9 Cheapest States To Live in With No Income Tax

Do you know which states across America are the most affordable states to live in without any income tax?

Trending Now: Here’s How Much the Definition of Rich Has Changed in Every State

Try This: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

To find out, GOBankingRates identified and ranked the cheapest states without income tax by calculating state-level annual expenditure estimates using national average expenditures and each state’s cost-of-living index. Additionally, we provided average costs for groceries, housing, utilities, transportation and healthcare, using the same indices.

These are the cheapest states to live in with no income tax in descending order.

9. Alaska

Cost-of-living index: 125.2

Annual cost of necessities: $48,679

Annual expenditure: $91,355

Even though Alaska doesn’t have any income tax, you’ll still pay more than the national average for your major expenses. One of the biggest expenses is for utilities, which are approximately 58% higher than the national average. Groceries are also a big expense at approximately 24% higher than the national average. These higher costs have a lot to do with the state’s location.

Check Out: Here’s What the US Minimum Wage Was the Year You Were Born

Be Aware: 7 Popular Clothing Brands the Middle Class Can’t Afford Anymore

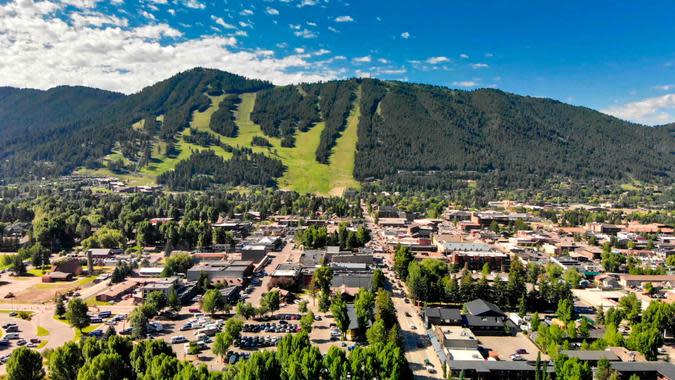

8. Washington

Cost-of-living index: 116.0

Annual cost of necessities: $44,740

Annual expenditure: $84,642

Groceries are about 10% above the national average in Washington. However, utility costs are about 8% lower.

For You: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

7. New Hampshire

Cost-of-living index: 114.1

Annual cost of necessities: $83,255

Annual expenditure: $44,740

Groceries in New Hampshire are just 2% higher than the national average. However, out of all your major living expenditures, you’ll pay the most for utilities. They run 31% higher than the national average.

6. Nevada

Cost-of-living index: 101

Annual cost of necessities: $39,430

Annual expenditure: $73,697

The cost-of-living index in Nevada is just 1% higher than the national average. Utilities are about 1% lower than the national average, while healthcare is about 8% lower.

Up Next: Here’s How Much the Definition of Middle Class Has Changed in Every State

5. Florida

Cost-of-living index: 100.7

Annual cost of necessities: $38,072

Annual expenditure: $73,478

Groceries in Florida are about 0.5% lower than the national average. Utilities and transportation and healthcare all are less than the national average by one to four percentage points.

4. Texas

Cost-of-living index: 92.7

Annual cost of necessities: $34,121

Annual expenditure: $67,640

The majority of the cost-of-living expenses in Texas are below the national average. Groceries are about 4% lower and housing is approximately 13% lower. The only cost that exceeds the national average is healthcare, which is 4% higher.

3. South Dakota

Cost-of-living index: 92.4

Annual cost of necessities: $34,648

Annual expenditure: $67,421

If you move to South Dakota, all of your cost-of-living expenses will be less than the national average. For example, utilities are about 12% lower than the national average and groceries are 3% lower.

Find Out: I’m an Economist: Here Are My Predictions for Inflation If Biden Wins Again

2. Wyoming

Cost-of-living index: 92.4

Annual cost of necessities: $33,845

Annual expenditure: $67,422

Three out of five cost-of-living expenses are lower than the national average in Wyoming — namely housing, utilities and transportation. Even so, groceries are just 2% above the national average and healthcare is only a tenth of a percent higher.

1. Tennessee

Cost-of-living index: 90.3

Annual cost of necessities: $33,060

Annual expenditure: $65,889

Tennesse ranks as the cheapest state without income tax on the list. All cost-of-living expenses are lower than the national average. Groceries are 2% lower than the national average, while housing is approximately 18% lower. Additionally, utilities are 7% lower; transportation is 11% lower; and healthcare is 12% lower.

Heather Taylor contributed to the reporting for this article.

Methodology: In order to find the cheapest states to live in with no income tax, GOBankingRates first isolated those 9 states with no income tax. Then found (1) the national average annual expenditures as sourced from the Bureau of Labor Statistics’ 2022 Consumer Expenditure Survey data. Then, GOBankingRates created (2) state-level annual expenditure estimates by multiplying the national figure by each state’s overall cost of living index score for 2023 from the Missouri Economic Research and Information Center. All qualifying states were then ranked with No. 1 being the state with no income tax that is the cheapest to live in. GOBankingRates provided supplemental information on the average annual cost of groceries, housing, utilities, transportation, and healthcare in each qualifying state by again using MERIC’s cost of living indices for each category to factor out national estimates from the CEX. All data was collected on and up to date as of April 30, 2024.

More From GOBankingRates

6 Things to Try This Week if You're Behind on Your Savings Goals

4 Reasons Retired Women Need More Money Than Men -- And What To Do About it

This article originally appeared on GOBankingRates.com: 9 Cheapest States To Live in With No Income Tax

Yahoo Finance

Yahoo Finance