3 High Insider Ownership Growth Companies On Chinese Exchange With At Least 26% Revenue Increase

Amid a backdrop of global economic fluctuations, the Chinese stock market has shown signs of weakening, with concerns about a slowing economy impacting investor sentiment. In such an environment, identifying growth companies with high insider ownership can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 23% | 33.1% |

We're going to check out a few of the best picks from our screener tool.

Chongqing Xishan Science & Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chongqing Xishan Science & Technology Co., Ltd. is a company with a market capitalization of approximately CN¥3.13 billion, focusing on the development and manufacturing of electronic components and related technologies.

Operations: The revenue segments for the company are not specified in the provided text.

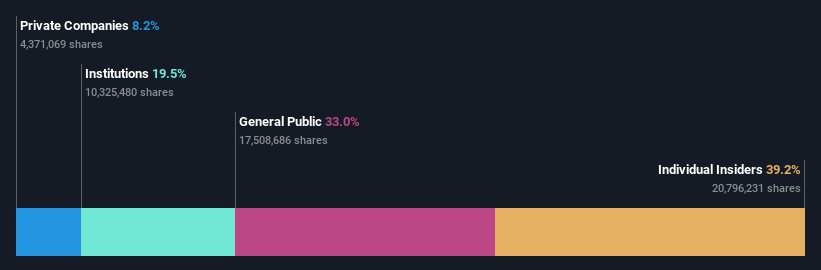

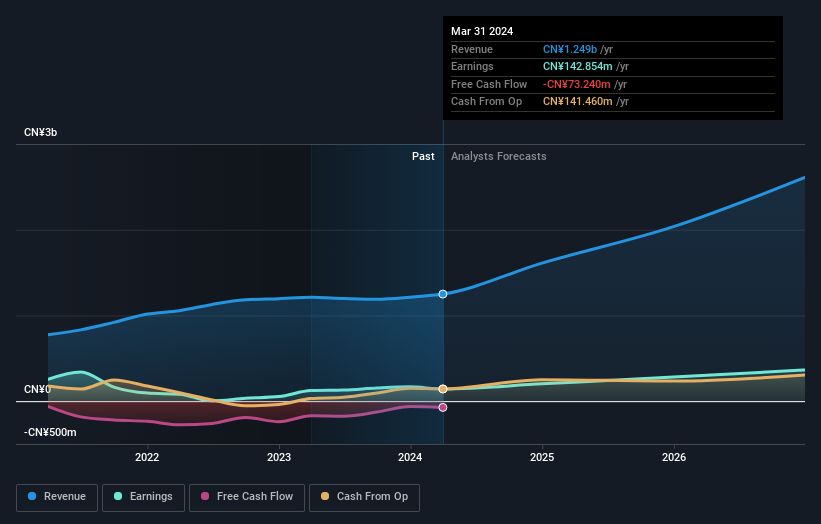

Insider Ownership: 39.2%

Revenue Growth Forecast: 26.3% p.a.

Chongqing Xishan Science & Technology is poised for robust growth with earnings expected to increase by 24.5% annually, outpacing the CN market's 22.2%. Despite a low forecasted Return on Equity of 8%, revenue growth is strong at 26.3% per year, also surpassing the market average. Recent strategic moves include a share repurchase program initiated on July 1, 2024, underlining insider confidence and commitment to shareholder value, with CNY 200 million allocated for buybacks at prices up to CNY 95 per share.

Shanghai Sinyang Semiconductor Materials

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. is a company engaged in the manufacturing of semiconductor materials, with a market capitalization of approximately CN¥9.81 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 15.1%

Revenue Growth Forecast: 26% p.a.

Shanghai Sinyang Semiconductor Materials Co., Ltd. is experiencing significant growth, with earnings projected to rise by 32.44% annually, surpassing the CN market's average of 22.2%. This growth trajectory is supported by a strong revenue increase forecast at 26% per year, also outperforming the market expectation of 13.7%. However, its Return on Equity is expected to remain low at 6.7% in three years' time. Recent corporate actions include dividend increases and amendments to company bylaws, reflecting active management and shareholder engagement.

M-Grass Ecology And Environment (Group)

Simply Wall St Growth Rating: ★★★★★☆

Overview: M-Grass Ecology And Environment (Group) Co., Ltd. specializes in ecological restoration and environmental protection projects, with a market capitalization of approximately CN¥3.72 billion.

Operations: The company generates revenue from ecological restoration and environmental protection projects.

Insider Ownership: 24.4%

Revenue Growth Forecast: 39.5% p.a.

M-Grass Ecology And Environment (Group) Co., Ltd. is navigating a challenging phase with a significant decline in quarterly sales and revenue, yet it maintains an optimistic long-term outlook with earnings expected to grow by 74.9% annually, outpacing the Chinese market's growth rate of 22.2%. Despite this, the company faces financial pressure as evidenced by its inability to cover interest payments effectively. The recent dividend announcement suggests an attempt to maintain shareholder confidence amidst fluctuating performance.

Seize The Opportunity

Click this link to deep-dive into the 368 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688576 SZSE:300236 and SZSE:300355.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance