'Big dog' Barclays banker paid £25m bonus for 2008 funding deal at the heart of court case

A senior Barclays (BARC.L) banker nicknamed “big dog” by his colleagues received a £25m ($32.9m) bonus for his role in securing a multibillion pound investment from Qatar at the height of the financial crisis, a court was told on Tuesday.

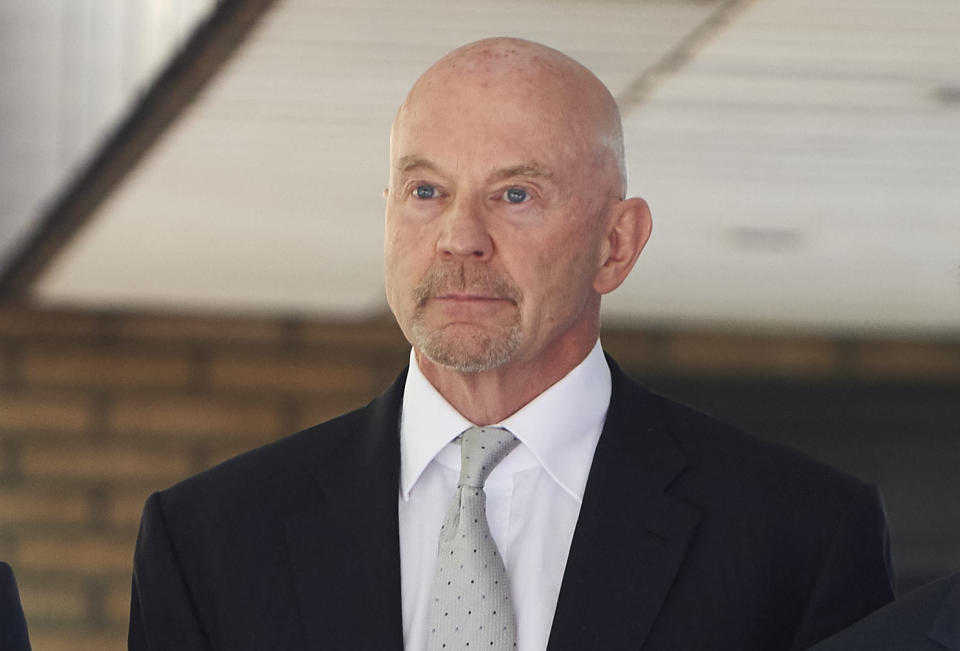

Roger Jenkins, who at the time ran Barclays Capital’s investment management business in the Middle East and North Africa, was paid that sizeable bonus as a “special award” for his role in a capital raising in October 2008, the jury at Southwark Crown Court was told.

Jenkins helped to secure a £2.05bn investment from the Qataris in Barclays as part of £6.8bn fundraising, the court heard, including hosting crucial talks with then Qatari Prime Minister Sheikh Hamad bin Jassim bin Jaber al-Thani at Mayfair home. The Qatari investment helped the bank avoid a bailout from the UK government as the financial crisis erupted.

Jenkins is one of four defendants in a criminal case alleging Barclays executives mislead investors by hiding the true amount of fees paid to Qatar for investing in the bank in 2008. The other defendants are John Varley, who was CEO of Barclays between 2004 and 2011; Thomas Kalaris, the former CEO of Barclays’ wealth and investment management; and Richard Boath, the former head of European financial institutions group at Barclays Capital.

Varley and Jenkins each face two counts of conspiracy to commit fraud, and Kalaris and Boath each face one. All four defendants have pleaded not guilty. Qatar is not accused of any wrongdoing.

‘Very serious consequences’

Edward Brown QC, the lead prosecutor for the UK’s Serious Fraud Office, argued that the bankers sought to cover up the true fees paid to the Qataris in order to avoid looking weak to the market and having to pay higher fees to other investors who took part in the fundraising. The case centres around two funding deals in June and October of 2008.

Brown addressed the October transaction on Tuesday. He argued Varley was motivated to meet the Qataris’ demands for higher fees because of a fear of the bank being nationalised.

Brown said on Tuesday: “Having announced publicly that it was not going to take government money, it was imperative for Barclays to secure the Qatari investment in late October 2008. Failure to do so at that time would have had very serious consequences for the bank.

“There was every reason for conspirators to agree to the demands for extra fees, therefore, and not to disclose them.”

Brown said executives wanted to avoid a nationalisation of the bank because it would “restrict the flexibility of a large multinational bank. It was said it would mean that some of those at the top of Barclays would have to leave (or so it was suspected). The level of remuneration inevitably would be attacked, as those at Barclays, including Roger Jenkins, had said in conversations.”

A day earlier, the court had been presented with transcripts of calls from the time in which Jenkins said he was “panicked” about what a government bailout would mean for pay packets above a million pounds.

‘Magician 3’

Brown argued on Tuesday that, unlike Varley, Jenkins was motivated by the promise of a large bonus.

“Roger Jenkins was to say, as you’ve heard, he couldn’t care less [about the bank’s independence] – and in the months following he demonstrated a different motivation,” Brown told the jury.

“Indeed, the very day of, and within a few hours, of the crucial shareholder vote that allowed the capital raising to go through — 24 November — Roger Jenkins wrote this in an email to Mr. Ricci [a senior Barclays Capital executive at the time].”

The email read [sic]: “‘So vote goes thru. This capital did the trick why can’t [John] varley diamond [Bob Diamond, the CEO of Barclays Capital at the time] go to renco [the remuneration committee] and say we need to make a special payment for this endeavour now. It was not his job no one else in the organization or at any other bank except credit suisse did this. Did it four times this year to save our arses and jobs guys you know the sell ! If not what is the plan’.”

Ricci replied: “Still the plan. Remco is dec 9.”

Brown said: “On 19 March the following year [2009], following a period of negotiation, a draft agreement with Jenkins records that he was to be paid £25m in a ‘special award’ for his role in the capital raising.”

Jenkins ultimately left Barclays in the autumn of 2009, the court was told. Brown said Jenkins had suffered a heart attack in August 2008 but had returned to work just a month later.

Earlier in the trial, the prosecution played a recording of two colleagues discussing Jenkins using the nickname “Big Dog.” In an email presented to the court on Tuesday, Varley refered to Jenkins as “Magician 3.”

The case continues and is expected to last up to six months.

Read more on the trial of the Barclays four:

Former Barclays execs lied about payments to Qatar, court told

Senior Barclays banker raised concerns about ‘hidden commission’ in Qatar deal, court told

Barclays bankers worried about ‘dodgy’ payments to Qatari Prime Minister, court hears

Bankers feared pay cuts if state had nationalised Barclays in 2008, court hears

Yahoo Finance

Yahoo Finance