Ameresco (AMRC) to Build Battery Storage System in Canada

Ameresco, Inc. AMRC, in collaboration with Atura Power, recently inked an agreement for the construction of a battery energy storage system (BESS) in Ontario, Canada. The deal has been awarded by the Independent Electricity System Operator (“IESO”).

Details of the Project

The strategic alliance established between Atura Power and Ameresco through a joint venture (JV), Napanee BESS Project, has been picked up by IESO for the construction of a 250-megawatt (MW), 1,000-megawatt hour (MWh) BESS. This highlights large-scale benefits for the JV.

In addition to a 20-year capacity agreement with IESO, the deal involves AMRC’s engineering and construction solutions and expertise for the installation of the BESS pursuant to another agreement. The project provides Ameresco’s proven expertise and a platform to further expand in Ontario in building BESS for large-scale utility projects.

AMRC’s Growth Prospects in Ontario

Ontario exhibits significant opportunities for the expansion of companies in the alternative energy space as the region transitions to renewable energy sources to curtail the carbon footprint in the environment.

IESO anticipates Ontario to be equipped with at least 1,217 MW of energy storage capacity by 2026. Considering the region’s growing demand for energy, there are significant opportunities for AMRC to secure additional contracts in the region and boost its revenue generation prospects.

Global Battery Storage Prospects & Peer Moves

The integration of battery storage with renewable sources of energy has witnessed significant growth in recent years and continues to portray promising prospects in the days ahead. Also, as battery storage systems provide opportunities for energy self-consumption, energy storage and grid independence, their demand may increase manifold.

Per the report from Fortune Business Insights, the global battery energy storage market is anticipated to witness a CAGR of 16.3% through 2029. This indicates promising returns for Ameresco and other companies in the battery storage segment of the renewable market. Other alternate energy companies that stand to benefit from the expanding energy storage market are as follows:

Clearway Energy CWEN: In January 2023, the company announced that its 36 MW solar farm with 144 MWh of battery storage on Kamehameha Schools’ lands in Waiawa in Central O‘ahu achieved commercial operations.

The Zacks Consensus Estimate for Clearway Energy’s 2023 sales suggests a growth rate of 17.8% from the prior-year reported figure. The Zacks Consensus Estimate for CWEN’s 2024 earnings has been revised upward by 5.1% in the past 60 days.

Energy Vault Holdings NRGV: In January 2023, the company, along with Pacific Gas and Electric Company, declared to deploy and operate a utility-scale battery plus green hydrogen long-duration energy storage system (BH-ESS) with a minimum of 293 MWh of dispatchable carbon-free energy.

The Zacks Consensus Estimate for Energy Vault’s 2023 sales suggests a growth rate of 157.9% from the prior-year reported figure. The Zacks Consensus Estimate for NRGV’s 2024 sales indicates a growth rate of 87.3% from the prior-year estimated figure.

Price Movement

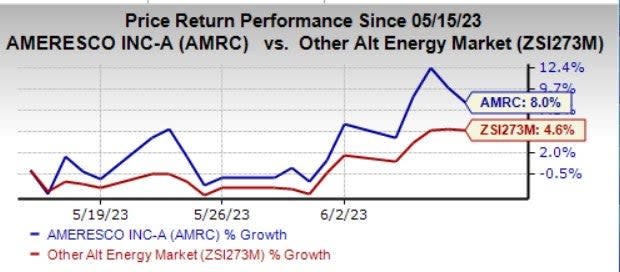

In the past month, shares of Ameresco have increased 8% compared with the industry’s growth of 4.6%.

Image Source: Zacks Investment Research

Zacks Rank & a Stock to Consider

Ameresco currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the same industry is Gevo GEVO, with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Gevo’s 2023 sales pegged at $14.8 million suggests a significant improvement from the prior-year reported figure. The Zacks Consensus Estimate for Gevo’s 2024 sales indicates an improvement of 80.3% from the prior-year estimated figure.

The Zacks Consensus Estimate for Gevo’s 2023 earnings suggests an improvement from the prior-year reported figure. In the past month, shares of Gevo have increased 26%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameresco, Inc. (AMRC) : Free Stock Analysis Report

Gevo, Inc. (GEVO) : Free Stock Analysis Report

Clearway Energy, Inc. (CWEN) : Free Stock Analysis Report

Energy Vault Holdings, Inc. (NRGV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance