Brazil Assets Rally as Lula Spending Cuts Bring Temporary Relief

(Bloomberg) -- Brazilian assets broadly rallied again Thursday after Finance Minister Fernando Haddad announced spending cuts meant to help hit the country’s fiscal goals, providing a reprieve to markets.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Newsom Shocks California Politics by Scrapping Crime Measure

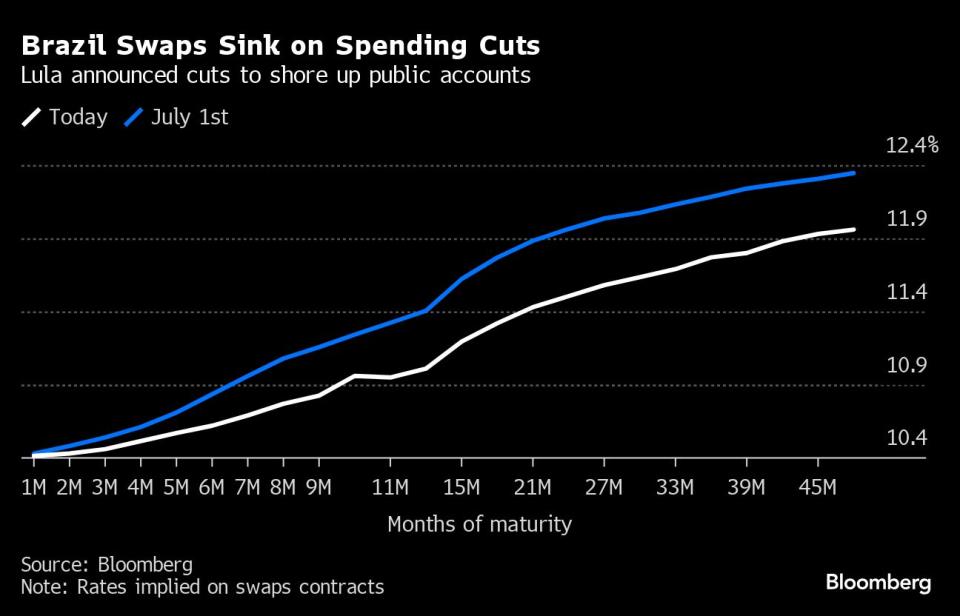

Swap rates fell and the Brazilian real strengthened amid a benign session for local assets, as investors welcomed Haddad’s Wednesday night announcement that the government would make 25.9 billion reais ($4.7 billion) in budget cuts in 2025. President Luiz Inacio Lula da Silva approved the plan and ordered the economic team to comply with the country’s fiscal framework, Haddad told reporters.

“More than announcement for the 25 billion reais in spending cuts, the direction of speech and addressing of fiscal concerns is being well received by the market,” said Gustavo Okuyama, a portfolio manager at Porto Asset, a money management firm based in Sao Paulo. “Today we have another day of a significant drop in the interest rate curve and the real is able to breathe.”

Brazilian swap rates are down 5 to 18 basis points across the curve, a second consecutive session of strong declines that underscores how eager investors were to see Lula’s government address fiscal concerns. Short maturing contracts now price in 71 basis points in rate hikes by the end of the year, down from 115 basis points forecast on Monday.

The real is by far the best-performer among major currencies, rising as much as 1.6% to touch 5.4661 against the dollar. The gains follow weeks of underperformance that pushed the currency to its weakest value since Jan. 2022, at 5.70, amid a series of Lula speeches in which he cast doubt on the need for spending cuts.

Assets extended a big Wednesday rally that had been driven by expectations of such an announcement as Lula met with members of his cabinet. The real gained 2.2% Wednesday, its biggest single-session appreciation since Jan. 2023.

Haddad’s announcement came after weeks of doubts about Lula’s willingness to agree to spending reductions and mounting concerns about the minister’s efforts to shore up public accounts.

Lawmakers swatted down Haddad’s latest proposal to bolster revenues last month, leaving the minister with no Plan B for how to deliver on his pledges to eliminate Brazil’s primary fiscal deficit, which excludes interest payments. The economic team had earlier in the year weakened its fiscal target for 2025 amid higher spending, backing off its initial aim of delivering a primary surplus.

Lula, meanwhile, had publicly said he would only agree to cuts if Haddad convinced him they were necessary, while stressing that the country needed lower interest rates and more revenue. The leftist president is battling declining popularity, and high rates have blunted his ability to deliver the renewed economic prosperity he promised during his campaign.

While the announcement may offer short-term relief to Brazilian assets, markets still expect more action to ensure fiscal sustainability in the days ahead.

“This spending reduction may help dissipate short-term noise in fiscal policy, but it should not have effects on long-term fiscal sustainability,” said Jeferson Bittencourt, head of macroeconomics at ASA. “Without changes to the rules for growth in total expenditure, these measures should not change the projections at all.”

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance