Avoid Redcentric And Explore One Better Dividend Stock Option

Investing in dividend stocks within the United Kingdom can be an appealing strategy for those seeking regular income. However, caution is needed as some companies may offer high dividends that are not sustainable over the long term. For instance, a company like Redcentric, with a high payout ratio, might face difficulties maintaining its dividend payments, which could impact investors relying on this income.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.10% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.54% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.19% | ★★★★★☆ |

DCC (LSE:DCC) | 3.50% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.75% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.77% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.20% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.52% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.59% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

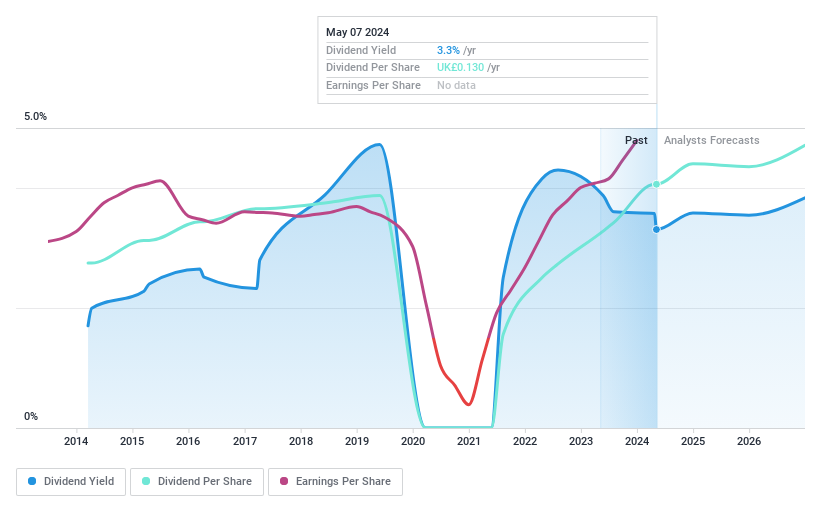

Mears Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc operates in the United Kingdom, offering a range of outsourced services to both public and private sectors, with a market capitalization of approximately £357.27 million.

Operations: The company generates revenue through three primary segments: Management (£543.35 million), Development (£2.70 million), and Maintenance (£543.28 million).

Dividend Yield: 3.4%

Mears Group's recent dividend increase to 13.00 pence for FY 2023, up from 10.50 pence the previous year, highlights its strong cash performance and management's confidence in future prospects. With a sustainable payout ratio of 39.5% and a cash payout ratio of only 11.4%, dividends are well-covered by both earnings and free cash flow, contrasting sharply with some peers struggling with high payout ratios that threaten dividend sustainability. However, it is worth noting Mears has experienced some volatility in dividend payments over the past decade.

One To Reconsider

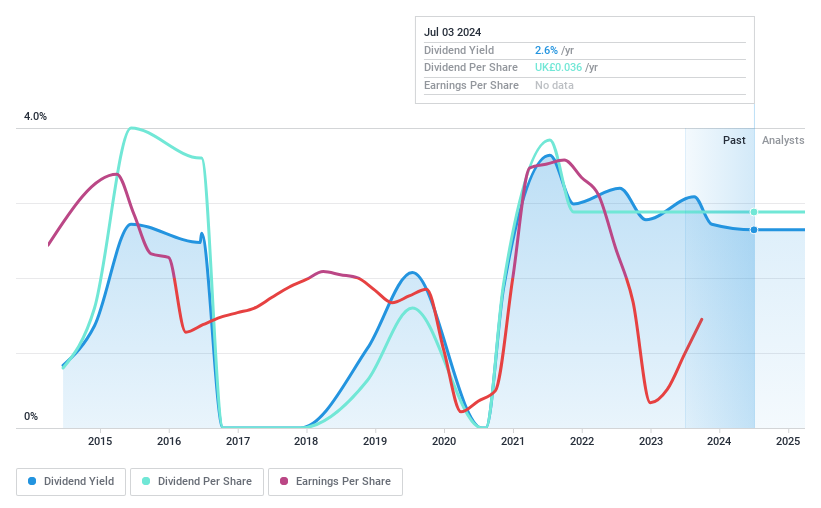

Redcentric

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Redcentric plc operates as an IT managed services provider catering to both public and private sectors in the United Kingdom, with a market capitalization of approximately £215.64 million.

Operations: The company generates £162.14 million from providing managed IT services.

Dividend Yield: 2.6%

Redcentric's dividend profile raises concerns due to its unstable history, with significant fluctuations over the past decade and an unprofitable status. Despite dividends increasing, the company's low yield of 2.64% falls short compared to the UK market's top quartile at 5.73%. Additionally, recent merger and acquisition discussions with Wiit S.p.A., still in preliminary stages as of May 2024, introduce uncertainty about Redcentric’s future financial stability and dividend sustainability.

Key Takeaways

Take a closer look at our Top Dividend Stocks list of 56 companies by clicking here.

Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:MER and AIM:RCN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance