Bank OZK (OZK) Announces a 2.6% Hike in Quarterly Dividend

Bank OZK OZK announced another hike in its quarterly dividend. The company declared a quarterly cash dividend of 40 cents per share, marking an increase of 2.6% from the prior quarter’s levels. The dividend will be paid out on Jul 19 to shareholders on record as of Jul 12.

This marks the 56th consecutive quarter of a dividend hike by OZK.

Before the recent hike, OZK raised its dividend by 2.6% to 39 cents per share in April 2024. Also, the company has a five-year annualized dividend growth of 10.2%. Currently, its payout ratio is 25% of earnings. This indicates that it retains adequate earnings for reinvestment and future growth initiatives while still delivering lucrative returns to its shareholders.

Considering yesterday’s closing price of $41.25, OZK’s dividend yield is currently pegged at 3.9%, which is above the industry average of 2.88%.

Bank OZK’s track record of consistent dividend hikes led to its inclusion in the S&P High Yield Dividend Aristocrats index since January 2018. The index includes the members of the S&P Composite 1500 that have maintained a managed-dividends policy of consistently increasing common stock dividends every year for at least 20 years and that meet minimum float-adjusted market capitalization and liquidity requirements.

At present, OZK doesn’t have any share repurchase program. The previous plan expired in November 2023. Under this plan (announced in November 2022), the company was authorized to buy back up to $300 million worth of shares.

Bank OZK maintains a solid liquidity position. As of Mar 31, 2024, the company had total debt (comprising other borrowings and accrued interest payable and other liabilities) of $715.4 million and cash and cash equivalents of $2.32 billion.

Given a robust capital and liquidity position, as well as lower debt-equity and dividend payout ratios compared with peers, the company is expected to continue its capital distribution activities. Through this, Bank OZK will keep enhancing shareholder value.

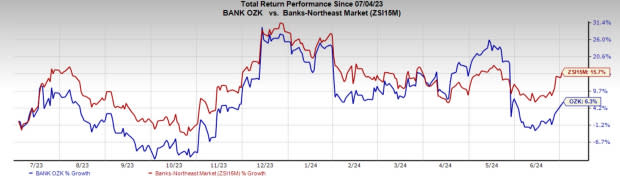

In the past year, shares of OZK have rallied 6.3% compared with the industry’s rally of 15.7%.

Image Source: Zacks Investment Research

Bank OZK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Taking Similar Steps

Earlier this week, The Bank of New York Mellon Corp. BK announced its plans to increase the quarterly cash dividend by 11.9% to 47 cents per share, beginning as early as the third quarter of 2024, subject to board approval. BK’s payout ratio is 32% of earnings.

Likewise, Goldman Sachs GS plans to increase its dividend by 9.1% to $3, while Bank of America Corp. BAC intends to hike its quarterly dividend by 8.33% to 26 cents per share. GS has a payout ratio of 43% while BAC’s payout ratio is 29% of earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance