Avoid Estée Lauder Companies And Explore This One Attractive Dividend Stock Instead

The allure of dividend stocks is evident, especially in the U.S. market where they promise a source of regular income. However, the stability of these dividends is crucial; companies like Estée Lauder Companies that have experienced significant cuts in their dividends may signal underlying financial challenges or a lack of resilience in maintaining shareholder returns. This distinction is vital for investors looking for dependable income streams from their stock investments.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.36% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.31% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.15% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.97% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.87% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.21% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.46% | ★★★★★☆ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.75% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.78% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

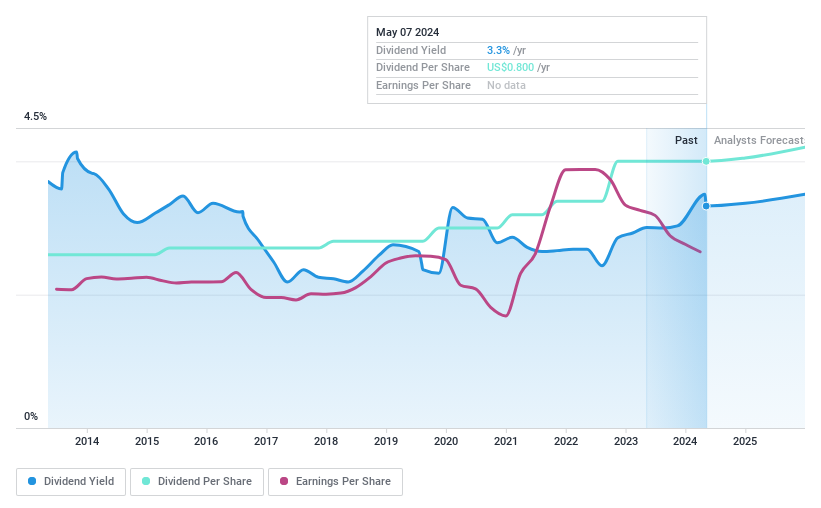

Middlefield Banc

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Middlefield Banc Corp., with a market cap of $187.96 million, serves as the bank holding company for The Middlefield Banking Company, offering commercial banking services to small and medium-sized businesses, professionals, small business owners, and retail customers in northeastern and central Ohio.

Operations: The company generates its revenue primarily through banking services, amounting to $68.11 million.

Dividend Yield: 3.4%

Middlefield Banc Corp. (MBCN) maintains a healthy dividend profile with a payout ratio of 38.9%, ensuring dividends are well-covered by earnings, unlike companies with unstable dividend histories. Despite trading below fair value by 10.6% and facing an earnings forecast decline of 12.1% annually over the next three years, MBCN has upheld a stable and growing dividend for the past decade, currently offering a yield of 3.4%. Recent inclusion in the Russell 2000 Dynamic Index and consistent quarterly dividends underscore its reliability in returning value to shareholders.

Navigate through the intricacies of Middlefield Banc with our comprehensive dividend report here.

Our valuation report unveils the possibility Middlefield Banc's shares may be trading at a premium.

One To Reconsider

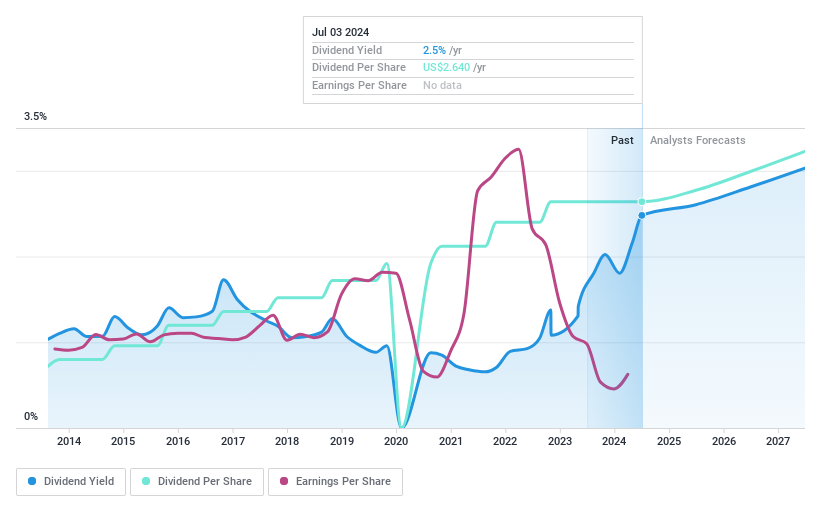

Estée Lauder Companies

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Estée Lauder Companies Inc. operates globally, specializing in the manufacturing, marketing, and sale of skincare, makeup, fragrance, and hair care products with a market capitalization of approximately $38.17 billion.

Operations: The company's revenue is segmented as follows: skincare products generate $7.62 billion, makeup contributes $4.46 billion, fragrances bring in $2.55 billion, and hair care accounts for $0.63 billion.

Dividend Yield: 2.5%

Estée Lauder Companies, despite a dividend yield of 2.49%, falls short as an attractive dividend stock due to its instability and poor coverage. Its dividends have shown volatility over the past decade, with significant reductions impacting reliability. Recent financials reveal a payout ratio of 147.7%, indicating dividends are not well-supported by earnings or cash flows, further evidenced by the absence of free cash flow. Additionally, Estée Lauder carries high debt levels, compounding concerns about its financial health and dividend sustainability.

Taking Advantage

Delve into our full catalog of 202 Top Dividend Stocks here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:MBCN and NYSE:EL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance