Amex Gold vs Platinum: Which benefits work for you?

American Express has long had a reputation as a top-notch credit card for jet-setting travellers with a taste for the finer things in life. On top of providing a means for you to spend with all the protections that credit cards offer, Amex cards also offer a range of additional benefits including concierge services, spending rewards and even Deliveroo discounts.

Cardholders may also be able to get exclusive access to on-demand entertainment events and extra benefits when they travel.

American Express has a range of different credit cards available to individuals but two of the most popular are Amex Gold and Amex Platinum.

Here Telegraph Money explores the differences between the two cards, to help you work out whether Amex Gold or Amex Platinum is the right choice for you.

What is Amex Gold?

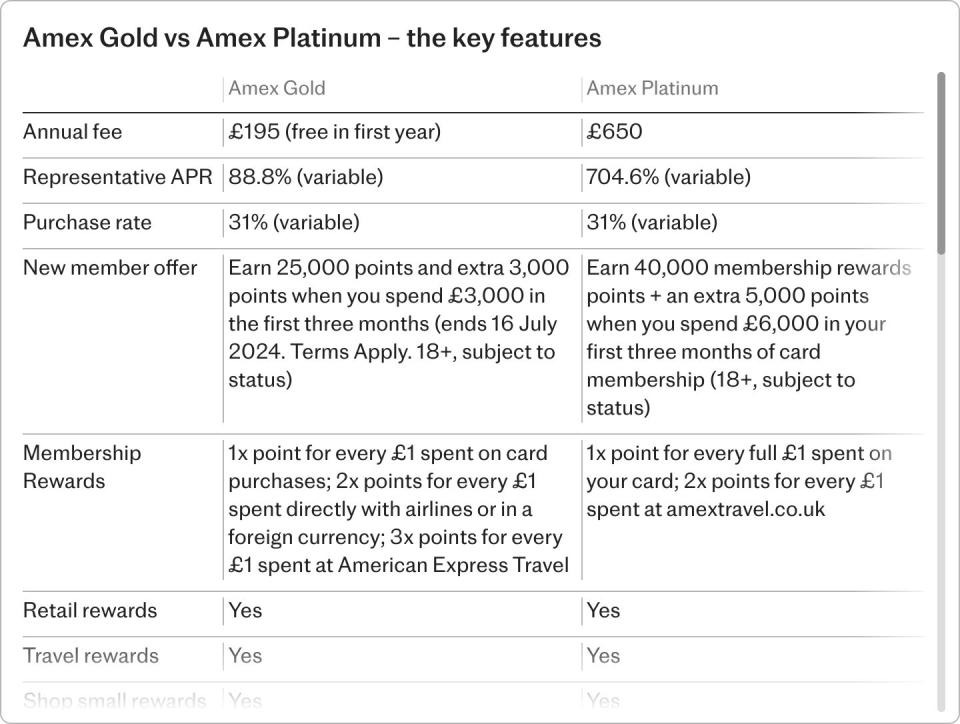

The American Express Preferred Rewards Gold credit card is all about the perks. For every £1 you spend, you get one membership reward point, rising to two points for every £1 spent on flight bookings and three points for spending with American Express Travel.

As an additional welcome bonus, new members can get 25,000 reward points when they sign up (up from 20,000), plus an extra 3,000 points if they spend £3,000 in three months. There’s a further 5,000 points up for grabs if they spend anything in month 15. However, this is part of a limited time offer which ends on 16th July 2024.

All Amex Gold card holders can also get four free Priority Pass airport lounge visits which can be used at airports across the world.

There’s also access to exclusive experiences, with previous events including a behind-the-scenes tour of the Tottenham Hotspur stadium and a cocktail-making masterclass.

Gold card holders don’t have to travel to make the most of benefits either, with two £5 credits a month when you order food with Deliveroo.

The annual fee for the Amex Gold is currently £195, but it is waived during the first year.

What is Amex Platinum?

The Amex Platinum card ramps the lifestyle benefits up a gear, with a variety of personal, lifestyle and travel perks.

New members get 40,000 membership reward points, plus an extra £5,000 points if they spend £6,000 in the first three months.

Members earn one point for every pound they spend on the card or two for every pound spent at Amex Travel.

There is also complimentary access to airport lounges across the world and worldwide travel insurance for members and their families.

The Global Dining Credit gives up to £150 in discounts in partner restaurants in the UK plus a further £150 credit for dining overseas.

Luxury shoppers will also appreciate the Harvey Nichols shopping credit worth £50 twice a year.

Hotel benefits, meanwhile, include free room upgrades (when available) and late check-outs.

On top of that, if you sign up between now and 27 August 2024 you will be entered into a draw to win tickets to the 2025 Wimbledon tennis tournament.

The catch is that the Amex Platinum comes with a hefty £650 annual fee.

How do I decide between Amex Gold and Amex Platinum?

The key to working out whether you should get Amex Gold or Amex Platinum is to look at the benefits and think about how much you will use each of them.

To make the most of rewards you will also need to spend large sums regularly. While it’s fine to put as much of your spending as you can on the card, you don’t want to then fall into the trap of spending just to get rewards.

For the majority of people a Gold card will provide a good introduction to the benefits of Amex – including some travel benefits such as 24/7 global assist (which can be helpful if you have an emergency overseas) and a limited number of airport lounge passes.

For the Platinum option to stack up you will need to really unpick the details to justify the £650 annual fee. For example, look at the partner hotels and restaurants you’ll need to use to get maximum benefits from the perks and think about whether they are the sort of places you’d go.

While it might look good in your wallet, it’s only likely to offer value for money if you’re a big spender, travel regularly and in style.

With either option, it’s essential you pay your outstanding balance off every month, otherwise interest charges will quickly erode the value of your perks. The interest rate on the Platinum card, at 704.6pc, is particularly high.

FAQs

Is Amex Gold easier to get than Platinum?

There’s no published information to suggest that it’s harder to qualify for an Amex Platinum over Amex Gold. However, American Express does state that to get either, you need to be over 18, have a permanent UK address and have no record of bad debts – meaning you will need to have a good credit score.

Before you apply for either, it’s a good idea to use Amex’s online eligibility checker to find out if you will qualify before you make a formal application (as it won’t leave a mark on your credit record).

Is it worth upgrading from Amex Gold to Amex Platinum?

If you already have an Amex Gold card, you might be tempted to upgrade to Platinum. Amex will tempt you with the offer of extra member reward points when you do. Frequent flyers might also appreciate the value of unlimited lounge access at airports and enhanced travel rewards.

However, Platinum costs £455 more a year than Gold, so you’ll want to be confident that you will make the most of the benefits. It’s important not to get swayed by benefits you might not in reality use.

How can I use member reward points?

You can use member reward points to pay for shopping with a broad range of every day and luxury retailers from Boots to John Lewis via Homebase and Harvey Nichols. Alternatively you can spend your reward points on hotels or flights.

You can even donate your points to charity if you wish through a partnership with JustGiving.

Do Amex Gold or Platinum pay cashback?

Amex does offer cashback rewards – but not on its Gold or Platinum cards.

If you would like a cashback benefit, it’s worth looking at its Cashback and Everyday Cashback credit cards.

Can I get air miles with American Express Gold or Platinum?

Neither Amex Gold or Platinum offer Avios points.

If you want to focus your rewards on flights, the British Airways American Express credit card pays one Avios point for every £1 spent on everyday purchases. There’s no annual fee and if you spend £12,000 over the year you can also earn a companion voucher.

Yahoo Finance

Yahoo Finance