Is a Beat Ahead for United Airlines (UAL) in Q3 Earnings?

United Airlines UAL is scheduled to report third-quarter 2022 results on Oct 18, after market close.

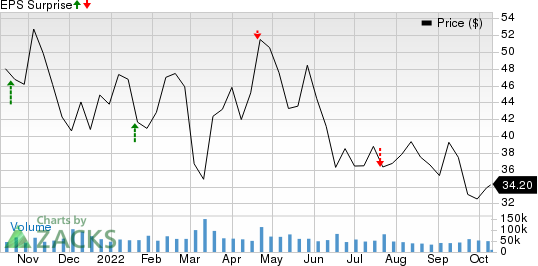

The Zacks Consensus Estimate for UAL’s third-quarter 2022 earnings has been revised 9.4% upward in the past 60 days. UAL also has a decent surprise history, with its earnings having outperformed the Zacks Consensus Estimate in two of the preceding four quarters (missing the mark in the other two quarters), the average beat being 10.53%.

United Airlines Holdings Inc Price and EPS Surprise

United Airlines Holdings Inc price-eps-surprise | United Airlines Holdings Inc Quote

Against this backdrop, let’s see how things are shaping up for United Airlines this earnings season.

We expect upbeat air-travel demand following the relaxation of COVID-related restrictions to have aided United Airlines’ top-line performance in the September quarter. Owing to upbeat passenger volume, passenger revenues, accounting for the bulk of the top line, are likely to have increased significantly from the year-ago quarter’s reading.

The presence of the Labor Day holiday period during the quarter is likely to have boosted the air traffic further. The Zacks Consensus Estimate for consolidated airline traffic, measured in revenue passenger miles, indicates a 39.3% increase from the year-earlier level. Buoyed by high traffic, the Zacks Consensus Estimate for third-quarter 2022 consolidated load factor (percentage of seats occupied by passengers) is currently pegged at 85, implying growth from the year-ago actual figure of 76.

However, high fuel costs per gallon are likely to have hurt the bottom line in the third quarter. UAL forecasts the average aircraft fuel price per gallon to be $3.83 in the third quarter, suggesting a rise from the figure reported in third-quarter 2021.

What Our Model Says

Our proven model predicts an earnings beat for United Airlines this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here as you can see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

UAL has an Earnings ESP of +5.29% (the Zacks Consensus Estimate is currently pegged at $2.21, 11 cents below the Most Accurate Estimate) and a Zacks Rank #3.

Highlights of Q2

United Airlines’ second-quarter 2022 earnings (excluding 43 cents from non-recurring items) of $1.43 per share fell short of the Zacks Consensus Estimate of $1.86. Escalated operating expenses induced the earnings miss. Consequently, shares declined in after-hours trading on Jul 20. In the year-ago quarter, UAL incurred a loss of $3.91 per share when air-travel demand was not as buoyant as in the current scenario. The second quarter of 2022 was the first profitable period at UAL since the onset of the pandemic.

Other Stocks to Consider

Here are a few other stocks worth considering from the broader Zacks Transportation sector, as our model shows that these too have the right combination of elements to beat on earnings for third-quarter 2022:

Canadian National Railway Company CNI has an Earnings ESP of +0.74% and a Zacks Rank #3. CNI will release results on Oct 25. You can see the complete list of today’s Zacks #1 Rank stocks here.

Upbeat freight revenues are likely to have boosted CNI’s September-quarter results. CNI has an impressive surprise history, with its earnings having outperformed the Zacks Consensus Estimate in three of the preceding four quarters (missing the mark in the remaining quarter), the average beat being 6.74%.

Canadian Pacific Railway Limited CP has an Earnings ESP of +3.81% and a Zacks Rank of 3. CP will release results on Oct 26.

Upbeat freight revenues are likely to have boosted CP’s September-quarter results. The Zacks Consensus Estimate for third-quarter earnings at Canadian Pacific has been revised 3.95% upward over the past 60 days.

CSX Corporation CSX has an Earnings ESP of +0.25% and is Zacks #3 Ranked. CSX will release results on Oct 20.

We expect CSX’s third-quarter results to have been aided by upbeat freight demand. CSX has an impressive surprise history, with its earnings having outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 6.15%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance