C Jun 2024 57.000 put

| Previous close | 0.1400 |

| Open | 0.2200 |

| Bid | 0.0000 |

| Ask | 0.0000 |

| Strike | 57.00 |

| Expiry date | 2024-06-28 |

| Day's range | 0.1200 - 0.2200 |

| Contract range | N/A |

| Volume | |

| Open interest | 977 |

Reuters

ReutersGermany fines Citigroup over 'fat-finger' failures

FRANKFURT (Reuters) -Germany has fined Citigroup nearly 13 million euros ($13.94 million) for lapses in its trading system controls, the nation's bank regulator said on Thursday, as its consumer protection division imposed its largest penalty ever. It is related to a mishap in 2022 involving $1.4 billion in mistaken sell orders in equities, an event that riled markets and for which Citigroup was already fined 61.6 million pounds($78.24 million) by British authorities in May. Citi on May 2, 2022 processed a $444 billion order that was meant to amount to just $58 million, prompting $1.4 billion in mistaken sell orders, according to British regulators' findings.

Bloomberg

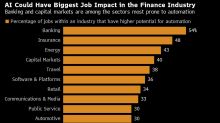

BloombergCiti Sees AI Displacing More Bank Jobs Than Any Other Sector

(Bloomberg) -- Citigroup Inc. said artificial intelligence is likely to displace more jobs across the banking industry than in any other sector as the technology is poised to upend consumer finance and makes workers more productive. Most Read from BloombergCar Dealerships Across US Halt Services After CyberattackHedge Fund Talent Schools Are Looking for the Perfect TraderWhat to Know About the Deadly Flesh-Eating Bacteria Spreading in JapanPutin’s Hybrid War Opens a Second Front on NATO’s Easter

Reuters

ReutersCiti bets on Europe despite political uncertainty, regional CEO says

Citigroup is looking to boost its business in Europe despite political instability on the continent spooking investors, the bank's new head of the region Ignacio Gutierrez-Orrantia said in an interview with Reuters. The U.S. bank, which last year undertook its most significant restructuring in decades, is currently placed fourth in EMEA league tables for M&A and sixth for equity capital markets (ECM), according to Refinitiv. "From a business perspective, this is also an opportunity for us to sit down with our clients and advise them on how to navigate this instability more effectively," Gutierrez-Orrantia said.