdaqGS - NasdaqGS Real-time price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous close | 1.1900 |

| Open | 1.2200 |

| Bid | 1.1800 x 600 |

| Ask | 1.2100 x 600 |

| Day's range | 1.1722 - 1.2400 |

| 52-week range | 0.4200 - 2.0500 |

| Volume | |

| Avg. volume | 1,593,456 |

| Market cap | 304.119M |

| Beta (5Y monthly) | 2.38 |

| PE ratio (TTM) | N/A |

| EPS (TTM) | -0.5400 |

| Earnings date | 15 May 2024 |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | N/A |

| 1y target est | 3.50 |

Zacks

ZacksAdaptimmune (ADAP) Down on End of Collaboration With Roche

Adaptimmune's (ADAP) shares plummet as the company;s collaboration to develop and commercialize allogeneic cell therapies with Roche gets terminated.

Simply Wall St.

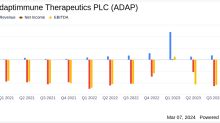

Simply Wall St.Adaptimmune Therapeutics Full Year 2023 Earnings: EPS Beats Expectations, Revenues Lag

Adaptimmune Therapeutics ( NASDAQ:ADAP ) Full Year 2023 Results Key Financial Results Revenue: US$60.3m (up 122% from...

GuruFocus.com

GuruFocus.comAdaptimmune Therapeutics PLC Reports Q4 and Full Year 2023 Financial Results

Key Financial Highlights and Business Updates