AZUL at 52-Week Low: Does the Stock Still Hold Promise?

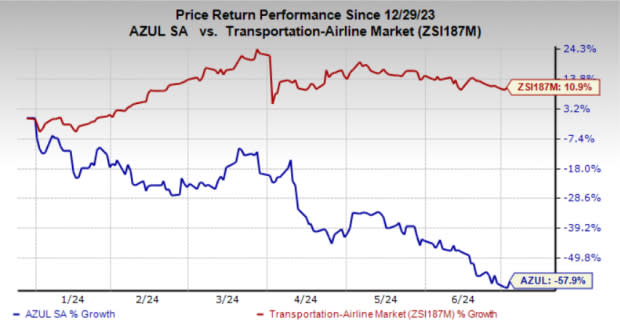

Shares of Azul AZUL have been in the red territory for a while now. This is evident from the stock’s price trend year to date. Azul has declined more than 57.9% compared to its industry’s 10.9% growth.

Image Source: Zacks Investment Research

Shares of this Latin American carrier have declined more than 26.2% in the past month. The stock closed at $3.84 yesterday (Jul 2) after hitting a 52-week low of $3.70 during the trading session.

While this Zacks Rank #3 (Hold) company is currently bearing the brunt of issues like weak liquidity and surging labor costs, including salaries and benefits, we believe that it still holds much promise and should be retained for long-term prospects. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What’s Hurting the Stock?

AZUL's gross debt surged 12.8% year over year to $2.7 billion at the end of the first quarter of 2024, significantly outpacing its cash and cash equivalents of $274 million and raising liquidity concerns. Moreover, the current ratio (a measure of liquidity) stood at 0.34 at the end of the quarter. A current ratio of less than 1 is undesirable as it indicates that the company does not have enough cash to meet its short-term obligations.

Labor costs, comprising salaries and benefits (accounting for 17.4% of the total operating expenses), rose by 25.5% year over year to $675 million in the first quarter of 2024. This northward movement in expenses on labor does not bode well for AZUL's bottom line.

AZUL has a very discouraging earnings surprise history. The company has underperformed the Zacks Consensus Estimate in each of the trailing four quarters. The average miss is 51.33%.

Downward Estimate Revisions

Due to the abovementioned headwinds, the Zacks Consensus Estimate for the company’s second-quarter earnings has moved 4.35% south over the past 60 days. Also, the reading for the current year has been revised 440% downward over the same time frame.

Tailwinds

Despite the headwinds, Azul does have its share of positives. Upbeat air travel demand has significantly boosted AZUL's consolidated traffic, measured in revenue passenger kilometers. To meet this strong demand, AZUL plans to boost its capacity by 11% in 2024 compared to 2023. We expect this metric to grow by 10.6% year over year in 2024.

The decline in operating costs is boosting AZUL's bottom line. AZUL’s total operating expenses of $3.9 billion decreased by 3.4% year over year in the first quarter of 2024. Fuel expenses plunged 19.1%, expenses on airport fees fell by 7.7%, and other cost items declined by 13.8% year over year.

Moreover, the stock has an expected earnings per share growth rate of 51.10% for the next five years, which is higher than its industry’s 16%. Azul also has an attractive VGM Score of A. Here, V stands for Value, G for Growth and M for Momentum. The company’s score is a weighted combination of these three scores.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZUL (AZUL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance