Accenture to Face Intensifying Competition From Indian Companies

Accenture PLC (NYSE:ACN) is one of the world's leading professional services companies, and it is driven to provide change and technological advancements for its clients. While it faces a significant threat from high-growth Indian multinational consultancy companies, I believe Accenture offers stability in its valuation.

In my opinion, investors would be wise to anticipate changes in growth related to Western and emerging markets over the next few decades, but for the foreseeable future, I think Accenture has a strong outlook.

Operations analysis

Accenture is a leading global professional services company that specializes in technology services and consulting. It operates in five primary business segments: Financial Services, Retail, Manufacturing Energy, Utilities, Resources and Services and Communications. However, it has a multitude of smaller segments beyond these.

The company faces the most significant threat at this time from four major competitors I have identified. Although there are many other strong players, these are the companies I believe are most competitive; I have also limited my selection to those that are publicly listed, which takes out Deloitte from the peer analysis as a key example of the effect of the omission.

IBM (NYSE:IBM) is a leader in artificial intelligence, cloud computing and quantum computing, which are critical areas to the future of IT services and consulting.

Cognizant (NASDAQ:CTSH) is a significant threat due to its rapid expansion and focus on digital transformation services.

Tata Consultancy Services (NSE:TCS) is an Indian multinational IT services and consulting company; its strong presence in emerging markets is noteworthy.

Infosys (NYSE:INFY) is an Indian multinational corporation offering a wide range of IT services, including consulting, technology, outsourcing and next-generation digital services.

India is particularly important to highlight in this analysis when assessing the future competitive value of Accenture. Indian IT companies can often provide services at a lower cost compared to their Western counterparts due to the relatively lower cost of labor. Indian companies are also investing heavily in technologies like AI, cloud computing and blockchain.

According to Deloitte United States and Asian Development Bank, India's gross domestic product grew by 7.20% in 2022-23 and is projected to grow between 6.40% and 6.70% in 2024. Deloitte also noted Indian government investment spending has consistently grown above 8% year over year, which should deliver a strong boost to the private capital expenditure cycle. According to the World Bank, the U.S. economy grew by approximately 2.10% in 2022; in 2023, the growth rate slowed down due to higher interest rates and global economic uncertainties, with projections varying from around 1.80% to 2.20%. Therefore, India is growing at a faster rate compared to the U.S., with projected GDP growth rates significantly higher.

While companies like Infosys generate most of their revenue from Western markets, I believe their foothold in India's economy positions it to capitalize on the growth forecasted there much more aggressively than Western consultancy players. This is important to consider when deciding whether to invest in a Western professional services company or an Indian one to hold for the next 10 to 20 years.

Financial and valuation peer analysis

IBM is quite an old company, and so its growth is contracting at this time. Primarily I consider this to be because it is in the later stage of its lifecycle. However, the other four companies are growing significantly, and we can see just how competitive the Indian multinational companies are to Accenture and Cognizant.

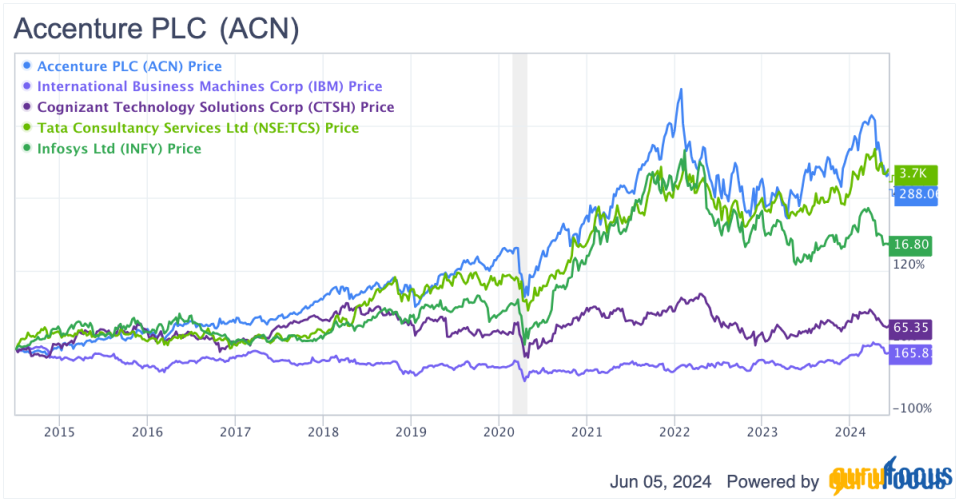

Accenture's price-return compound annual growth rate over the past 10 years is 12.95%, which is succeeded only by Tata, which has a 10-year price-return CAGR of 13.32%. Accenture is a compelling investment due to its competitive revenue, earnings per share and free cash flow growth rates. Despite delivering exceptional price growth, Indian multinationals like Tata are more highly valued, particularly based on price-to-free cash flow, making Accenture's stock more attractive relative to its intrinsic value.

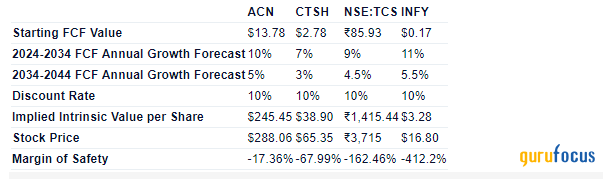

I have placed each of these companies into a discounted cash flow model to ascertain how the results compare relatively and the impact on the security of each investment from the standpoint of intrinsic value. Please note I have removed IBM because its fundamental growth has been in a long-term decline. I have also used a 10% discount rate, as this is my baseline total portfolio return expectation.

I believe a heavy emphasis on discounted cash flow models can provide an element of security in times of economic recession, reducing volatility because the stock valuation is less dependent on market sentiment. Therefore, I believe the two best companies out of the four I have selected here are Accenture and Tata. Tata has a much lower negative margin of safety than Infosys, which is why I chose it despite the lower forecasted growth rates. It also offers native exposure to Indian markets, which I find very attractive at this time when the macroeconomic climate looks like it could begin to favor emerging markets for long-term growth.

Tata has a 10-year median price-earnings ratio of 25.50 and is trading at a price-earnings ratio of 29.50 at the time of this writing. Accenture has a 10-year median price-earnings ratio of 25.50, while its current ratio is 26.50. The GF Value chart also shows Accenture to be modestly undervalued, with the current stock price around 14.50% lower than the GF Value of $340.45. For Tata, the GF Value is 4,077 rupees ($48.85(, which indicates an 8% margin of safety against the present stock price. Please note the figures in this part of my value analysis differ slightly from the DCF models above, as it was constructed a day later.

I think both investments have an immense amount of merit to them, and I think it takes an advanced and nuanced understanding to appreciate that DCF models are not the be-all, end-all of valuation analysis. Much of ascertaining fair value is about analyzing market psychology and sentiment over extended periods, which is much easier to do with valuation multiples than discount models. I commend the GF Value algorithm for including several elements of valuation analysis to incorporate this market sentiment against historical financial results and future financial forecasts.

I believe Tata offers a good balance between Infosys and Accenture, providing a manageable price related to its intrinsic value, which should help ease periods of volatility in the stock price. However, Tata also offers the potential for my forecasted growth rates for the company to be exceeded if the company manages to develop its client base more aggressively in its native economy.

Risk analysis

Recently, The Cambridge Consultant outlined six of Accenture's biggest clients, which include Cardinal Health (NYSE:CAH), Best Buy (NYSE:BBY), Barclays (NYSE:BCS), CNH Industrial (NYSE:CNH) and Adidas (ADDYY). As Accenture generates a significant portion of its revenue from a number of key clients, it is vulnerable to changes in spending from these companies. While Accenture is likely well positioned by focusing its resources on its best-paying customers, the lack of diversification in revenue streams from company sources poses a threat worth considering as a shareholder.

In addition, I would like to reiterate my point about India, as well as highlight the potential for growth in China. As companies like Tata and Infosys are native to India, they will likely be able to benefit from economic growth there that is not as available for Western companies. At this time, roughly 80% of Accenture's operating revenue is from Western markets, with just 19.50% from growth markets. While Accenture operates in India, China, Southeast Asia, Africa and Latin America, I believe over the next 10 to 20 years, there is a significant risk that the growth in emerging markets becomes more acute, and we may begin to see signs of contraction in previously dominant Western markets. This shift in economic growth might place native Indian and Chinese companies, which are likely to be the beneficiaries of a higher growth period, in a stronger position than Western companies like Accenture.

Key elements

Accenture is one of the leading professional services companies in the world, with a heavy emphasis on technological advancements. However, it has faced significant rivalry from Indian multinational companies, and I believe this threat could increase as the growth opportunities compound in emerging markets over the next few decades.

It has the second-highest price return against other major consultancy players I have peer analyzed. Accenture also offers the best valuation when assessing the stock price against its intrinsic value in a DCF model. However, based on the future growth opportunity from exposure to a native Indian company, Tata might offer the best balance between value and emerging market growth when compared to Accenture and Infosys.

Accenture shareholders should be aware a significant portion of the company's revenue comes from a small number of key customers. Any changes to the macroeconomic environment related to these predominantly Western companies could produce contraction and difficulty for Accenture in producing competitive financial results.

Conclusion

At this time, I consider Accenture to be a very strong investment. While there is arguably a growing competitive threat from Indian multinational companies, I think Accenture's valuation and my growth forecasts position it as a very favorable investment over the next 10 years at least. Considering its proactive approach and foothold in many emerging markets already, it may be able to navigate current macroeconomic shifts with stability and continued leadership.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance