3 High-Yielding ASX Dividend Stocks With Yields Starting At 3.4%

Over the past year, the Australian stock market has shown robust growth with a 10% increase, while remaining stable in the last week. In this context of promising market conditions and anticipated annual earnings growth of 14%, investors might consider high-yielding dividend stocks as a potentially attractive component of their investment portfolio.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 7.19% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.03% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.03% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.61% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.65% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 6.88% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.44% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.04% | ★★★★★☆ |

New Hope (ASX:NHC) | 9.00% | ★★★★☆☆ |

Click here to see the full list of 26 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

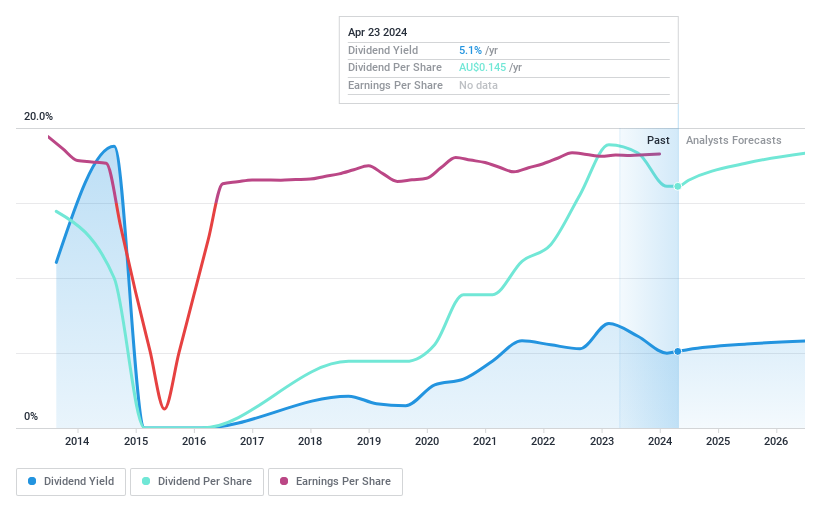

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited offers diversified contract services to the resources and infrastructure sectors in Australia, with a market capitalization of approximately A$1.43 billion.

Operations: NRW Holdings Limited generates its revenue primarily from three segments: Mining (A$1.49 billion), Civil (A$593.62 million), and MET (A$739.07 million).

Dividend Yield: 4.6%

NRW Holdings has demonstrated a volatile dividend history over the past decade, making its reliability uncertain for consistent income. Despite this, the dividends are currently well-supported, with a payout ratio of 74% and cash payout ratio of 68.6%, indicating that earnings and cash flows adequately cover dividend payments. However, its dividend yield of 4.63% is below the top quartile in the Australian market, which stands at 6.54%. Additionally, while NRW's stock trades at a significant discount to estimated fair value and earnings have shown substantial growth recently, prospective investors might weigh these positives against the backdrop of historical payment instability.

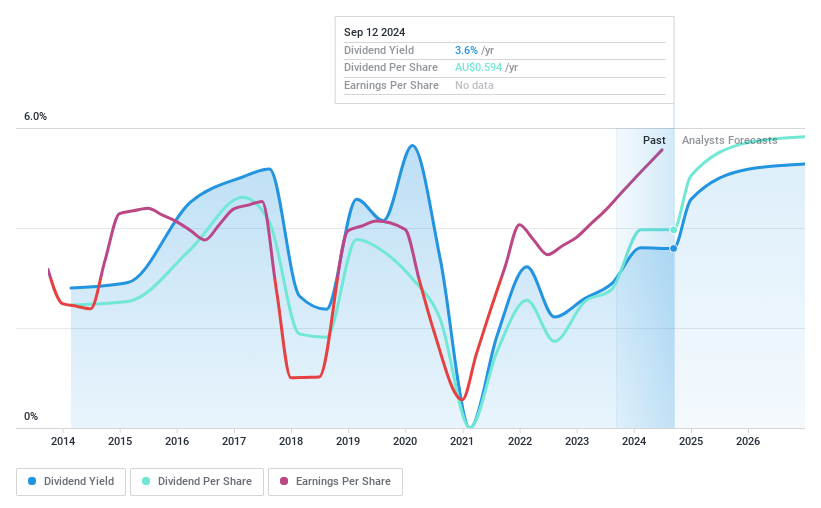

QBE Insurance Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited specializes in underwriting general insurance and reinsurance risks across the Australia Pacific, North America, and other international markets, with a market capitalization of approximately A$27.12 billion.

Operations: QBE Insurance Group Limited generates revenue primarily through three geographic segments: Australia Pacific with A$5.97 billion, North America with A$11.12 billion, and International markets contributing A$9.56 billion.

Dividend Yield: 3.4%

QBE Insurance Group's dividend sustainability is underpinned by a low payout ratio of 48.3% and cash payout ratio of 44.7%, indicating that both earnings and cash flows adequately cover dividends. However, its dividend track record has been unstable, with volatile payments over the past decade. Despite recent earnings growth of 143%, its dividend yield at 3.41% remains below the Australian market's top quartile average of 6.54%. Recent board changes could signal strategic shifts, potentially impacting future dividend policies.

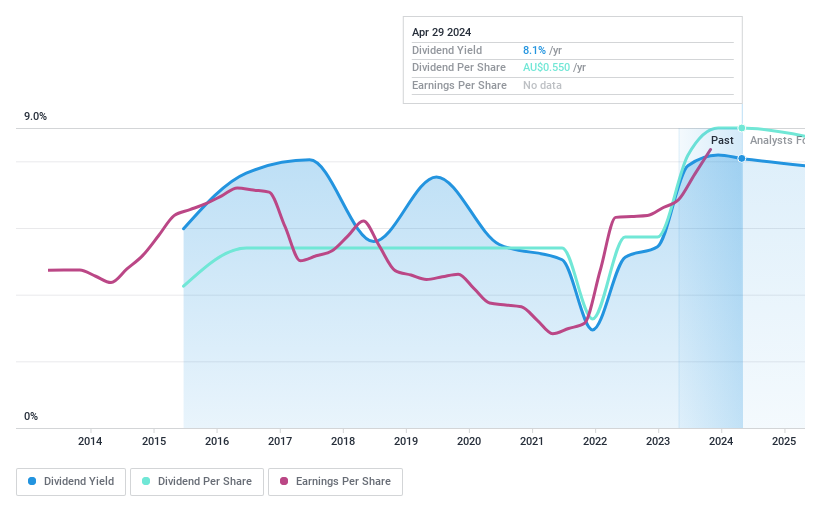

Ricegrowers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, operating under the ticker ASX:SGLLV, is a rice food company with activities spanning both Australia and international markets, boasting a market capitalization of approximately A$457.07 million.

Operations: Ricegrowers Limited generates revenue through several segments including Riviana at A$219.12 million, Cop Rice at A$253.52 million, Rice Food at A$115.93 million, Rice Pool at A$487 million, and International Rice at A$821.54 million.

Dividend Yield: 7.8%

Ricegrowers Limited, while offering a dividend yield of 7.76%, higher than the market's top quartile average, has shown volatility in its dividend payments with significant annual drops over the past nine years. Despite this instability, both earnings and cash flows support current dividend levels with payout ratios at 53.9% and 43.1% respectively. Trading at a substantial discount to estimated fair value and compared to industry peers, the stock presents potential value but carries risks due to its inconsistent dividend history.

Make It Happen

Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 23 more companies for you to explore.Click here to unveil our expertly curated list of 26 Top ASX Dividend Stocks.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NWH ASX:QBE and ASX:SGLLV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance