3 High-Yielding Dividend Stocks On Euronext Paris With Up To 4.9% Yield

As the French market navigates through heightened political uncertainty with upcoming elections, investors are closely monitoring the impacts on economic indicators and market movements. In this climate, dividend stocks on Euronext Paris present a particular interest for those seeking income-generating investments in a landscape marked by fluctuating bond yields and cautious monetary policies. In considering dividend stocks, it's essential to look for companies with robust financial health and a history of consistent dividend payouts, which can offer some stability amidst market volatility.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.50% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.54% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.84% | ★★★★★★ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.06% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.31% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.91% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 6.59% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.59% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.18% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.94% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

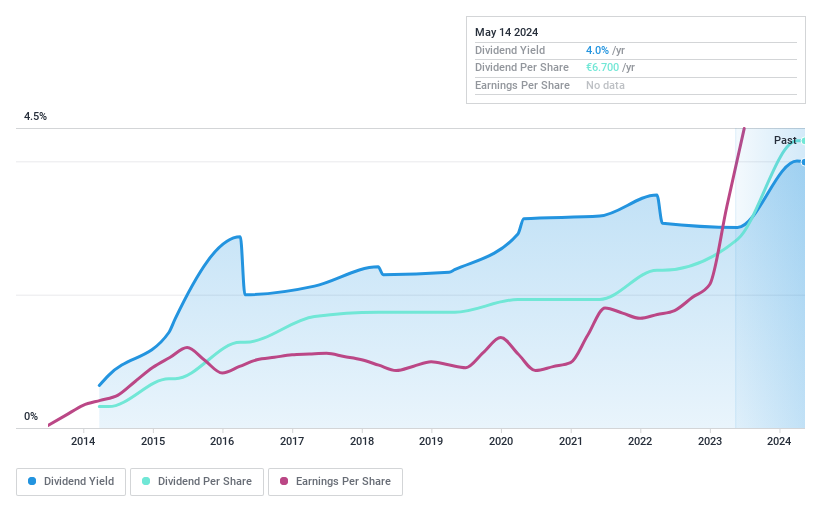

Exacompta Clairefontaine

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. is a company based in France that specializes in the production, finishing, and formatting of papers, operating both throughout Europe and internationally, with a market capitalization of approximately €165.20 million.

Operations: Exacompta Clairefontaine S.A. generates its revenue primarily through two segments: Paper, which contributes €368.58 million, and Processing, accounting for €613.23 million.

Dividend Yield: 4.6%

Exacompta Clairefontaine S.A. has demonstrated a robust financial performance with its net income rising to €43.12 million, up from €27.06 million the previous year, on sales of €843.25 million. The company maintains a low payout ratio of 17.6% and an even lower cash payout ratio of 10.3%, ensuring dividends are well-covered by both earnings and cash flow. Despite a reliable dividend yield of 4.59%, it falls below the top quartile in the French market, and recent months have seen significant share price volatility.

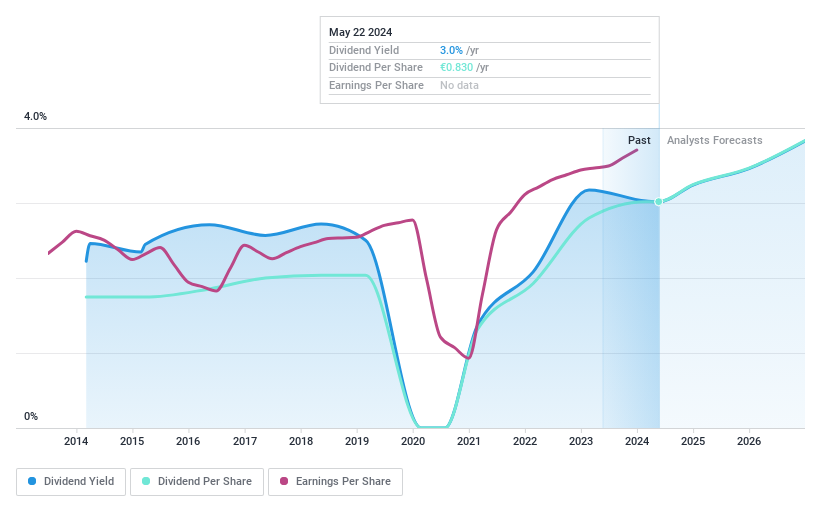

Bureau Veritas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bureau Veritas SA operates in the field of laboratory testing, inspection, and certification services, with a market capitalization of approximately €11.73 billion.

Operations: Bureau Veritas SA's revenue is distributed across several sectors: Buildings & Infrastructure generates €1.75 billion, Industry contributes €1.25 billion, Agri-Food & Commodities brings in €1.23 billion, Consumer Products Services adds €710.70 million, Certification accounts for €465 million, and Marine & Offshore provides €455.70 million.

Dividend Yield: 3.2%

Bureau Veritas SA, trading at €12.7% below estimated fair value, has seen a 7.9% earnings growth over the past year. Despite a decade of dividend increases and coverage by both earnings (74.6% payout ratio) and cash flow (56.9% cash payout ratio), its dividend yield of 3.21% remains below the French market's top quartile at 5.6%. The company's dividends have shown volatility over the past ten years, indicating some instability in its dividend track record despite recent approvals for increased distributions and strong bond issuance performance signaling investor confidence.

Click to explore a detailed breakdown of our findings in Bureau Veritas' dividend report.

Our valuation report here indicates Bureau Veritas may be overvalued.

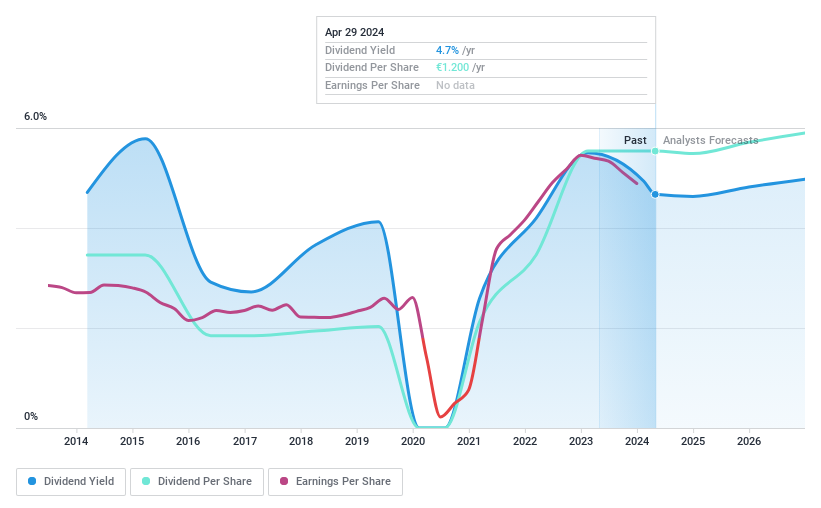

Rexel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. is a distributor of low and ultra-low voltage electrical products and services for various markets, operating in France, Europe, North America, and Asia-Pacific, with a market capitalization of approximately €7.19 billion.

Operations: Rexel S.A. generates €19.15 billion in revenue primarily through its wholesale electronics segment.

Dividend Yield: 5%

Rexel S.A. has experienced fluctuations in its dividend payments over the past decade, with a notably unstable dividend track record and a yield of 4.97%, which is below the top quartile of French dividend payers at 5.6%. However, both earnings and cash flows provide solid support for its dividends, with payout ratios of 46.6% and 45.6% respectively, indicating sustainability from a financial perspective. Recent corporate guidance forecasts stable to slightly positive sales growth for 2024 despite a challenging first quarter.

Make It Happen

Embark on your investment journey to our 34 Top Euronext Paris Dividend Stocks selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALEXAENXTPA:BVI and ENXTPA:RXL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance