Academy Sports (NASDAQ:ASO) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

Sporting goods retailer Academy Sports & Outdoor (NASDAQ:ASO) missed analysts' expectations in Q1 CY2024, with revenue down 1.4% year on year to $1.36 billion. The company's full-year revenue guidance of $6.21 billion at the midpoint also came in slightly below analysts' estimates. It made a GAAP profit of $1.01 per share, down from its profit of $1.19 per share in the same quarter last year.

Is now the time to buy Academy Sports? Find out in our full research report.

Academy Sports (ASO) Q1 CY2024 Highlights:

Revenue: $1.36 billion vs analyst estimates of $1.38 billion (small miss)

EPS (non-GAAP): $1.08 vs analyst expectations of $1.22 (11.3% miss)

The company reconfirmed its revenue guidance for the full year of $6.21 billion at the midpoint

The company raised its EPS guidance for the full year to $6.55 per share at the midpoint as it expects to repurchase more shares than originally planned

Gross Margin (GAAP): 33.4%, down from 33.8% in the same quarter last year

Free Cash Flow of $167.3 million, up from $11.67 million in the same quarter last year

Locations: 284 at quarter end, up from 269 in the same quarter last year

Same-Store Sales fell 5.7% year on year

Market Capitalization: $3.94 billion

Steve Lawrence, Chief Executive Officer, commented, "As expected, our first quarter results reflect that our customers remain under pressure in the current economic environment. We will navigate through the remainder of the year by continuing to lean into our position as the value leader in our space, while also inspiring customers to shop through introductions and expansions of new and innovative products. We will also continue making strategic investments in our long-range growth initiatives. We are pleased that we drove a positive comp in our new stores and omnichannel business. Academy has the right elements in place to achieve our long-range goals: a well-established business model, an experienced leadership team and a strong balance sheet."

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

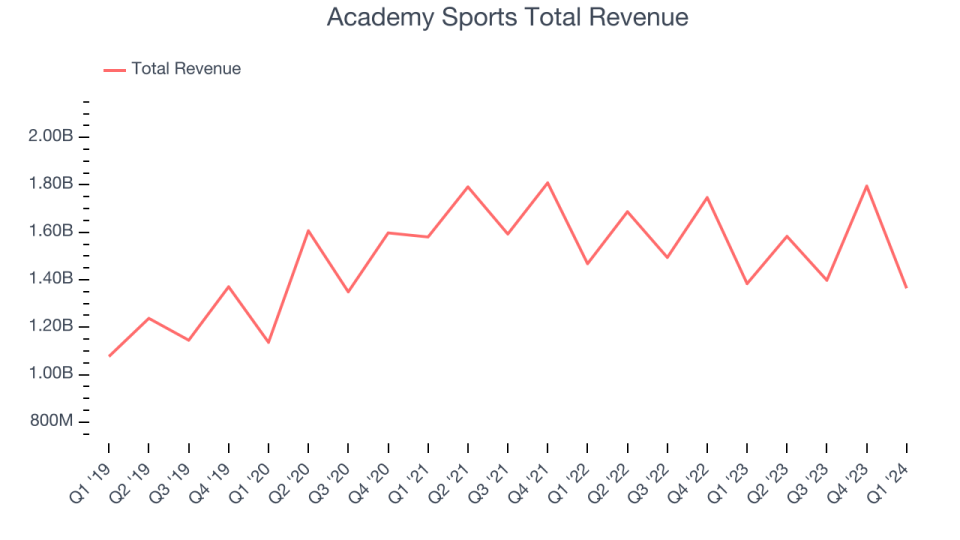

Sales Growth

Academy Sports is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's annualized revenue growth rate of 5.3% over the last five years was sluggish , but to its credit, it opened new stores and expanded its reach.

This quarter, Academy Sports missed Wall Street's estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $1.36 billion in revenue. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

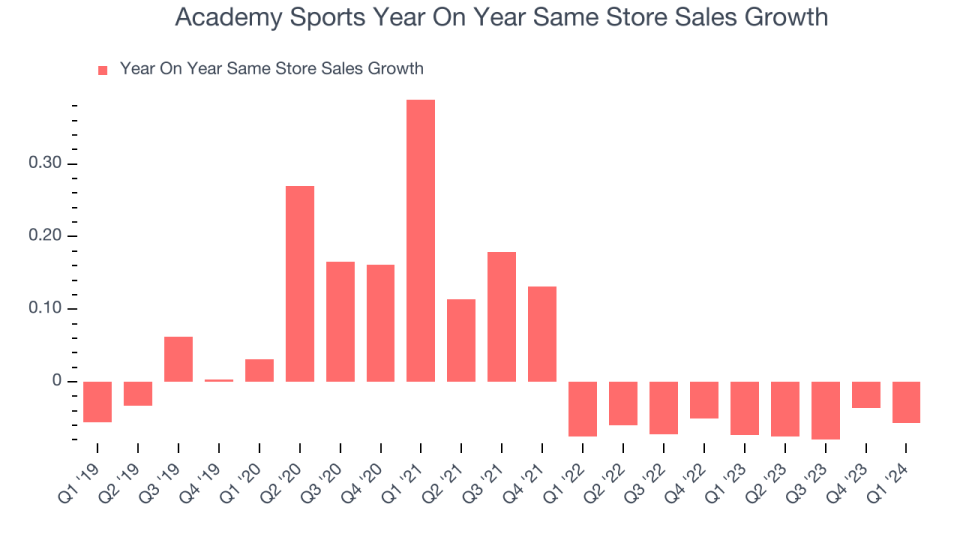

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Academy Sports's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 6.3% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Academy Sports's same-store sales fell 5.7% year on year. This decrease was a further deceleration from the 7.3% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Academy Sports's Q1 Results

We struggled to find many strong positives in these results. Although it raised its full-year EPS outlook, the forecast still missed analysts' estimates. Furthermore, this quarter's gross margin and EPS missed Wall Street's expectations. Overall, this was a bad quarter for Academy Sports. The company is down 7.3% on the results and currently trades at $49.50 per share.

Academy Sports may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance